FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

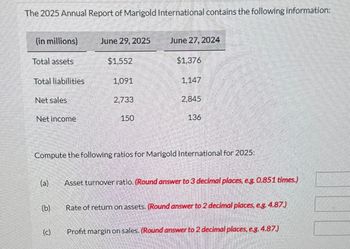

Transcribed Image Text:The 2025 Annual Report of Marigold International contains the following information:

(in millions)

Total assets

Total liabilities

Net sales

Net income

(b)

June 29, 2025

(c)

$1.552

1.091

2,733

150

June 27, 2024

$1.376

1.147

2.845

Compute the following ratios for Marigold International for 2025:

136

Asset turnover ratio. (Round answer to 3 decimal places, e.g. 0.851 times.)

Rate of return on assets. (Round answer to 2 decimal places, e.g. 4.87.)

Profit margin on sales. (Round answer to 2 decimal places, e.g. 4.87.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For 2022, Bramble Corp. reported beginning total assets of $217,000 and ending total assets of $419,000. Its net income for this period was $57,000, and its net sales were $795,000.Compute the company’s asset turnover in times for 2022. (Round answer to 2 decimal places, e.g. 1.25.)arrow_forwardSuppose during 2022 that Federal Express reported the following information (in millions): net sales of $34,000 and net income of $80. Its balance sheet also showed total assets at the beginning of the year of $24,500 and total assets at the end of the year of $23,300.Calculate the asset turnover and return on assets. (Round asset turnover to 2 decimal places, e.g. 6.25 and return on assets to 1 decimal place, e.g. 17.5%.) Asset turnover enter the asset turnover rounded to 2 decimal places times Return on assets enter the return on assets in percentages rounded to 2 decimal places %arrow_forwardSuppose during 2022 that Federal Express reported the following information (in millions): net sales of $34,400 and net income of $88. Its balance sheet also showed total assets at the beginning of the year of $24,580 and total assets at the end of the year of $23,300. Calculate the asset turnover and return on assets. (Round asset turnover to 2 decimal places, e.g. 6.25 and return on assets to 1 decimal place, e.g. 17.5%.) Asset turnover Return on assets times %arrow_forward

- The following ratios have been computed for Pina Colada Company for 2022. Profit margin ratio 20 % Current ratio 2.5 :1 Times interest earned 12 times Debt to assets ratio 24 % Accounts receivable turnover 5 times Use the above ratios and information from the Pina Colada Company financial statements to fill in the missing information on the financial statements.The 2022 financial statements for Pina Colada Company with missing information follows: (Include calculations) PINA COLADA COMPANYComparative Balance SheetDecember 31, 2022 2021 Assets Cash $ 26,500 $ 37,100 Debt Investments 15,900 15,900 Accounts receivable (net) 53,000 Inventory 53,000 Property, plant, and equipment (net) 212,000 169,600 Total assets Liabilities and stockholders' equity Accounts payable $ 15,900 $ 26,500 Short-term notes payable 37,100 31,800 Bonds payable Enter…arrow_forwardIn a recent annual report, Target reported beginning total assets of $44.1 billion, ending total assets of $44.5 billion, and net sales of $63.4 billion.Compute Target’s asset turnover ratio. (Round answer to 2 decimal places, e.g. 5.60.) Target’s asset turnover ratio enter the target’s asset turnover ratio in number of times rounded to 2 decimal places timesarrow_forwardAssume Metro Company had a net income of $2,100 for the year ending December 2018. Its beginning and ending total assets were $30,000 and $18,000, respectively. Calculate Metro's return on assets (ROA). (Round your percentage answer to two decimal places.) A. 7% B. 11.67% C. 4.38% D. 8.75%arrow_forward

- The following information is from Lacy's Inc. $ millions Prior Fiscal Year Current Fiscal Year Net Year-End Assets Revenue Income $21,330 14,403 $18,955 $1,070 a. Compute the asset turnover ratio for the current fiscal year. b. Compute the return on assets ratio for the current fiscal year. Numerator a. Asset Turnover Ratio $ Check b. Return on Assets Ratio $ Numerator Denominator / $ Denominator / $ || Result Resultarrow_forwardK Winky Flash Photo reported the following figures on its December 31, 2024, income statement and balance sheet: (Click the icon to view the figures.) Compute the asset turnover ratio for 2024. Round to two decimal places. Data table Net sales Net sales 230,500 Cash Accounts Receivable Merchandise Inventory Prepaid Expenses Property, Plant, and Equipment, net Print + + *** Done Average total assets 460,000 - X $ 460,000 Dec. 31, 2024 Dec. 31, 2023 $ 33,000 $ 26,000 60,000 58,000 71,000 78,000 11,000 7,000 101,000 16,000 = = Asset turnover ratio 1.99arrow_forwardIn a recent annual report, Target reported beginning total assets of $44.1 billion, ending total assets of $44.5 billion, and net sales of $63.4 billion. Compute Target's asset turnover ratio. (Round answer to 2 decimal places, e.g. 5.60.) Target's asset turnover ratio timesarrow_forward

- Suppose in its 2027 annual report that McDonald's Corporation reports beginning total assets of $20.80 billion, ending total assets of $19.20 billion, net sales of $21.80 billion, and net income of $4.10 billion. (a) Compute McDonald's return on assets. (Round return on assets to one decimal place, e.g. 5.1%.) McDonald's return on assets % (b) Compute McDonald's asset turnover. (Round asset turnover to 2 decimal places, e.g. 5.12.) McDonald's asset turnover timesarrow_forwardAsset Efficiency Ratios Sammy Inc.'s financial statements for 2023 indicate the following account balances: Net sales Cost of goods sold Average accounts receivable Average inventory Average property, plant, and equipment Average total assets. Required: Round your answers to two decimal places. 1. Using this information, calculate Sammy's receivable turnover ratio. $307,608 170,100 21,329 3,960 85,367 144,140 2. Using this information, calculate Sammy's asset turnover ratio and also convert the ratio into days. Assume 365 days in a year. Round your answer to nearest whole day. Asset turnover ratio Conversion into days daysarrow_forwardWhere would you find the financial statements for Costco? https://motley.com https://wallstreet.com https://investor.costco.com https://sec.gov Endotherm Company produced revenue of $120,000. Beginning Assets for the period were $200,000 and Ending Assets were $250,000. What is the Total Asset Turnover Ratio for this period? .53 1.87 .48 .26 What is the Total Asset Turnover Ratio for a company with $120,000 in annual sales, beginning Assets of $250,000 and ending Assets of $200,000? .48 1.34 .26 .53 The efficiency ratio that shows how efficiently a company uses its cash to generate revenue is: Accounts Receivable Turnover Ratio. Total Asset Receivable Turnover Ratio. Cash Turnover Ratio. Inventory Turnover Ratio. please answer all questions. explainte answwer provide me with correct optionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education