FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Lowest price $

Gain

eTextbook and Media

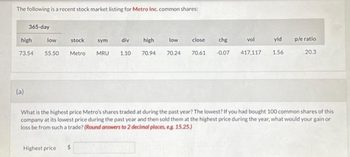

Transcribed Image Text:The following is a recent stock market listing for Metro Inc. common shares:

365-day

high

73.54

(a)

low

stock

sym

div

55.50 Metro MRU 1.10

Highest price

high

70.94

$

low

70.24

close chg

70.61 -0.07

vol

417,117

yld

1.56

What is the highest price Metro's shares traded at during the past year? The lowest? If you had bought 100 common shares of this

company at its lowest price during the past year and then sold them at the highest price during the year, what would your gain or

loss be from such a trade? (Round answers to 2 decimal places, e.g. 15.25.)

p/e ratio

20.3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- In each case in the following table attached, how many dollars of preferred dividends per share must be paid to preferred stockholders before common stock dividends are paid?arrow_forwardSmith Enterprises recently was profiled on a financial information website and touted as a "hot" growth stock. You acquired the stock quote shown here from that website. Smith Enterprises (AMEX: SME) Last Trade: 51.63 Day’s Range: 47.22 – 51.96 Trade Time: 4:00 PM ET 52wk Range: 25.48 – 60.71 One-Day Stock Return: 12.09% Volume: 1,419,317 Prev. Close: 46.06 Avg. Vol. (3m): 629,072 Open: 47.25 Market Cap: 1.63B Bid: N/A P/E (ttm): 23.58 Ask: N/A EPS (ttm): 1y Target Est: 55.40 Div. & Yield: 0.20 (0.40%) The last trade time is shown to be at 4:00 PM Eastern Time. The abbreviation “ttm” stands for “trailing twelve months,” and the number shown reflects data from the previous 12 months. The abbreviation “3m” reflects data from the previous 3 months. What exchange does Smith Enterprises trade on? DAX SME NASDAQ FTSE AMEX What is Smith’s earnings per share (EPS) for the trailing 12 months? $1.75…arrow_forwardThe following problem refers to the stock table for KIRED, Inc. (a computer company) given below Use the stock table to answer the following questions. Where necessary, round the dollar amounts to the nearest cent. 52-Week High 74.15 Yld Vol Net Low Stock SYM Div % PE 100s Hi Lo Close Chg 42.72 KIRED, Inc. KIR 3.11 4.1 22 7473 61.00 60.29 60.62 -1.52 a. What were the high and low prices for a share for the past 52 weeks? High price: $ Low price: S b. If you owned 700 shares of this stock last year, what dividend did you receive? %24 c. What is the annual return for the dividends alone? How does this compare to a bank offering a 3% interest rate? % O A. The %oyield is lower, than the bank rate O B. The bank rate is lower than the %yield. d. How many shares of this company's stock were traded yesterday? Click to select your answer(s). 1:56 PM P Type here to search 昂 A O D Q 24/2021 中0 (99+ 4/24/2021 DELL F11 PrtScr Insert Delete F7 F8 F9 F10 F12 F3 F4 F5 F6 Esc F1 F2 @ # $ % & Backspace…arrow_forward

- Use the given stock table to find sales for the day for ABC Technologies (ABC). 52-Week Yld Vol High SYM Div % PE 100s Close Low Stock 73.30 39.92 ABCTch ABC 2.17 1.3 17 4950 59.85 The sales for the day were shares. Net Chg 1.02arrow_forwardes You have 35,000 shares of preferred stock outstanding in the market, with a current price of $101 per share. What is the cost of preferred stock if the dividend per share is $5.90? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) Cost of preferred stock %arrow_forwardAssume that you want to reindex with the index value at the beginning of the year equal to 100. What is the index level at the end of the year? (Round your answer to 2 decimal places.) Kirk, Inc. Picard Co. Shares Outstanding Index level 37,000 27,000 Price per Share Beginning of Year $ 52 77 End of Year $57 82arrow_forward

- I need the answer as soon as possiblearrow_forwardIf C CORP. had 3,198,000 shares of common stock outstanding when it paid dividends last year, how much did it pay in dividends? Portion of Stock Exchange Listing Name Symbol Open High Low Close Net Chg %Chg Volume 52 Wk High 52 Wk Low Div Yield P/E Ytd % Chg A CORP. A 30.6 31.24 30.5 31.12 0.58 1.9 994,770 32.9 19.4 ... ... 24 6.6 B LTD. B 28.14 28.57 27.67 28.42 0.28 1 270,400 28.87 16.11 0.48 1.7 14 25.1 C CORP. C 48.6 49.07 48.52 28.42 0.29 0.6 1,598,100 50.33 25.43 1.48 3 ... 52.1 D LTD. D 14.35 14.58 13.92 14.51 0.16 1.11 54,900 16.55 12.6 ... ... ... −6.1 E CORP. E 23.76 24.3 23.62 24.03 0.23 0.97 570,711 27.45 17.95 ... ... 172 −9.2arrow_forwardOne year ago, KJ Industries stock sold for $52 a share. Over the past year, the stock has returned 16.0 percent with half of that return coming from dividend income. What is the current price of this stock? Multiple Choice O о O $56.16 $47.84 $60.32 $43.68arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education