FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

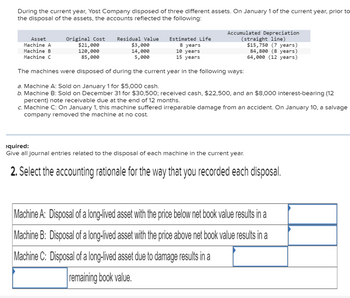

Transcribed Image Text:During the current year, Yost Company disposed of three different assets. On January 1 of the current year, prior to

the disposal of the assets, the accounts reflected the following:

Asset

Machine A

Machine B

Machine C

Estimated Life

8 years

10 years

15 years

The machines were disposed of during the current year in the following ways:

a. Machine A: Sold on January 1 for $5,000 cash.

b. Machine B: Sold on December 31 for $30,500; received cash, $22,500, and an $8,000 interest-bearing (12

percent) note receivable due at the end of 12 months.

c. Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10, a salvage

company removed the machine at no cost.

Original Cost Residual Value

$21,000

120,000

85,000

Accumulated Depreciation

(straight line)

$15,750 (7 years)

84,800 (8 years)

64,000 (12 years)

$3,000

14,000

5,000

equired:

Give all journal entries related to the disposal of each machine in the current year.

2. Select the accounting rationale for the way that you recorded each disposal.

Machine A: Disposal of a long-lived asset with the price below net book value results in a

Machine B: Disposal of a long-lived asset with the price above net book value results in a

Machine C: Disposal of a long-lived asset due to damage results in a

remaining book value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can I please get help with this practice question?7.11 Yoshi Company completed the following transactions and events involving its delivery trucks. Year 1 January 1 Paid $25,015 cash plus $1,635 in sales tax for a new delivery truck estimated to have a five-year life and a $2,450 salvage value. Delivery truck costs are recorded in the Trucks account. December 31 Recorded annual straight-line depreciation on the truck. Year 2 December 31 The truck’s estimated useful life was changed from five to four years, and the estimated salvage value was increased to $2,550. Recorded annual straight-line depreciation on the truck. Year 3 December 31 Recorded annual straight-line depreciation on the truck. December 31 Sold the truck for $5,400 cash. Required: 1-a. Calculate depreciation for Year 2. 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events. Required 1A Required 1B…arrow_forwardDiaz Company owns a machine that cost $125,700 and has accumulated depreciation of $93,300. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $15,600 cash. 3. Diaz sold the machine for $32,400 cash. 4. Diaz sold the machine for $40,900 cash. View transaction list 1 Record the disposal of the machine receiving nothing in return. 2 Record the sale of the machine for $15,600 cash. 3 Record the sale of the machine for $32,400 cash. 4 Record the sale of the machine for $40,900 cash. Note : = = journal entry has been entered Record entry Clear entry X Credit View general journal >arrow_forwardBravo Company's furnace, which has a current book value of $40,000 (original cost less than accumulated depreciation), has been destroyed. If the insurance company pays Bravo $45,000, which of the following transactions is Bravo supposed to record? Select the single best answer: A debit Cash $45,000 credit Equipment/Furnace $45,000 B. debit Cash $40,000, debit Equipment/Furnace $40,000 C credit Gain on Disposition of Equipment/Furnace $45,000, debit Cash $45,000 D. debit Equipment/Furnace $5,000 credit Equipment/Furnace $40.000, debit Cash $45,000 E credit Gain on Disposition of Equipment/Furnace $5,000 credit Equipment/Furnace $40,000; debit Cash $45.000arrow_forward

- Ace Company buys a machine on April 1, Year One, for $50,000 in cash. It has a residual value of $10,000 and an expected useful life of ten years. The straight-line method and the half-year convention are applied. The asset is sold on September 1, Year Three, for $39,900. What loss should be reported on this sale? a. $100 loss b. $850 loss c. $1,767 loss d. $2,100 lossarrow_forwardBlossom Inc. recently replaced a piece of automatic equipment at a net price of $3,500, f.o.b. factory. The replacement was necessary because one of Blossom’s employees had accidentally backed his truck into Blossom’s original equipment and made it inoperable. Because of the accident, the equipment had no resale value to anyone and had to be scrapped. Blossom’s insurance policy provided for a replacement of its equipment and paid the price of the new equipment directly to the new equipment manufacturer, minus the deductible amount paid to the manufacturer by Blossom. The $3,500 that Blossom paid was the amount of the deductible that it has to pay on any single claim on its insurance policy. The new equipment represents the same value in use to Blossom. The used equipment had originally cost $64,000. It had a book value of $45,000 at the time of the accident and a second-hand market value of $50,000 before the accident, based on recent transactions involving similar equipment. Freight…arrow_forward1arrow_forward

- On January 1, Year 2, Webb Construction Company overhauled four cranes resulting in a slight increase in the life of the cranes. Such overhauls occur regularly at two-year intervals and have been treated as maintenance expense in the past. Management is considering whether to capitalize this year's $28,310 cash cost expense. Assume that the cranes have a remaining useful life of two years and no expected salvage value. Assume straight-line depreciation. the Cranes asset account or to expense it as a maintenance Required a. Determine the amount of additional depreciation expense Webb would recognize in Year 2 and Year 3 if the cost were capitalized in the Cranes account. b. Determine the amount of expense Webb would recognize in Year 2 and Year 3 if the cost were recognized as maintenance expense. c. Determine the effect of the overhaul on cash flow from operating activities for Year 2 and Year 3 if the cost were capitalized and expensed through depreciation charges. (Cash outflows…arrow_forwardVishuarrow_forwardDiaz Company owns a machine that cost $125,400 and has accumulated depreciation of $92,500. Prepare the entry to record the disposal of the machine on January 1 in each seperate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $16,300 cash. 3. Diaz sold the machine for $32,900 cash. 4. Diaz sold the machine for $40,400 cash. View transaction list Journal entry worksheet 3 Record the sale of the machine for $40,400 cash. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Record entry Clear entry View general journalarrow_forward

- Prepare journal entries to record these transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Blossom Company retires its delivery equipment, which cost $40,000. Accumulated depreciation is also $40,000 on this delivery equipment. No salvage value is received. Assume the same information as in part (a), except that accumulated depreciation for the equipment is $36,000 instead of 40,000. (a) (b) No. Account Titles and Explanation Debit Credit (a) (b)arrow_forwardBlossom Inc. recently replaced a piece of automatic equipment at a net price of $3,500, f.o.b. factory. The replacement was necessary because one of Blossom’s employees had accidentally backed his truck into Blossom’s original equipment and made it inoperable. Because of the accident, the equipment had no resale value to anyone and had to be scrapped. Blossom’s insurance policy provided for a replacement of its equipment and paid the price of the new equipment directly to the new equipment manufacturer, minus the deductible amount paid to the manufacturer by Blossom. The $3,500 that Blossom paid was the amount of the deductible that it has to pay on any single claim on its insurance policy. The new equipment represents the same value in use to Blossom. The used equipment had originally cost $64,000. It had a book value of $45,000 at the time of the accident and a second-hand market value of $50,000 before the accident, based on recent transactions involving similar equipment. Freight…arrow_forwardA company purchased a computer that cost $10,000, It had an estimated useful life of 5 years and no residual value. The computer was depreciated by the straight-line method and it was sold at the end of the second year of use for $5,000 cash. The company should record:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education