FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

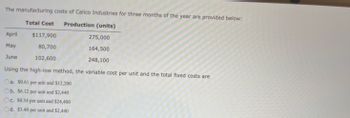

Transcribed Image Text:The manufacturing costs of Calico Industries for three months of the year are provided below:

Total Cost Production (units)

$117,900

80,700

102,600

April

May

June

275,000

164,500

248,100

Using the high-low method, the variable cost per unit and the total fixed costs are

Oa. $0.61 per unit and $12,200

b. $6.12 per unit and $2,440

c. $0.34 per unit and $24,400

Od. $3.40 per unit and $2,440

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The manufacturing costs of Kellam Industries for the first three months of the year follow: Total Costs Units Produced January $318,060 2,015 units February 357,640 3,850 March 494,760 5,115 Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost. a. Variable cost per unit $fill in the blank 1 b. Total fixed cost $fill in the blank 2arrow_forwardPlease do not give image formatarrow_forwardPo.8.arrow_forward

- Lindquist Company has the following information for February: Line Item Description Amount Sales $370,000 Variable cost of goods sold 173,900 Fixed manufacturing costs 55,500 Variable selling and administrative expenses 40,700 Fixed selling and administrative expenses 22,200 Determine the following for Lindquist Company for the month of February: Line Item Description Amount a. Manufacturing margin $fill in the blank 1 b. Contribution margin $fill in the blank 2 c. Operating income $fill in the blank 3arrow_forwardSalem Company has the following costs information for June where production volume is 2,000 units: 7. The variable cost and fixed cost per unit respectively are: A) $8.75 and $1.50. B) $8.75 and $0.25. C) $4.25 and $3.00. D) $8.50 and $12.00. B) fixed cost per unit. C) total variable cost. D) total cost per unit. A) 1,000 B) 1,800 Direct materials Direct labor 8. If production changes to 2.200 units, which cost will remain the same? A) variable cost per unit. C) 3,200 D) 2,600 Straight-line depreciation Rent expenses other fixed costs 9.The production budget shows expected unit sales of 16,000. Beginning finished goods units are 1,800. Required production units are 16,800. What are the desired ending finished goods units? A) B) D) 10. The production budget shows expected unit sales are 50,000. The required production units are 52,000. What are the beginning and desired ending finished goods units, respectively? Ending Units 2,000 5,000 $8,500 $9,000 5800 Beginning Units 5,000 3.000…arrow_forwardJason Inc. provides the following manufacturing costs for the first four months of the year. Manufacturing Costs for the First Four Months Months Production in Units Total Costs January 2,500 $33,750 February 1,800 $29,900 March 3,000 $36,500 April 2,600 $34,300 Using the high-low method, determine the total fixed costs. (Round intermediate calculations to two decimal places, and the final calculation to the nearest dollar.) Group of answer choices $15,500 $20,000 $30,300 $16,500arrow_forward

- Marley Company has the following information for March: Sales $912,000 Variable cost of goods sold 474,000 Fixed manufacturing costs 82,000 Variable selling and administrative expenses 238,100 Fixed selling and administrative expenses 54,700 Determine the following for Marley Company for the month of March: a. Manufacturing margin $fill in the blank 1 b. Contribution margin $fill in the blank 2 c. Operating income $fill in the blank 3arrow_forwardNorwood Company has the following information for July: Sales $440,000 Variable cost of goods sold 198,000 Fixed manufacturing costs 70,400 Variable selling and administrative expenses 44,000 Fixed selling and administrative expenses 26,400 Determine the following for Norwood Company for the month of July: a. Manufacturing margin $fill in the blank 1 b. Contribution margin $fill in the blank 2 c. Operating income $fill in the blank 3arrow_forwardMarley Company has the following information for March: Sales $912,000 Variable cost of goods sold 474,000 Fixed manufacturing costs 82,000 Variable selling and administrative expenses 238,100 Fixed selling and administrative expenses 54,700 Determine (A) the manufacturing margin, (B) the contribution margin, and (C) income from operations for Marley Company for the month of Marcharrow_forward

- need answer of this Question Please Provide itarrow_forwardNonearrow_forwardThe table below shows monthly data collected on production costs and on the number of units produced over a twelve month period. Month Total Production Costs Level of Activity (Units Produced) July $ 230,000 3,500 August 250,000 3,750 September 260,000 3,800 October 220,000 3,400 November 340,000 5,800 December 330,000 5,500 January 200,000 2,900 February 210,000 3,300 March 240,000 3,600 April 380,000 5,900 May 350,000 5,600 June 290,000 5,000 Required: Determine the variable cost per unit and the fixed cost using the high-low method. What is the equation of the total mixed cost function? Prepare the scatter diagram, clearly showing any outliers Using the line of best-fit, determine the company’s fixed cost per month and the variable cost per unit. (Use 0 & 5,000 units. In view of the department’s cost behaviour pattern, which of the two methods appear more appropriate?…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education