FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Marigold decided to discontinue its entire wholesale division (a major line of business) and to keep its manufacturing division. On

September 15, it sold the wholesale division to Dylane Corp. During 2023, there were 500,000 common shares outstanding all year.

Marigold's tax rate is 20% on operating income and all gains and losses (use this rate where the tax provisions are not given). Marigold

prepares financial statements in accordance with IFRS.

Prepare a multiple-step statement of financial performance for the year ended December 31, 2023, showing expenses by function

Include calculation of EPS. (List other revenues and gains before other expenses and losses. Round EPS answers to 2 decimal places, e.g.

52.75.)

Marigold Corp.

Statement of Financial Performance

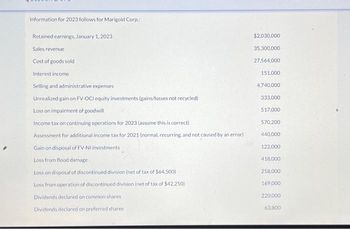

Transcribed Image Text:Information for 2023 follows for Marigold Corp

Retained earnings, January 1, 2023

Sales revenue

Cost of goods sold

Interest income

Selling and administrative expenses

Unrealized gain on FV-OCI equity investments (gains/losses not recycled)

Loss on impairment of goodwill

Income tax on continuing operations for 2023 (assume this is correct)

Assessment for additional income tax for 2021 (normal, recurring, and not caused by an error)

Gain on disposal of FV-NI investments

Loss from flood damage

Loss on disposal of discontinued division (net of tax of $64,500)

Loss from operation of discontinued division (net of tax of $42,250)

Dividends declared on common shares

Dividends declared on preferred shares

$2,030,000

35,300,000

27,564,000

151,000

4,740,000

333,000

517,000

570,200

440,000

122,000

418,000

258,000

169,000

220,000

63,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Novak Fashions needs to replace a beltloop attacher that currently costs the company $58,000 in annual cash operating costs. This machine is of no use to another company, but it could be sold as scrap for $3,128. Managers have identified a potential replacement machine, Euromat's Model HD-435. The HD-435 is priced at $93,000 and would cost Novak Fashions $38,000 in annual cash operating costs. The machine has a useful life of 8 years, and it is not expected to have any salvage value at the end of that time. Click here to view the factor table.arrow_forwardAccountingarrow_forwardRequired information [The following information applies to the questions displayed below.] The balance sheets for Sports Unlimited for 2024 and 2023 are provided below. 2. Prepare a horizontal analysis of Sports Unlimited's 2024 balance sheet using 2023 as the base year. (Values to be deducted and decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity SPORTS UNLIMITED Balance Sheets For the Years Ended December 31 Year $ $ $ $ 2024 211,500 $ 140,800 99,900 50,400 82,800 154,400 28,800 14,400 108,900 238,500 206,100 (76,500) 900,000 $…arrow_forward

- State the effect the following situation would have on the amount of annual net income reported for 2019. No adjustment was made for the revenue earned previously recorded as unearned revenue for USD 6,000 as of 2019 December 31. Group of answer choices Net income is overstated, liabilities are understated Net income is understated, assets are overstated Net income is overstated, assets are overstated Net income is understated, liabilities are overstatedarrow_forwardpls answer the following questionarrow_forwardPrepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Lishilitinn WALTON COMPANY Vertical Analysis of Balance Sheets Year 4 $ Amount 17,800 21,300 55,100 136,900 25,700 256,800 27,600 270,600 30,300 328,500 585,300 Percentage of Total % $ $ Amount Year 3 13,700 6,800 47,500 144,700 10,500 223,200 21,100 256,000 24,900 302,000 525,200 Percentage of Total %arrow_forward

- Need help please. Thank youarrow_forwardCompute the following for Stanley Limited. Round your answers to two decimal places. All answers MUST be expressed in the unit as specified in the question, if any. Show your workings. (a) Gross Profit Rate (in %) (b) Current Ratio (c) Quick Ratio B Stanley Limited Statement of Financial Position 31 December 2021 ($ in million) Stanley Limited Income Statement For the year ended 31 December 2021 ($ in million) Question B5 (continued) (d) Accounts Receivable Turnover Rate (e) Return on Equity (%) (f) Debt Ratio (in %) (g) Price-Earnings Ratioarrow_forwardJoseph Bright lists the following transactions for the period ended 30 September 2017. Classify EACH item as follows: i. Write either capital or revenue in the expenditure type column to indicate the type of expenditure involved or EACH item. ii. Insert a-check mark (√) in the appropriate column to indicate whether the item is reported-in the Statement of profit or loss or in the Statement of financial position. The first one is done as an example. Description CLASSIFICATION OF EXPENDITURE Expenditure Type Statement where item should be reported Statement of Profit Statement of Example Wages of the computer operators 1 Cost of customizing software for use in business 2 Installing thief detection equipment 3 Cost of paper used for printing receipts during the year 4 Cost of toner used by the computer printer 5 Cost of adding extra memory to the compute or loss Revenue financial positionarrow_forward

- Required: Explain how each of the following events or series of events and the related adjustments will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase, decrease) and the amount of the change. Organize your answers according to the following table. The first event is recorded as an example. If an event does not have a related adjustment, record only the effects of the event. Note: Not all cells require entry. Do not round intermediate calculations and round your final answers to nearest whole dollar amount. Paid $2,300 cash on October 1 to purchase a one-year insurance policy. Purchased $1,100 of supplies on account. Paid $850 cash on accounts payable. The ending balance in the Supplies account, after adjustment, was $250. Provided services for $7,700 cash. Collected $10,400 in advance for services to be performed in the future. The contract called for…arrow_forwardPrepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other RUNDLE COMPANY Vertical Analysis of Balance Sheets Year 4 Total noncurrent liabilities Total liabilities Stockholders' equity Preferred stock (par value $10, 4% cumulative, nonparticipating; 6,000 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities & stockholders' equity Amount $ 16,900 21,000 55,100…arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education