FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Note

Valuation.

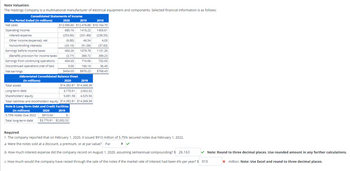

The Hastings Company is a multinational manufacturer of electrical equipment and components. Selected financial information is as follows:

Consolidated Statements of Income

For Period Ended (In millions)

Net sales

Operating income

Interest expense

Other income (expense), net

Noncontrolling interests

Earnings before income taxes

(Benefit) provision for income taxes

Earnings from continuing operations

Discontinued operations (net of tax)

Net earnings

Abbreviated Consolidated

(in millions)

2020

2019

$12,586.60 $12,476.88

680.16 1416.22

2018

$10,164.70

1403.61

(331.89) (238.55)

46.54

(253.00)

(6.80)

4.03

(20.10) (51.09) (37.83)

400.26 1079.78 1131.26

399.23

(3.77) 369.72

404.03

710.06

732.03

0.00

160.16

36.40

$404.03

$870.22

$768.43

2020

$910.00

$3,770.91

Balance Sheet

2020

2019

$14,382.81 $14,368.38

Total assets

Long-term debt

Shareholders' equity

Total liabilities and stockholders' equity $14,382.81 $14,368.38

Note 8-Long-Term Debt and Credit Facilities

2019

(in millions)

5.75% Notes Due 2022

Total long-term debt

3,770.91 2,002.52

5,091.58 4,525.56

$-

$2,002.52

Required

1. The company reported that on February 1, 2020, it issued $910 million of 5.75% secured notes due February 1, 2022.

a. Were the notes sold at a discount, a premium, or at par value? Par

b. How much interest expense did the company record on August 1, 2020, assuming semiannual compounding? $ 26.163

c. How much would the company have raised through the sale of the notes if the market rate of interest had been 6% per year? $ 910

Note: Round to three decimal places. Use rounded amount in any further calculations.

x million. Note: Use Excel and round to three decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- View Policies Current Attempt in Progress For its fiscal year ending October 31, 2025, Cullumber Corporation reports the following partial data. Income before income taxes Income tax expense (20% × $390,600) Income from continuing operations Loss on discontinued operations Net income $502,200 78,120 424,080 111,600 $312,480 The loss on discontinued operations was comprised of a $46,500 loss from operations and a $65,100 loss from disposal. The income tax rate is 20% on all items. (a) Prepare a correct partial income statement, beginning with income before income taxes. CULLUMBER CORPORATION Income Statement (Partial)arrow_forwardHow much net income did Wolf Enterprises earn during 2021? Net income for 2021 was Cost of services sold Accumulated depreciation Selling, general, and administrative expenses Retained earnings, December 31, 2020 $ 14,500 Service revenue 40,800 Depreciation expense Other revenue 6,100 Dividends declared Income tax expense 2,700 Income tax payable 32,400 4,200 700 700 500 1,100arrow_forwardHanshabenarrow_forward

- Forecast an Income Statement Following is the income statement for Medtronic PLC. Consolidated Statement of Income ($ millions) For Fiscal Year Ended April 26, 2019 Net sales $27,807 Costs and expenses Cost of products sold 8,331 Research and development expense 2,330 Selling, general, and administrative expense 9,480 Amortization of intangible assets 1,605 Restructuring charges, net 198 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 5,439 Other nonoperating income, net (373) Interest expense 1,314 Income before income taxes 4,498 Income tax provision 547 Net income 3,951 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $3,932 Use the following assumptions to prepare a forecast of the company’s income statement for FY2020. Note: Complete the entire question in Excel using the following template: Excel Template. Format each answer to two decimal…arrow_forwardCompute NOPATThe income statement for TJX Companies follows. THE TJX COMPANIES, INC.Consolidated Statements of Income Fiscal Year Ended ($ thousands) February 2, 2019 Net sales $38,972,934 Cost of sales, including buying and occupancy costs 27,831,177 Selling, general and administrative expenses 6,923,564 Pension settlement charge 36,122 Interest expense, net 8,860 Income before provision for income taxes 4,173,211 Provision for income taxes 1,113,413 Net income $ 3,059,798 Assume that the combined federal and state statutory tax rate is 22%. a. Compute NOPAT using the formula: NOPAT = Net income + NNE. Round to the nearest whole number. b. Compute NOPAT using the formula: NOPAT = NOPBT − Tax on operating profit. Round to the nearest whole number.arrow_forwardPlease Prepare The Income Statement !arrow_forward

- Daarrow_forwardIn its proposed 2022 income statement, Swifty Corporation reports income before income taxes $775,000, income taxes $155,000 (not including unusual items), loss on operation of discontinued music division $93,000, gain on disposal of discontinued music division $62,000, and unrealized loss on available-for-sale securities $232,500. The income tax rate is 20%. Prepare a correct statement of comprehensive income, beginning with income before income taxes. SWIFTY CORPORATIONPartial Statement of Comprehensive Incomearrow_forwardThe trial balance of Kroeger Incorporated included the following accounts as of December 31, 2024: Sales revenue Interest revenue Gain on sale of investments Gain on debt securities Loss on projected benefit obligation Cost of goods sold Selling expense Goodwill impairment loss Interest expense General and administrative expense Debits $ 160,000 6,100,000 600,000 500,000 30,000 500,000 Credits $ 8,200,000 60,000 120,000 140,000 The gain on debt securities represents the increase in the fair value of debt securities and is classified a component of other comprehensive income. Kroeger had 300,000 shares of stock outstanding throughout the year. Income tax expense has not yet been recorded. The effective tax rate is 25%. Required: Prepare a 2024 single, continuous statement of comprehensive income for Kroeger Incorporated. Use a multiple-step income statement format. Note: Round earnings per share answer to 3 decimal places.arrow_forward

- INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income Federal taxes (@ 21%) Net income $ 27,576 17,578 1,411 $ 8,587 526 8,061 1,693 $ 6,368 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Assets Current assets Cash and marketable securities 2022 2021 Liabilities and Shareholders' Equity Current liabilities $ 2,345 $ 2,345 Debt due for repayment Receivables Inventories Other current assets 1,384 131 1,098 1,344 126 Accounts payable Total current liabilities 625 Total current assets $ 4,958 $ 4,440 Fixed assets Property, plant, and equipment $ 24,686 2,813 2,992 2,662 Long-term debt $ 22,844 Other long-term liabilities Total liabilities 3,108 Total shareholders' equity $ 35,449 $ 33,054 Total liabilities and shareholders' equity 2022 2021 $3,412 $ 3,412 $ 394 3,152 $ 3,546 $ 13,642 3,066 $ 20,120 15,329 $ 35,449 $ 12,143 2,966 $ 18,655 14,399…arrow_forwardThe following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2022. INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 Net sales Costs Depreciation (Figures in $ millions) Earnings before interest and taxes (EBIT) Interest expense Pretax income $ 27,572 17,574 1,407 $ 8,591 522 8,069 Federal taxes (@ 21%) Net income 1,694 $ 6,375 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible assets (goodwill) Other long-term assets Total assets 2022 2021 Liabilities and Shareholders' Equity Current liabilities 2022 2021 $ 2,341 $ 2,341 Debt due for repayment 1,380 127 1,094 $ 4,942 1,340 Accounts payable 122 Total current liabilities $ 3,408 $ 3,408 $ 382 3,148 $ 3,530 621 $ 4,424 Long-term debt $ 24,682 2,809 2,988 $ 22,840 Other long-term liabilities 2,658…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education