FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

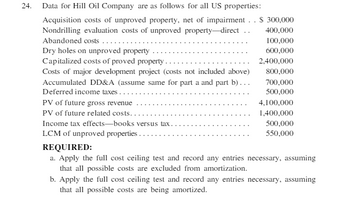

Transcribed Image Text:24.

+4

Data for Hill Oil Company are as follows for all US properties:

Acquisition costs of unproved property, net of impairment. . $ 300,000

Nondrilling evaluation costs of unproved property-direct ..

400,000

Abandoned costs....

100,000

Dry holes on unproved property

600,000

Capitalized costs of proved property..

2,400,000

Costs of major development project (costs not included above)

800,000

Accumulated DD&A (assume same for part a and part b)...

Deferred income taxes...

PV of future gross revenue

PV of future related costs...

Income tax effects-books versus tax.

LCM of unproved properties...

700,000

500,000

4,100,000

1,400,000

500,000

550,000

REQUIRED:

a. Apply the full cost ceiling test and record any entries necessary, assuming

that all possible costs are excluded from amortization.

b. Apply the full cost ceiling test and record any entries necessary, assuming

that all possible costs are being amortized.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 3. ABC Company acquired a tract of land containing an extractable natural resource. ABC is required by the purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 2,500,000 tons and that the land will have a value of P1,000,000 after restoration. Relevant cost information follows: Land .- P9,000,000 and Estimated restoration costs - 1,500,000. What should be the depletion charge per ton of extracted material?arrow_forward(Adapted) 5. Joseph Company acquired a tract of land containing an extractable natural resource. Joseph is required by the purchase contract to restore the land to a condition suitable fo recreational use after it has extracted the natural resource Geological surveys estimate that the recoverable reserves will be 2,500,000 tons and that the land will have a value of P1,000,000 after restoration. Relevant cost information follows: P9,000,000 Land Present value of estimated restoration costs 1,500,000 What should be the depletion charge per ton of extracted material? a. P4.00 (Adapted) •b. P3.80 c. P3.60 d. P3.20arrow_forwardGiven the following information and assuming straight-line depreciation to zero, what is the IRR of this project? Initial investment = $400,000; life = four years; cost savings = $125,000 per year; salvage value = $20,000 in year 5; tax rate = 34%; discount rate = 12%.Multiple Choice7.51%9.43%10.24%6.25%8.15%arrow_forward

- PC Shopping Network may upgrade its modem pool. It last upgraded 1 year ago, when it spent $114 million on equipment with an assumed life of 4 years and an assumed salvage value of $22 million for tax purposes. The firm uses straight-line depreciation. The old equipment can be sold today for $86 million. A new modem pool can be installed today for $156 million. This will have a 3-year life, and will be depreciated to zero using straight-line depreciation. The new equipment will enable the firm to increase sales by $15 million per year and decrease operating costs by $12 million per year. At the end of 3 years, the new equipment will be worthless. Assume the firm's tax rate is 35% and the discount rate for projects of this sort is 13%. (Enter your answers in millions. For example, an answer of $13,000,000 should be entered as 13. Use minus sign to enter cash outflows, if any.) a. What is the net cash flow at time 0 if the old equipment is replaced? (Do not round intermediate…arrow_forwardFor the first collumn how much do the current liabilites. What is the difference between current and total liabilites?arrow_forwardV2arrow_forward

- 1. In 20X4, ABC Mining Inc. purchased land for P5,600,000 that had a natural resource supply estimated at 4,000,000 tons. When the natural resources are removed, the land has an estimated value of P640,000. The required restoration cost for the property is estimated to be P800,000. Development and road construction costs on the land were P560,000, and a building was constructed at a cost of P88,000 with an estimated P8,000 salvage value when all the natural resources have been extracted. During 20X5, additional development costs of P272,000 were incurred, but additional resources were not discovered. Production for 20X4 and 20X5 was 700,000 tons and 900,000 tons, respectively. Round depletion and depreciation rates to 2 decimal places. In the year 20X5, the total inventoriable cost is?arrow_forward16. Determine the amount of the total amortization cost base, assuming (1) no exclusions from the amortization base, and (2) all possible costs are excluded from the amortization base. Unproved property-cost $80,000, amount impaired $20,000 (if excluded) Unproved property-abandoned- -cost $30,000, no impairment Unproved property-found proved reserves- cost $18,000, no impairment Unproved property purchased- cost $50,000 Wells-in-progress on unproved property $100,000 Well completed on unproved property dry-hole cost $250,000 Total (1) Amount |(2) Amount― no exclusions all exclusions ?arrow_forward16. An asset originally cost $100,000, also incurred installation costs of $10,000 and has an estimated salvage value of $25,000. It is being depreciated under MACRS, using a 5-year normal recovery period. What is the depreciation expense in year 1?A. $15,000B. $12,750C. $11,250D. $22,000arrow_forward

- Please help with answers asaparrow_forwardThe components of the cost of a major item of equipment are given below.GHSPurchase price 780,000Import duties 117,000VAT (refundable) 78,000Site preparation 30,000Installation costs 28,000Pre-production costs 18,000Initial operating losses before the asset reaches planned performance 50,000Estimated cost of dismantling and removal of the asset, recognized as a provision under IAS 37 Provisions,Contingent Liabilities and Contingent Assets 100,0001,201,000In accordance with IAS 16 Property, Plant and Equipment, what amount should be recognized as the cost of the asset?arrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education