FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

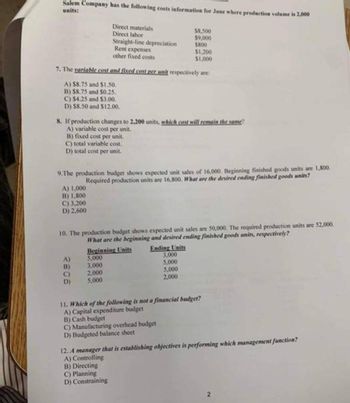

Transcribed Image Text:Salem Company has the following costs information for June where production volume is 2,000

units:

7. The variable cost and fixed cost per unit respectively are:

A) $8.75 and $1.50.

B) $8.75 and $0.25.

C) $4.25 and $3.00.

D) $8.50 and $12.00.

B) fixed cost per unit.

C) total variable cost.

D) total cost per unit.

A) 1,000

B) 1,800

Direct materials

Direct labor

8. If production changes to 2.200 units, which cost will remain the same?

A) variable cost per unit.

C) 3,200

D) 2,600

Straight-line depreciation

Rent expenses

other fixed costs

9.The production budget shows expected unit sales of 16,000. Beginning finished goods units are 1,800.

Required production units are 16,800. What are the desired ending finished goods units?

A)

B)

D)

10. The production budget shows expected unit sales are 50,000. The required production units are 52,000.

What are the beginning and desired ending finished goods units, respectively?

Ending Units

2,000

5,000

$8,500

$9,000

5800

Beginning Units

5,000

3.000

$1,200

$1,000

3,000

5,000

5,000

2,000

C) Manufacturing overhead budget

D) Budgeted balance sheet

11. Which of the following is not a financial budget?

A) Capital expenditure budget

B) Cash budget

12. A manager that is establishing objectives is performing which management function?

A) Controlling

B) Directing

C) Planning

D) Constraining

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- R Ltd. produces a product with the following costs as of July 1, 20XX: Material Labour Overhead $5 per unit 7 per unit 5 per unit Assuming R sold 26,000 units during the last six months of the year at $22 each, beginning inventory at these costs on July 1 was 8,000 units. From July 1 to December 31, 20XY, R produced 20,000 units. These units had a material cost of $6 per unit. The costs for labour and overhead were the same. a. If R uses FIFO inventory accounting, what would be the gross profit for the period? Gross profit b. If R uses FIFO inventory accounting, What is the value of ending inventory? Ending inventoryarrow_forwardJason Inc. shows the following manufacturing costs for the first four months of the year. Manufacturing Costs for the First Four Months Months Production in Units Total Costs January 2,500 $33,750 February 1,800 $29,900 March 3,000 $36,500 April 2,600 $34,300 Using the high-low method, determine the variable costs per unit. (Round intermediate calculations and your final answer to two decimal places.) Group of answer choices $14.39 $12.17 $13.50 $5.50arrow_forwardThe manufacturing costs of Calico Industries for 3 months of the year are as follows: Total Cost Production (units) April $111,100 276,200 May 82,600 163,200 June 106,300 244,600 Using the high-low method, the variable cost per unit and the total fixed costs are Round your intermediate calculations to two decimal places. a.$2.50 per unit and $4,205, respectively b.$4.50 per unit and $4,205, respectively c.$0.25 per unit and $42,050, respectively d.$0.45 per unit and $21,025, respectivelyarrow_forward

- Bernard Company shows the following manufacturing costs for the first six months of the year: Production in Units Total Costs 1,350 $38,636 1,200 $36,000 1,520 $40,436 2,150 2,590 2,600 January February March April May June Using the high-low method, the total fixed costs are A. $14,900 B. $50,900 C. $23,236 D. $27,664 $48,636 $50,780 $50,900 (Round intermediate calculations to two decimal places, and the final calculation to the nearest dollar.)arrow_forwardThe manufacturing costs of Mocha Industries for three months of the year are as follows: Total Cost Production April $98,908 1,180 Units May 101,540 1,650 June 105,740 2,400 a. Using the high-low method, determine the variable cost per unit. Round your answer to two decimal places.$ per unit b. Using the high-low method, determine the total fixed costs.$arrow_forwardThe manufacturing cost of Mocha Industries for three months of the year are provided below: Total Cost Production April $52,866 1,860 Units May 55,160 2,600 Units June 58,818 3,780 Units (a) Using the high-low method, determine the variable cost per unit. Round your answer to two decimal places. per unit (b) Using the high-low method, determine total fixed costs.arrow_forward

- The manufacturing costs of Ackerman Industries for the first three months of the year follow: Total Costs Units Produced January $264,960 1,380 units February 392,730 2,330 March 412,160 3,680 Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost. Round all answers to the nearest whole dollar. a. Variable cost per unit $fill in the blank 1 b. Total fixed cost $fill in the blank 2arrow_forwardThe manufacturing costs of Kellam Industries for the first three months of the year follow: Total Costs Units Produced January $318,060 2,015 units February 357,640 3,850 March 494,760 5,115 Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost. a. Variable cost per unit $fill in the blank 1 b. Total fixed cost $fill in the blank 2arrow_forwardThe manufacturing cost of Mocha Industries for three months of the year are provided below: Total Cost Production April $85, 160 1,600 Units May 89,064 2,240 Units June 95, 225 3,250 Units (a) Using the high - low method, determine the variable cost per unit. Round your answers to two decimal places. $ fill in the blank 1 per unit (b) Using the high-low method, determine total fixed costs. $ fill in the blank 2arrow_forward

- Ocean Company makes calendars. Information on cost per unit is as follows: Direct materials $1.50 Direct labor 1.20 Variable overhead 0.90 Variable marketing expense 0.40 Fixed marketing expenses totaled $12,000 and fixed administrative expenses totaled $32,000. The price per calendar is $15. What is the break-even point in units?arrow_forwardAmber Company produces iron table and chair sets. During October, Amber's costs were as follows: Actual purchase price Actual direct labor rate $2.70 per pound $7.90 per hour $ 2.50 per pound 1,010,000 pounds 21,000 1,215,000 pounds 14,000 1,040,000 pounds $5,880 F Standard purchase price Standard quantity for sets produced Standard direct labor hours allowed Actual quantity purchased in October Actual direct labor hours Actual quantity used in October Direct labor rate variance Required: 1. Calculate the total cost of purchases for October. 2. Compute the direct materials price variance based on the actual quantity purchased. 3. Calculate the direct materials quantity variance based on the actual quantity used. 4. Compute the standard direct labor rate for October. 5. Compute the direct labor efficiency variance for October. Complete this question by entering your answers in the tabs below.arrow_forwardThe manufacturing costs of Calico Industries for three months of the year are provided below: Total Cost Production (units) April $113,700 281,300 May 80,700 165,900 June 105,000 243,500 Using the high-low method, the variable cost per unit and the total fixed costs are a.$2.90 per unit and $3,212 b.$0.29 per unit and $32,123 c.$0.52 per unit and $16,062 d.$5.22 per unit and $3,212arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education