FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

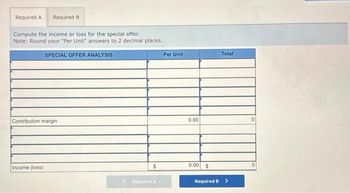

Transcribed Image Text:Required A Required B

Compute the income or loss for the special offer.

Note: Round your "Per Unit" answers to 2 decimal places.

SPECIAL OFFER ANALYSIS

Contribution margin

Income (loss)

$

Required A

Per Unit

0.00

0.00 $

Total

Required B >

0

0

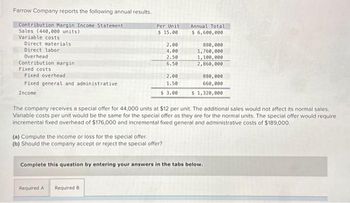

Transcribed Image Text:Farrow Company reports the following annual results.

Contribution Margin Income Statement

Sales (440,000 units)

Variable costs

Direct materials

Direct labor

Overhead

Contribution margin.

Fixed costs

Fixed overhead

Fixed general and administrative

Income

Per Unit

$15.00

2.00

4.00

2.50

6.50

2.00

1.50

$ 3.00

(a) Compute the income or loss for the special offer.

(b) Should the company accept or reject the special offer?

Required A Required B

Annual Total

$ 6,600,000.

880,000

1,760,000

1,100,000

2,860,000

The company receives a special offer for 44,000 units at $12 per unit. The additional sales would not affect its normal sales.

Variable costs per unit would be the same for the special offer as they are for the normal units. The special offer would require

incremental fixed overhead of $176,000 and incremental fixed general and administrative costs of $189,000.

880,000

660,000

$ 1,320,000

Complete this question by entering your answers in the tabs below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please don't give image formatarrow_forwardContribution margin per constraint Zion Metals Inc. has three grades of metal product, A1, B3, and E6. Financial data for the three grades are as follows: A1 B3 E6 Revenue $ 400,000 $ 578,000 $ 300,000 Variable cost $(250,000) $(380,000) $(270,000) Fixed cost (105,000) (118,800) (20,000) Total cost $(355,000) $(498,800) $(290,000) Operating income $ 45,000 $ 79,200 $ 10,000 Number of units ÷ 15,000 ÷ 16,500 ÷ 5,000 Operating income per unit $ 3.00 $ 4.80 $ 2.00 Zion Metals’ operations require all three grades to be melted in a furnace before being formed. The furnace runs 24 hours a day, 7 days a week, and is a production constraint. The furnace hours required per unit of each product are as follows: A1: 8 hours B3: 10 hours E6: 6 hours The Marketing Department is considering a new marketing and sales campaign. Which product should be emphasized in the marketing and sales…arrow_forwardonly need 4-7arrow_forward

- Lattimer Company had the following results of operations for the past year: Contribution margin income statement Sales (18,000 units) Variable costs Direct materials Direct labor Overhead Contribution margin Fixed costs Fixed overhead Fixed selling and administrative expenses Income Multiple Choice O $6,000 profit. Per Unit $ 12.00 $4,000 loss. 1.50 4.00 1.00 5.50 1.00 1.40 $ 3.10 A foreign company offers to buy 6,000 units at $7.50 per unit. In addition to variable costs, selling these units would add a $0.25 selling expense for export fees. Lattimer's annual production capacity is 28,000 units. If Lattimer accepts this additional business, the special order will yield a: Annual Total $ 216,000 27,000 72,000 18,000 99,000 18,000 25, 200 $ 55,800arrow_forwardSubject: acountingarrow_forwardPlease do not give solution in image format thankuarrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward?? Ansarrow_forwardRequired information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (11,200 units at $280 each) Variable costs (11,200 units at $210 each) Contribution margin Fixed costs Income $ 3,136,000 2,352,000 784,000 567,000 $ 217,000 1. Compute break-even point in units. 2. Compute break-even point in sales dollars. 1. Break-even units 2. Break-even sales dollars unitsarrow_forward

- N1. Accountarrow_forwardHudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (10,500 units at $225 each) Variable costs (10,500 units at $180 each) Contribution margin Fixed costs Income $ 2,362,500 1,890,000 472,500 369,000 $ 103,500 Exercise 5-18 (Algo) Evaluating strategies-price increase LO C2 If the company raises its selling price to $240 per unit. 1. Compute Hudson Company's contribution margin per unit. 2. Compute Hudson Company's contribution margin ratio. 3. Compute Hudson Company's break-even point in units. 4. Compute Hudson Company's break-even point in sales dollars. 1. Contribution margin 2. Contribution margin ratio 3. Break-even in units 4. Break-even sales dollars per unit % unitsarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education