Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Sagar

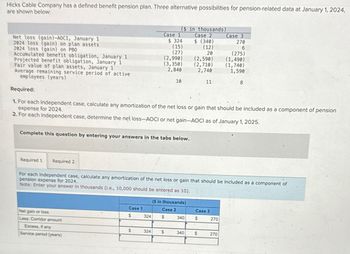

Transcribed Image Text:Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2024,

are shown below:

Case 1

Net loss (gain)-AOCI, January 1

$ 324

($ in thousands)

Case 2

$ (340)

Case 3

270

2024 loss (gain) on plan assets

(15)

2024 loss (gain) on PBO

(12)

6

(27)

Projected benefit obligation, January 1

Accumulated benefit obligation, January 1

20

(275)

(2,990)

(2,590)

(1,490)

Fair value of plan assets, January 1

Average remaining service period of active

employees (years)

(3,350)

(2,710)

(1,740)

2,840

2,740

1,590

10

11

8

Required:

1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension

expense for 2024.

2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2025.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

For each independent case, calculate any amortization of the net loss or gain that should be included as a component of

pension expense for 2024.

Note: Enter your answer in thousands (i.e., 10,000 should be entered as 10).

($ in thousands)

Case 1

Case 2

Case 3

$

324

$

340

$

270

Net gain or loss

Less: Corridor amount

Excess, if any

$

324

$

340

$

270

Service period (years)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2024, are shown below: Case 1 Net loss (gain)-AOCI, January 1 $ 333 ($ in thousands) Case 2 $ (371) Case 3 279 2024 loss (gain) on plan assets (24) (21) 7 2024 loss (gain) on PBO (36) 29 Accumulated benefit obligation, January 1 (3,080) (2,680) (285) (1,580) Projected benefit obligation, January 1 (3,440) Fair value of plan assets, January 1 2,930 (2,800) 2,830 (1,830) 1,680 Average remaining service period of active employees (years) 10 11 8 Required: es 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2024. 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2025. Complete this question by entering your answers in the tabs below. Required 1 Required 2 For each independent case, calculate any amortization of the net loss or gain…arrow_forwardHicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021, are shown below: ($ in thousands) Case 1 Case 2 Case 3 Net loss (gain)—AOCI, Jan. 1 $ 337 $ (407 ) $ 297 2021 loss (gain) on plan assets (28 ) (25 ) 5 2021 loss (gain) on PBO (40 ) 33 (301 ) Accumulated benefit obligation, Jan. 1 (3,120 ) (2,720 ) (1,620 ) Projected benefit obligation, Jan. 1 (3,480 ) (2,840 ) (1,870 ) Fair value of plan assets, Jan. 1 2,970 2,870 1,720 Average remaining service periodof active employees (years) 12 15 10 Required:1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021.2. For each independent case, determine the net loss—AOCI or net gain—AOCI as of January 1, 2022.arrow_forwardPart 1 and part 2 of this question pleasearrow_forward

- Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2024, are shown below. Net loss (gain)-AOCI, January 1 2024 loss (gain) on plan assets 2024 loss (gain) on PBO Accumulated benefit obligation, January 1 Projected benefit obligation, January 1 Fair value of plan assets, January 1 Average remaining service period of active employees (years) Required: ($ in thousands) Case 1 Case 2 Case 3 $ 340 $ (410) 281 (31) (28) 6 (43) 36 (3,150) (2,750) (290) (1,650) (3,510) (2,870) 3,000 2,900 (1,900) 1,750 10 12 7 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2024. 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2025.arrow_forwardHicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2016, are shown below: ($ in 000s) Case 1 Case 2 Case 3 $ (330) (8) 16 (2,550) (2,670) 2,700 Net loss (gain)-AOCI, Jan. 1 2016 loss (gain) on plan assets 2016 loss (gain) on PBO Accumulated benefit obligation, Jan. 1 Projected benefit obligation, Jan. 1 Fair value of plan assets, Jan. 1 Average remaining service period of active employees (years) $ 320 $ 260 (11) (23) (2,950) (265) (1,450) (1,700) 1,550 (3,310) 2,800 12 15 10 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2016. 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2017.arrow_forwardVaughn Enterprises provides the following information relative to its defined benefit pension plan. Balances or Values at December 31, 2020Projected benefit obligation $2,726,600Accumulated benefit obligation 1,982,100Fair value of plan assets 2,293,300Accumulated OCI (PSC) 208,700Accumulated OCI—Net loss (1/1/20 balance, 0) 45,700Pension liability 433,300Other pension plan data for 2020: Service cost $94,700Prior service cost amortization 42,100Actual return on plan assets 129,100Expected return on plan assets 174,800Interest on January 1, 2020, projected benefit obligation 252,800Contributions to plan 93,100Benefits paid 138,800 Collapse question part(a) Prepare the note disclosing the components of pension expense for the year 2020. (Enter amounts that reduce pension expense with either a negative sign preceding the number e.g. -45 or parenthesis e.g. (45).) Components of Pension ExpenseService Cost$94700Interest Cost252800Expected Return on Plan Assets(174800)Prior Service Cost…arrow_forward

