FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

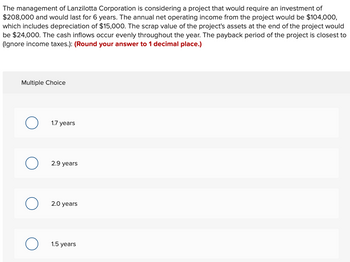

Transcribed Image Text:The management of Lanzilotta Corporation is considering a project that would require an investment of

$208,000 and would last for 6 years. The annual net operating income from the project would be $104,000,

which includes depreciation of $15,000. The scrap value of the project's assets at the end of the project would

be $24,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to

(Ignore income taxes.): (Round your answer to 1 decimal place.)

Multiple Choice

1.7 years

2.9 years

2.0 years

1.5 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Spicy Ice Cream Co. is considering a three-year project with annual operating cash flows (OCF) of $42,790. The project requires an initial increase in Net Working Capital of $70,000 and an up-front capital expense of $60,000. The capital asset will depreciate to zero in three years and will be sold at the end of the project for $3,800 (after-tax). The required return is 24.25%. What is the project's NPV? (Note: all tax implications have already been factored into the cash flows above.)arrow_forwardIronZee Industries is adding a new product line that will require an investment of $1,268,000. It is estimated this investment will have a 10-year life and will generate net cash inflows of $296,000 the first year, $266,000 during the second year, and $235,000 each year thereafter for 8 years. The project will have $0.00 residual value. Compute the ARR for the investment. (Round your answers to two decimal places when needed and use rounded answers for all future calculations). IronZee Industries Total net cash inflows during operation life of expansion Less: Total depreciation during operating life of expansion Total operating income during operating life Divide by: expansions operating life in years Average annual operating income from expansion (Amount Invested + Residual Value) / 2 / 2 = = / Average amount Invested Average annual operating income / Average amount invested = = ARR (%)arrow_forwardA project is expected to create operating cash flows of $25,300 a year for four years. The fixed assets required for the project cost $60,000 and will be worthless at the end of the project. An additional $3,000 of net working capital will be required when the project starts and will be fully recovered at the end of the project. What is the project's net present value if the required rate of return is 12 percent? O $14,028.18 O $15.751.49 O $16,954.17 O $17,396.31arrow_forward

- You are evaluating an investment project costing $42,000 initially. The project will provide $3,000 in after - tax cash flows in the first year, and $7,000 each year thereafter for 10 years. The maximum payback period for your company is 6 years. What is the payback period for this project?arrow_forwardA project will produce an operating cash flow of $78,900 a year for five years. The initial cash outlay for equipment will be $110,530. The net after-tax salvage value of $33,147 will be received at the end of the project. The project requires $17,938 of net working capital that will be fully recovered at the end of the project. What is the net present value of the project if the required rate of return is 12 percent?arrow_forwardRapp Hardware is adding a new product line that will require an investment of $1,418,000. Managers estimate that this investment will have a 10-year life and generate net cash inflows of $320,000 the first year, $270,000 the second year, and. $240,000 each year thereafter for eight years. Assume the project has no residual value. Compute the ARR for the investment. Round to two places. Select the formula, then enter the amounts to calculate the ARR (accounting rate of return) for the new product line. (Round ARR to the nearest hundredth percent [two decimal places], X.XX%.) Average annual operating income +Average amount invested = ARR = %arrow_forward

- Olinick Corporation is considering a project that would require an investment of $354,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (ignore income taxes.): Sales Variable expenses Contribution margin Fixed expenses: Salaries Rents Depreciation Total fixed expenses Net operating income Multiple Choice The scrap value of the project's assets at the end of the project would be $30,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to: (Round your answer to 1 decimal place.) 4.8 years $ 210,000 22,000 188,000 7.5 years 40,000 53,000 48,000 141,000 $ 47,000arrow_forwardA 7-year project is expected to provide annual sales of $221,000 with costs of $97,500. The equipment necessary for the project will cost $360,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-15 percent. The tax rate is 35 percent. What is the annual operating cash flow for the worst-case scenario?arrow_forwardEbay is considering an investment into a project which it intends to operate for 5 years. The project requires an initial outlay of $6 million. The project will generate cash sales of $2.5 million in the first year. Sales will grow by $1 million each year in the following two years. After the third year, sales will grow by 7%. Cash operating costs, excluding depreciation, will be 20% of sales. Depreciation expenses will be 10% of sales. There are no cash flows associated with the salvage value or the net working capital. Ebay’s tax rate is 30%. What is the IRR of this project? (Round to the nearest two digits)arrow_forward

- A project will produce an operating cash flow of $164,000 a year for three years. The initial cash outlay for equipment will be $305,000. The net aftertax salvage value of $12,500 will be received at the end of the project. The project requires $41,000 of net working capital up front that will be fully recovered when the project ends. What is the net present value of the project if the required rate of return is 11 percent?$93,887.95 correct $90,124.63 incorrect$86,361.31 incorrect$82,597.99 incorrect$78,834,67 incorrect $93,887.95 $90,124.63 $86,361.31 $82,597.99 $78,834.67arrow_forwardTesla is considering an investment into a project which it intends to operate for 6 years. The project requires an initial outlay of $7 million. The project will generate cash sales of $3.5 million in the first year. Sales will grow by $1.5 million each year in the following two years. After the third year, sales will grow by 8%. Cash operating costs, excluding depreciation, will be 22% of sales. Depreciation expenses will be 11% of sales. There are no cash flows associated with the salvage value or the net working capital. Tesla’s tax rate is 35%. What is the IRR of this project?arrow_forwardGalbraith Co. is considering a four-year project that will require an initial investment of $9,000. The base-case cash flows for this project are projected to be $15,000 per year. The best-case cash flows are projected to be $22,000 per year, and the worst-case cash flows are projected to be –$1,500 per year. The company’s analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project’s cost of capital is 11%? $24,135 $36,203 $30,169 $25,644arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education