Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

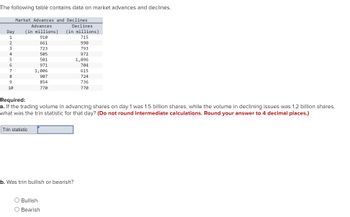

Transcribed Image Text:The following table contains data on market advances and declines.

Day

1

2

3

4

5

6

7

8

9

10

Market Advances and Declines

Advances

Declines

(in millions) (in millions)

715

990

793

972

Trin statistic

910

661

723

505

501

971

1,006

907

854

770

Required:

a. If the trading volume in advancing shares on day 1 was 1.5 billion shares, while the volume in declining issues was 1.2 billion shares,

what was the trin statistic for that day? (Do not round intermediate calculations. Round your answer to 4 decimal places.)

Bullish

O Bearish

b. Was trin bullish or bearish?

1,096

704

615

724

736

770

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardUse the data below to construct the advance or decline line and Arms ratio for the market. Volume is in thousands of shares. Note: Input all amounts as positive values. Do not round intermediate calculations. Round your "Arms Ratio" answers to 3 decimal places. Stocks Advancing. 1,903 Monday Tuesday 2,601 Wednesday 1,699 2,204 Thursday Friday 1,901 Monday Tuesday Wednesday Thursday Friday Advancing Volume 948,321 784,531 517,757 931,460 593,799 Advance or Decline Stocks Declining 632 699 1,371 829 1,194 Cumulative Declining Volume 68,252 214,915 498,712 313,713 383,328 Arms Ratioarrow_forwardNonearrow_forward

- Use the data below to construct the advance/decline line and Arms ratio for the market. Volume is in thousands of shares. (Input all amounts as positive values. Do not round intermediate calculations. Round your "Arms Ratio" answers to 3 decimal places.) StocksAdvancing AdvancingVolume StocksDeclining DecliningVolume Monday 1,936 876,951 333 126,645 Tuesday 2,641 509,531 809 217,135 Wednesday 1,340 519,132 1,188 499,845 Thursday 2,159 942,526 840 314,846 Friday 2,033 596,483 1,205 381,953arrow_forwardSuppose a market consists of four stocks. The number of shares outstanding for each stock as well as the stock prices in two consecutive days are as follows: Stock A Stock B Stock C Stock D Shares outstanding 200 1000 400 3000 I $5 $30 $100 $40 Ро $15 $25 $80 $50 a) Compute the percentage increase in the price-weighted index for this market. b) Compute the percentage increase in the value-weighted index for this market. P₁arrow_forwardHere are data on two stocks, both of which have discount rates of 14%: Stock A Stock B Return on equity 14 % 10 % Earnings per share $ 1.50 $ 1.40 Dividends per share $ 1.20 $ 1.20 a. What are the dividend payout ratios for each firm? (Enter your answers as a percent rounded to 2 decimal places.) b. What are the expected dividend growth rates for each stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) c. What is the proper stock price for each firm?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education