FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

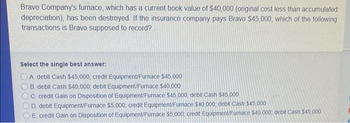

Transcribed Image Text:Bravo Company's furnace, which has a current book value of $40,000 (original cost less than accumulated

depreciation), has been destroyed. If the insurance company pays Bravo $45,000, which of the following

transactions is Bravo supposed to record?

Select the single best answer:

A debit Cash $45,000 credit Equipment/Furnace $45,000

B. debit Cash $40,000, debit Equipment/Furnace $40,000

C credit Gain on Disposition of Equipment/Furnace $45,000, debit Cash $45,000

D. debit Equipment/Furnace $5,000 credit Equipment/Furnace $40.000, debit Cash $45,000

E credit Gain on Disposition of Equipment/Furnace $5,000 credit Equipment/Furnace $40,000; debit Cash $45.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ashvinnarrow_forwardShamrock Inc. owns equipment that cost $605,000 and has accumulated depreciation of $157,000. The expected future net cash flows from the use of the asset are expected to be $400,000. The fair value of the equipment is $346,000. Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardPiper's Pizza sold baking equipment for $27,000. The equipment was originally purchased for $74,000, and depreciation through the date of sale totaled $53,000. Record the gain or loss on the sale of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

- Prepare journal entries to record these transactions. (a) Echo Company retires its delivery equipment, which cost $41000. Accumulated depreciation is also $41000 on this delivery equipment. No salvage value is received. (b) Assume the same information as in part (a), expcept that accumulated depreciation for the equipment is $37200 instead of $41000.arrow_forwardStar Co had an on-going litigation claim which had been brought against the company for damage to a public road allegedly caused by one of its lorries. At 1 October 20X2, Star Co had disclosed a contingent liability of $120,000. Due to new developments in the court case, the latest correspondance with the solicitors at 30 September 20X3 suggests it is now probable that Star Co will lose and have to pay damages of $150,000. What is the impact of the above provision on the statements of profit or loss for the year ended 30 September 20X3?arrow_forwardWindsor Company owns equipment that cost $972,000 and has accumulated depreciation of $410,400. The expected future net cash flows from the use of the asset are expected to be $540,000. The fair value of the equipment is $432,000.Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amountarrow_forward

- Novak Corp., a small company that follows ASPE, owns machinery that cost $925,000 and has accumulated depreciation of $385,000. The undiscounted future net cash flows from the use of the asset are expected to be $513,000. The equipment's fair value is $440,000. Using the cost recovery impairment model, prepare the journal entry, if any, to record the impairment loss. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forwardGg.33.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education