- Vaughn Enterprises provides the following information relative to its defined benefit pension plan. Balances or Values at December 31, 2020Projected benefit obligation $2,726,600Accumulated benefit obligation 1,982,100Fair value of plan assets 2,293,300Accumulated OCI (PSC) 208,700Accumulated OCI—Net loss (1/1/20 balance, 0) 45,700Pension liability 433,300Other pension plan data for 2020: Service cost $94,700Prior service cost amortization 42,100Actual return on plan assets 129,100Expected return on plan assets 174,800Interest on January 1, 2020, projected benefit obligation 252,800Contributions to plan 93,100Benefits paid 138,800 Collapse question part(a)Prepare the note disclosing the components of pension expense for the year 2020. (Enter amounts that reduce pension expense with either a negative sign preceding the number e.g. -45 or parenthesis e.g. (45).) Components of Pension ExpenseService Cost$94700Interest Cost252800Expected Return on Plan Assets(174800)Prior Service Cost…arrow_forwardCrane Enterprises Ltd. provides the following information about its defined benefit pension plan: Balances or Values at December 31, 2023 Defined benefit obligation Vested benefit obligation Fair value of plan assets $2,710,000 1,629,393 2,255,546 Other pension plan data: Current service cost for 2023 93,000 Actual return on plan assets in 2023 129,000 Return on plan assets in 2023 using discount rate 173,920 Interest on January 1, 2023 defined benefit obligation 250,000 Funding of plan in 2023 91,406 Benefits paid 139,000 (a) Calculate the January 1, 2023 balances for the pension-related accounts if Crane follows IFRS. Defined benefit obligation Fair value of plan assets Net defined benefit +A +Aarrow_forwardun.3arrow_forward

- Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2024 (the end of Beale's fiscal year), the following pension-related data were available: Projected Benefit Obligation Balance, January 1, 2024 Service cost Interest cost, discount rate, 5% Gain due to changes in actuarial assumptions in 2024 Pension benefits paid Balance, December 31, 2024 ($ in millions) $ 480 82 24 (10) (40) $ 536 Plan Assets ($ in millions) Balance, January 1, 2024 $ 500 Actual return on plan assets 40 (Expected return on plan assets, $45) Cash contributions 70 Pension benefits paid (40) Balance, December 31, 2024 $ 570 January 1, 2024, balances: ($ in millions) $ 20 48 80 Pension asset Prior service cost-AOCI (amortization $8 per year) Net gain-AOCI (any amortization over 15 years) Required: 1. to 3. Prepare the journal entries required for the pension during 2024. 4. Determine the balances at December 31, 2024, in the net gain-AOCI, and prior service cost-AOCI. [Hint: You might…arrow_forwardBeale Management has a noncontributory, defined benefit pension plan. On December 31, 2024 (the end of Beale's fiscal year), the following pension-related data were available: Projected Benefit Obligation Balance, January 1, 2024 Service cost Interest cost, discount rate, 5% Gain due to changes in actuarial assumptions in 2024 Pension benefits paid Balance, December 31, 2024 Plan Assets ($ in millions) $ 740 76 37 (21) (37) $ 795 ($ in millions) $ 760 47 (Expected return on plan assets, $52) 88 Pension benefits paid (37) Balance, December 31, 2024 $ 858 January 1, 2024, balances: ($ in millions) Pension asset $ 20 Balance, January 1, 2024 Actual return on plan assets Cash contributions Prior service cost-AOCI (amortization $7 per year) Net gain-AOCI (any amortization over 10 years) Required: 1. to 3. Prepare the journal entries required for the pension during 2024. 35 116 4. Determine the balances at December 31, 2024, in the net gain-AOCI, and prior service cost-AOCI. [Hint: You might…arrow_forwardWildhorse Company provides the following information about its defined benefit pension plan for the year 2025. Service cost Contribution to the plan Prior service cost amortization Actual and expected return on plan assets Benefits paid Plan assets at January 1, 2025 Projected benefit obligation at January 1, 2025 Accumulated OCI (PSC) at January 1, 2025 Interest/discount (settlement) rate Compute the pension expense for the year 2025. Pension expense for 2025 $89,400 105,700 10,800 64,500 40,200 640,200 710,100 152,200 10%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning