Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

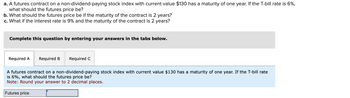

Transcribed Image Text:a. A futures contract on a non-dividend-paying stock index with current value $130 has a maturity of one year. If the T-bill rate is 6%,

what should the futures price be?

b. What should the futures price be if the maturity of the contract is 2 years?

c. What if the interest rate is 9% and the maturity of the contract is 2 years?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

A futures contract on a non-dividend-paying stock index with current value $130 has a maturity of one year. If the T-bill rate

is 6%, what should the futures price be?

Note: Round your answer to 2 decimal places.

Futures price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- a. A single-stock futures contract on a non-dividend-paying stock with current price $260 has a maturity of 1 year. If the T-bill rate is 5%, what should the futures price be? (Round your answer to 2 decimal places.) Futures price b. What should the futures price be if the maturity of the contract is 4 years? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Futures price c. What should the futures price be if the interest rate is 8% and the maturity of the contract is 4 years? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Futures pricearrow_forwardAn investor has agreed to LEND $10 million for 3-months in the future at a rate of (SOFR + 1%). What position should the investor take in the SOFR Futures contract to hedge against interest-rate changes? Answer in terms of LONG or SHORT position and provide a brief rationale in the response box belowarrow_forwardSuppose we enter into a 76-day T-bill futures contract quoted at 0.021. The notional amount is $1,000. What is the actual price?arrow_forward

- following questions: a. What is the mid-rate for each maturity? b. What is the annual forward premium for all maturities? (Click on the icon to import the table into a spreadsheet.) Period spot 1 month 2 months 3 months 6 months 12 months 24 months Period Bid Rate Spot 1.3267 1.3265 1.3263 1.3259 1.3250 1.3228 1.3179 a. What is the mid-rate for each maturity? Calculate the mid-rate for each maturity below: (Round to five decimal places.) Days Forward Ask Rate 0 1.3268 1.3266 1.3264 1.3262 1.3252 1.3233 1.3207 Bid Rate US$/€ 1.3267 Ask Rate US$/€ 1.3268 Mid-rate US$/€arrow_forwardAssume that today's settlement price on a CME EUR futures contract is $1.1145/EUR. You have a long position in one contract. Your margin balance is currently of $2,763. The next three days' settlement prices are $1.1144, $1.1141, and $1.1148. Calculate the balance in the margin account after the third day due to dailly mark-to-market. The size of a futures contract on the euro is EUR125,000. Note: Enter your answer rounded to the nearest dollar. For example, if the calculated balance on the margin account after the third day of mark-to-market is $2,475.80, enter it as: 2476 or 2,476.arrow_forwardQuestion 3. Assume the continuously compounded interest rate has constant value 15%. The table below is for a futures contract maturing on day 5 with delivery price equal to the futures price. The underlying asset is a stock paying no income. The St column gives the stock price on each day. The Φ(t,T) column gives the futures price on each day. The MTM column lists the mark-to-market payments. The interest column lists the interest that will be accrued on the mark-to-market payment by the maturity date. Fill in the table. Give at least four decimal places. day St Φ(t,T) MTM interest 0 2000 1 1900 2 2100 3 2200 4 2000 5 2100 sum: Hint: Use Mathematica or a spreadsheet for the calculations.arrow_forward

- Consider a European Call Option with a strike of 82. The current price of the underlying asset is 80, and the time to expiry is 5 months. The current market price of the option is 6.22. The risk-free rate is 4.1%. (a) Find the implied volatility of the underlying. Provide all necessary calculations.arrow_forwardSuppose that you purchase a Treasury bond futures contract at $95 per $100 of face value. What is your obligation when you purchase this futures contract? If an FI purchases this contract, in what kind of hedge is it engaged? Assume that the Treasury bond futures price falls to 94. What is your loss or gain? Assume that the Treasury bond futures price rises to 97. Mark your position to market.arrow_forwardSuppose that, on 5 November 2020, you opened a short position in a two-year futures contract on the Tesla stock. The share price at the beginning of the contract was $146, and the initial futures price was equal to a theoretical two-year forward price. Assume the following: initial margin of 40% of the futures value, maintenance margin of 32% of the futures value, 3% flat interest rate, continuous compounding, no withdrawals of the excess margin. Next, suppose that, on 1 November 2022, the Tesla stock is priced at $228 per share, and it goes down by 1% daily over 2nd, 3rd and 4th November. Suppose further that, on 1 November 2022, you have received a margin call from your broker (this was your first margin call during this contract) and had to make an instant adjustment to your margin account. Calculate the value of your position in this contract at a close of each day between 1-4 November 2022. Show and explain each step of your derivations.arrow_forward

- Suppose that, on 5 November 2020, you opened a short position in a two-year futures contract on the Tesla stock. The share price at the beginning of the contract was $146, and the initial futures price was equal to a theoretical two-year forward price. Assume the following: initial margin of 40% of the futures value, maintenance margin of 32% of the futures value, 3% flat interest rate, continuous compounding, no withdrawals of the excess margin. Next, suppose that, on 1 November 2022, the Tesla stock is priced at $228 per share, and it goes down by 1% daily over 2nd, 3rd and 4th November. Suppose further that, on 1 November 2022, you have received a margin call from your broker (this was your first margin call during this contract) and had to make an instant adjustment to your margin account. Show how the balance on your margin account was changing over this period (i.e., 1-4 November 2022).arrow_forwardSuppose that, on 5 November 2020, you opened a short position in a two-year futures contract on the Tesla stock. The share price at the beginning of the contract was $146, and the initial futures price was equal to a theoretical two-year forward price. Assume the following: initial margin of 40% of the futures value, maintenance margin of 32% of the futures value, 3% flat interest rate, continuous compounding, no withdrawals of the excess margin. Next, suppose that, on 1 November 2022, the Tesla stock is priced at $228 per share, and it goes down by 1% daily over 2nd, 3rd and 4th November. Suppose further that, on 1 November 2022, you have received a margin call from your broker (this was your first margin call during this contract) and had to make an instant adjustment to your margin account. Your position in this contract is closed on 4 November 2022. How can you assess your overall profit or loss? Would your overall profit/loss from 1) change if, on 5 November 2020, you had…arrow_forwardAssume today's settlement price on a CME EUR futures contract is $1.3140/EUR. You have a short position in one contract. Your performance bond account currently has a balance of $1,700. The next three days' settlement prices are $1.3126, $1.3133, and $1.3049. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Changes in the performance bond account Warrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education