FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

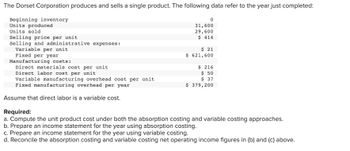

Transcribed Image Text:The Dorset Corporation produces and sells a single product. The following data refer to the year just completed:

Beginning inventory

Units produced

Units sold

Selling price per unit

Selling and administrative expenses:

Variable per unit

Fixed per year

0

31,600

29,600

$ 414

$ 21

$ 621,600

Manufacturing costs:

Direct materials cost per unit

Direct labor cost per unit

Variable manufacturing overhead cost per unit

Fixed manufacturing overhead per year

Assume that direct labor is a variable cost.

Required:

a. Compute the unit product cost under both the absorption costing and variable costing approaches.

b. Prepare an income statement for the year using absorption costing.

c. Prepare an income statement for the year using variable costing.

d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above.

$ 216

$ 50

$37

$ 379,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Chapter 3- CVP Cost-volume-profit (CVP) analysis requires an understanding of cost behavior: variable and fixed costs. Cost behavior differs from the GAAP-based financial reporting focus: product and period costs. The two ways to categorize costs results in TWo different income statements: Absorption costing income statement: S-C-GM-SA-NI (Key assumption: Split costs into product and period costs) Variable costing income statement: S-VE-CM-FE-NI (Key assumption: Split costs into variable and fixed) 1. 2. Absorption Costing Income Statement Variable Costing Income Statement Sales $500,000 Sales $500,000 Less: Variable expenses Less: Cost of goods sold: Variable (DM+DL+VOH) Fixed (FOH) Gross margin 100,000 Product costs 100,000 60,000 S&A costs 110,000 340,000 Contribution margin 290,000 Less: Fixed expenses Less: Selling & administrative Variable 110,000 Product costs 60,000 Fixed 140,000 S&A costs 140,000 Taxable income $90,000 Taxable income $90,000 LINK THE LINEAR COST FUNCTION TO…arrow_forwardshow Total Period cost by using absorption costing.arrow_forwardvishu subject-Accountingarrow_forward

- Amazin' 69 Corp. Income Statement For Month Ending May 31, 20XX Fixed Cost of Goods Sold Fixed Selling and Administrative Costs Sales Revenue Variable Cost of Goods Sold Variable Selling and Administrative Costs Operating Income Calculate the contribution margin and operating income for May Amazin' 69 Corp. Contribution Margin Income Statement For Month Ending May 31 20XXarrow_forwardOn November 30, the end of the first month of operations, Weatherford Company prepared the following income statement, based on the absorption costing concept: Weatherford Company Absorption Costing Income Statement For the Month Ended November 30 Sales (6,100 units) Cost of goods sold: Cost of goods manufactured (7,000 units) Inventory, November 30 (1,000 units) Total cost of goods sold Gross profit $161,000 Sales Variable cost of goods sold: Variable cost of goods manufactured Inventory, November 30 (23,000) $201,300 138,000 $63,300 Selling and administrative expenses 35,910 Income from operations $27,390 Assume the fixed manufacturing costs were $38,640 and the fixed selling and administrative expenses were $17,590 Prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Weatherford Company Variable Costing Income Statement For the Month Ended November 30 201,300arrow_forwardHt.9.arrow_forward

- Part 2: Based on the data presented in the Unit VII Spreadsheet Template in Excel (Full Variable tab), complete thecalculations listed below.• Calculate the value of ending inventory under full or absorption costing.• Calculate the value of ending inventory under variable costing.Which method you think is more helpful to managers and why. Cookie Business Productions Costs: Direct material $ 0.60 Direct labor $ 1.00 Variable manufacturing overhead $ 0.40 Total variable manufacturing costs per unit $ 2.00 Fixed manufacturing overhead per year $ 139,000.00 In addition, the company has fixed selling and administrative costs: Fixed selling costs per year $ 50,000.00 Fixed administrative costs per year $ 65,000.00 Selling price per cookie $ 3.75 Number of cookies produced 2,780,000 Number of cookies sold 2,600,000 Full (absorption) costing : Full…arrow_forwardDogarrow_forwardneed last three requirement , answer in text form please (without image)arrow_forward

- Please do not give solution in image format thankuarrow_forwardCheck my work During Heaton Company's first two years of operations, It reported absorption costing net operating income as follows: Sales (@ $63 per unit) Cost of goods sold (@ $35 per unit) Gross margin Selling and administrative expenses* Year 1 $ 1, 008, 00 560, 000 448, 000 295, 000 Year 2 $ 1, 638, 00 910, 000 728, 000 325, 000 Net operating income 153, 000 403, 000 * $3 per unit variable; $247,000 fixed each year. The company's $35 unit product cost is computed as follows: Direct materials $ 5 Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($357, 000 + 21, 000 units) Absorption costing unit productlcost 10 3 17 $ 35 Production and cost data for the first two years of operations are: Year 2 21, 000 Year 1 Units produced Units sold 21, 000 16, 000 26, 000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education