Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

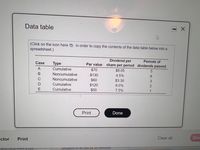

In each case in the following table attached, how many dollars of preferred dividends per share must be paid to preferred stockholders before common stock dividends are paid?

Transcribed Image Text:Data table

(Click on the icon here in order to copy the contents of the data table below into a

spreadsheet.)

Dividend per

Par value share per period dividends passed

Periods of

Case

Туре

A

Cumulative

$70

$8.05

B

Noncumulative

$130

4.5%

C

Noncumulative

$60

$3.30

3

Cumulative

$120

6.0%

2

Cumulative

$50

7.5%

1

Print

Done

ictor Print

Clear all

Che

nana neiD Trom a ive

ANswerS In as fast as 30 minutes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Compute number of shares outstanding after the stock dividend. Number of shares outstandingarrow_forwardDeclared interim dividends for preferred shareholders as well as $.80 per share to common stockholders. Using the info above and as a guide: Prepare the journal entries with narrations to record the following: The issuances of stock. Close out net income to retained earnings. Dividend declared. Close out dividend to retained earnings.arrow_forwardCumulative preferred stock gives its owners a right to be paid both the current and all prior periods' unpaid dividends before any paid to common stockholders. True or False True Falsearrow_forward

- ration has outstanding 9,600 shares of $100 par value, 6% preferred stock and 57,000 shares of $10 par value common stock. The preferred stock was issued in January 2020, and no dividends were declared in 2020 or 2021. In 2022, Oriole declares a cash dividend of $307,000. (a) Assume that the preferred are noncumulative. How much dividend will the preferred stockholders receive? Preferred stockholders would receive 2$ How much dividend will the common stockholders receive? Common stockholders would receive 24 (b) Assume that the preferred are cumulative. How much dividend will the preferred stockholders receive? 10:37F 77°F Type here to searcharrow_forwardhello, I need help pleasearrow_forwardWith the given set of data, find the dividend of the five stockholders.arrow_forward

- Required: 1. How many common shares are outstanding on each cash dividend date? January 5 April 5 July 5 October 5 Outstanding common sharesarrow_forwardCalculate the dividends for the following: The board of directors declared preferred dividends and common dividends of $2.45 per share. The preferred stock was $200 par, 8% stock with 2,200 shares outstanding. The common stock is $5 par value stock with 5,600 shares outstanding. Show your calculations for each type of stock as well as the total of the dividends to be paid. a. Dividends for Preferred stockholders. b. Dividends for Common stockholders. c. Total cash dividends to be paid.arrow_forwardplease step by step answer.arrow_forward

- Your corporation has declared a cash dividend of $5.00 per share. Before the cash dividend the stock was selling for $60.00 per share. When the stock goes ex-dividend what will the price per share be? Please show your calculations in the space provided.What would the ex-dividend price per share be?arrow_forwardCopperhead Trust has the following classes of stock: LOADING... (Click the icon to view the data.) Read the requirements LOADING... . Requirement 1. Copperhead declares cash dividends of $44,000 for 2024. How much of the dividends goes to preferred stockholders? How much goes to common stockholders? (Complete all input boxes. Enter "0" for any zero amounts.) Copperhead's dividend would be divided between preferred and common stockholders in this manner: Total Dividend Dividend to preferred stockholders: Dividend in arrears Current year dividend Total dividend to preferred stockholders Dividend to common stockholders Data Table Preferred Stock—6%, $12 Par Value; 8,500 shares authorized, 7,000 shares issued and outstanding Common Stock—$0.10 Par Value; 2,100,000 shares authorized, 1,400,000 shares issued and outstanding Requirements 1. Copperhead…arrow_forwardWhich of the following statements regarding preferred stock is true? a.Dividends are guaranteed to preferred stockholders. b.Preferred stockholders have a lower chance of receiving dividends than common stockholders do. c.When only one class of stock is issued, it is called preferred stock. d.Cumulative preferred stock has a right to receive regular dividends that were not declared (paid) in prior years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education