FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

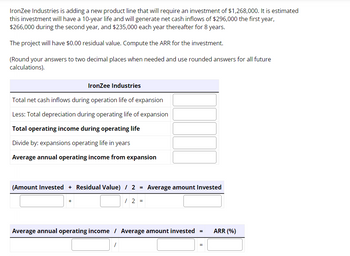

Transcribed Image Text:IronZee Industries is adding a new product line that will require an investment of $1,268,000. It is estimated

this investment will have a 10-year life and will generate net cash inflows of $296,000 the first year,

$266,000 during the second year, and $235,000 each year thereafter for 8 years.

The project will have $0.00 residual value. Compute the ARR for the investment.

(Round your answers to two decimal places when needed and use rounded answers for all future

calculations).

IronZee Industries

Total net cash inflows during operation life of expansion

Less: Total depreciation during operating life of expansion

Total operating income during operating life

Divide by: expansions operating life in years

Average annual operating income from expansion

(Amount Invested + Residual Value) / 2

/ 2 =

=

/

Average amount Invested

Average annual operating income / Average amount invested

=

=

ARR (%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Company is evaluating investing in a new metal stamping machine costing $80,458. The Company estimates that it will realize $14,000 in annual cash inflows for each year of the machine's 8-year useful life. The internal rate of return (IRR) for the machine is approximately:Present Value of $1 Periods 6% 8% 10% 12% 14% 3 0.840 0.794 0.751 0.712 0.675 4 0.792 0.735 0.683 0.636 0.592 5 0.747 0.681 0.621 0.567 0.519 6 0.705 0.630 0.564 0.507 0.456 7 0.665 0.583 0.513 0.452 0.400 8 0.627 0.540 0.467 0.404 0.351 9 0.592 0.500 0.424 0.361 0.308 10 0.558 0.463 0.386 0.322 0.270 Present Value of Annuity of $1 Periods 6% 8% 10% 12% 14% 3 2.673 2.577 2.487 2.402 2.322 4 3.465 3.312 3.170 3.037 2.914 5 4.212 3.993 3.791 3.605 3.433 6 4.917 4.623 4.355 4.111 3.889 7 5.582 5.206 4.868 4.564 4.288 8 6.210 5.747 5.335 4.968 4.639 9 6.802 6.247 5.759 5.328 4.946 10 7.360 6.710 6.145 5.650 5.216 8%. 12%. 4%. 6%.arrow_forwardA company is deciding between two systems to purchase. System A has a purchase price of $21,000 and will generate cash flows of $6,000 at the end of each of the next 6 years. Alternatively the company can purchase System B for $11,000 and it will generate cash flows of $6,000 for each of the next 3 years. If the company's WACC is 11% and both "projects" can be repeated indefinitely, what is the EAA of System B? Do not round intermediate calculations. Round your final answer to the nearest whole number.arrow_forwardConsolidated Aluminum is considering the purchase of a new machine that will cost $308,000 and provide the following cash flows over the next five years: $88,000, 92,000, $91,000, $72,000, and $71,000. What is the internal rate of return (IRR) for this piece of equipment? Use the Present Value tables in Time Value of Money Appendix e of the book or use Excel to calculate the answer. Round to 2 decimal places. O Cannot be determined from the information provided. O 11.30% O 11.28% O 11.00%arrow_forward

- Mini Inc. is contemplating a capital project costing $47,019. The project will provide annual cost savings of $18,501 for 3 years and have a salvage value of $3,000. The company's required rate of return is 10%. The company uses straight-line depreciation. Present Value of an Annuity of 1 Period Present Value of 1 at 10% Present Value of an Annuity of 1 at 10% 1 .909 .909 .826 1.736 3 .751 2.487 Calculate the Net Present Value. Round your answer to 2 decimal places.arrow_forwardStrange Manufacturing Company is purchasing a production facility at a cost of $12 million. The company expects the project to generate annual cash flows of $6.4 million over the next 5 years. Its cost of capital is 6.7 per cent. What is the net present value of this project? Round your answer to 2 decimal places. E.g. if the final value is $12345.8342, please type 12345.83 in the answer box (do not type the dollar sign).arrow_forwardYour company is planning to purchase a new log splitter for its lawn and garden business. The new splitter has an initial investment of $312,000. It is expected to generate $40,000 of annual cash flows, provide incremental cash revenues of $165,488, and incur incremental cash expenses of $80,000 annually. What is the payback period and accounting rate of return (ARR)? Round your answers to 1 decimal place. Payback period fill in the blank 1 years ARR fill in the blank 2%arrow_forward

- A project has annual cash flows of $3,500 for the next 10 years and then $11,000 each year for the following 10 years. The IRR of this 20-year project is 12.93%. If the firm's WACC is 11%, what is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $ ___arrow_forwardCII, Incorporated, invests $700,000 in a project expected to earn a 9% annual rate of return. The earnings will be reinvested in the project each year until the entire investment is liquidated 11 years later. What will the cash proceeds be when the project is liquidated? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "FV of a single amount" to 4 decimal places and final answer to the nearest whole dollar.) Present Value X f (FV of a Single Amount) Future Valuearrow_forwardAn investment has an installed cost of $527,630. The cash flows over the four-year life of the investment are projected to be $212,200, $243,800, $203,500 and $167,410, respectively. If the discount rate is 10%, at what discount rate is the NPV just equal to 0? (Input in percentage, keep 2 decimals. e.g. if you got 0.10231, input 10.23) Question 10 The Yurdone Corporation wants to set up a private cemetery business. According to the CFO, Barry M. Deep, business is "looking up". As a result, the cemetery project will provide a net cash inflow of $145,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 4% per year forever. The project requires an initial investment of $1,900,000. The company is somewhat unsure about the assumption of a growth rate of 4% in its cash flows. At what constant growth rate would the company just break even if it still required a return of 11% on investment? (Input in percentage, keep 2 decimals. e.g. if you got…arrow_forward

- Chaquille's K-House, Inc. made an investment in a project with an initial cost of $11,205,051. This investment was for 8 years and had no residual value. The company expects to receive yearly net cash inflows of $2,611,900. Management is requiring a return of 12% on the investment. (Round your answers to two decimal places when needed and use rounded answers for all future calculations).arrow_forward3) see picturearrow_forwardYour company is planning to purchase a new log splitter for its lawn and garden business. The new splitter has an initial investment of $320,000. It is expected to generate $40,000 of annual cash flows, provide incremental cash revenues of $215,760, and incur incremental cash expenses of $130,000 annually. What is the payback period and accounting rate of return (ARR)? Round your answers to 1 decimal place. Payback period years ARR %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education