Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

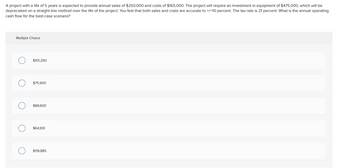

Transcribed Image Text:A project with a life of 5 years is expected to provide annual sales of $250,000 and costs of $165,000. The project will require an investment in equipment of $475,000, which will be

depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-10 percent. The tax rate is 21 percent. What is the annual operating

cash flow for the best-case scenario?

Multiple Choice

$101,250

$75,900

$88,600

$64,100

$119,885

Expert Solution

arrow_forward

Step 1

Annual Sales = $ 250000

Cost =$ 165000

Tax rate 21%

Life of project 5 years

Project will require an investment of $475000

Depreciation as per Straight line method

To calculate the annual operating Cash flow for best case scenario

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A 6-year project is expected to generate annual sales of 10,100 units at a price of $88 per unit and a variable cost of $59 per unit. The equipment necessary for the project will cost $413,000 and will be depreciated on a straight-line basis over the life of the project. Fixed costs are $250,000 per year and the tax rate is 21 percent. How sensitive is the operating cash flow to a $1 change in the per unit sales price? Multiple Choice O $5,172 $4,897 $5,448 $7,979 $5,999arrow_forwardA 7-year project is expected to provide annual sales of $201,000 with costs of $95,000. The equipment necessary for the project will cost $335,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-10 percent. The tax rate is 40 percent. What is the annual operating cash flow for the worst-case scenario? Multiple Choice $45,840 $100,503 $49,703 $64,983 $73,383arrow_forwardA 5-year project is expected to provide annual sales of $237,000 with costs of $99,500. The equipment necessary for the project will cost $380,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +-15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the worst-case scenario? Multiple Choice $143,185 $52,215 $105,590 $65,210 $84,710arrow_forward

- A 7-year project is expected to generate annual sales of 10,200 units at a price of $89 per unit and a variable cost of $60 per unit. The equipment necessary for the project will cost $421,000 and will be depreciated on a straight-line basis over the life of the project. Fixed costs are $255,000 per year and the tax rate is 23 percent. How sensitive is the operating cash flow to a $1 change in the per unit sales price? Multiple Choice $7,854 $6,116 O $6,433 O $7,069 $5,798arrow_forwardA 5-year project is expected to generate annual sales of 8,400 units at a price of $71 per unit and a variable cost of $42 per unit. The equipment necessary for the project will cost $277,000 and will be depreciated on a straight-line basis over the life of the project. Fixed costs are $165,000 per year and the tax rate is 21 percent. How sensitive is the operating cash flow to a $1 change in the per unit sales price? Multiple Choice о O $4,914 $6,636 $3,598 $4,037 $3,159arrow_forwardA 7-year project is expected to generate annual sales of 10,400 units at a price of $91 per unit and a variable cost of $62 per unit. The equipment necessary for the project will cost $437,000 and will be depreciated on a straight-line basis over the life of the project. Fixed costs are $265,000 per year and the tax rate is 21 percent. How sensitive is the operating cash flow to a $1 change in the per unit sales price? Multiple Choice O O $8,216 $6,084 $5,119 $5,361 $5,602arrow_forward

- A proposed new project has projected sales of $244,500, costs of $123,100, and depreciation of $15,100. The tax rate is 21%. What is the operating cash flow of this project?arrow_forwardA 5-year project is expected to generate annual sales of 8,800 units at a price of $75 per unit and a variable cost of $46 per unit. The equipment necessary for the project will cost $309,000 and will be depreciated on a straight-line basis over the life of the project. Fixed costs are $185,000 per year and the tax rate is 21 percent. How sensitive is the operating cash flow to a $1 change in the per unit sales price? Multiple Choice $3,254 $3,629 $6,952 $4,752 $4,003arrow_forwardSuppose you are considering an investment project that requires $800,000, has a six-year life, and has a salvage value of $100,000. Sales volume is projected to be 65,000 units per year. Price per unit is $63, variable cost per unit is $42, and fixed costs are $532,000 per year. The depreciation method is a five-year MACRS. The tax rate is 35% and you expect a 20% return on this investment.(a) Determine the break-even sales volume.(b) Calculate the cash flows of the base case over six years and its NPW.(c) lf the sales price per unit increases to $400, what is the required break-even volume?(d) Suppose the projections given for price, sales volume, variable costs, and fixed costs are all accurale to wi thin ± 15%. What would be the NPW figures of the best-case and worst-case scenarios?arrow_forward

- You are evaluating purchasing the rights to a project that will generate after tax expected operating cash flows of $91k at the end of each of the next five years, plus an additional $1,000k non-operating terminal period cash flow at the end of the fifth year. You can purchase this project for $531k. If your firm's cost of capital (aka required rate of return) is 14.3%, what is the NPV of this project? Note: All dollar values are given in units of $1k = $1000. Provide your answer in units of $1000, thus, $15000 = 15k and thus you should enter 15 for your answer.arrow_forwardA 7-year project is expected to provide annual sales of $221,000 with costs of $97,500. The equipment necessary for the project will cost $360,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the worst-case scenario? es Multiple Choice $77,946 $44,504 0 $70,623 $129,329 $49.221arrow_forwardWe are evaluating a project that costs RM604,000, has an 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 55,000 units per year. Price per unit is RM36, variable cost per unit is RM17, and fixed costs are RM685,000 per year. The tax rate is 21 percent and we require a return of 15 percent on this project. (i) Calculate the base-case cash flow and NPV., (ii) Assume the sales figure increases to 56,000 units per year, calculate the sensitivity of NPV to changes in the sales figure?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education