Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

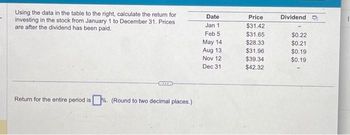

Transcribed Image Text:Using the data in the table to the right, calculate the return for

investing in the stock from January 1 to December 31. Prices

are after the dividend has been paid.

Return for the entire period is. (Round to two decimal places.)

Date

Jan 1

Feb 5

May 14

Aug 13

Nov 12

Dec 31

Price

$31.42

$31.65

$28.33

$31.96

$39.34

$42.32

Dividend D

$0.22

$0.21

$0.19

$0.19

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Vijayarrow_forwardThe following table shows your stock positions at the beginning of the year, the dividends that each stock paid during the year, and the stock prices at the end of the year. Company US Bank PepsiCo JDS Uniphase Duke Energy Shares 200 100 300 100 Portfolio Return $ Dollar return Percentage return Beginning of Year Price $ 43.60 59.18 18.98 27.50 902.00 Dividend Per End of Year Price What is your portfolio dollar return and percentage return? Note: Do not round intermediate calculations and round your final answer to 2 decimal places. % Share $ 2.07 1.18 1.27 $ 43.53 62.65 16.76 33.26arrow_forwardBhupatbhaiarrow_forward

- Use the following information to answer questions 1 - 3. A stock is selling today for $20 per share. At the end of the year, it pays a dividend of $1 per share and sells for $22. Dividend yield = ………………………. % Capital gain = ……………………..% Total return = ………………………….. %arrow_forwardDetermine the following measures for 20Y2, rounding to one decimal place including, percentage, except for per-share amounts. 5. Number of days sales in receivables 7. number of days sale in inventory 12. return on total asset 14. return on common stockholders equity 17. dividends per share of common stock 18. dividend yield i need help on these questions i have provided please please pleasearrow_forwardAssume you own shares in Walmart and that the company currently earns $6.80 per share and pays annual dividend payments that total $5.55 a share each year. Calculate the dividend payout for Walmart. Note: Enter your answer as a percent rounded to 2 decimal places. Dividend payout %arrow_forward

- Using the data in the following table, Date Jan 1 Feb 5 " Calculate the returns for each subperiod below: (Round to five decimal places. Enter dividend yield and capital gain yield as decimal numbers.) Capital Gain Yield Price 33.88 30.67 $ calculate the dividend yield and the capital gain yield from investing in the stock from January 1 to December 31. Dividend Dividend Yield 0.17 Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Stock and Dividend Data Price $33.88 $30.67 $29.49 $32.38 $39.07 $41.99 Date Jan 1 Feb 5 May 14 Aug 13 Nov 12 Dec 31 Print Done Dividend $0.17 $0.17 $0.17 $0.17 Xarrow_forwardYou've collected the following information from your favorite financial website. 52-Week Price Dividend Hi Lo Stock (Dividend) Yield % PE Ratio Close Price Net Change 77.40 10.43 Acevedo .36 2.6 6 13.90 -.24 55.96 33.57 Georgette, Incorporated 1.69 4.2 10 40.58 -.01 130.93 69.50 YBM 2.00 2.2 10 88.97 3.07 50.24 35.00 13.95 Manta Energy .80 5.2 15.43 -.26 20.74 winter sports .32 1.5 28 ?? .18 Find the quote for the Georgette, Incorporated. Assume that the dividend is constant. a. What was the highest dividend yield over the past year? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What was the lowest dividend yield over the past year? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Highest dividend yield b. Lowest dividend yield -7.54% 3.96 %arrow_forwardCalculate the Capital Gain/Loss on 100 shares of the stock Price on September 13th: 211.35 Price on November 24th:207.52 Use the Price on Sep 13th as the purchase price and the Price on November 24th as the sale price. Capital Gain: _______________________________ Percent Return: ___________________________arrow_forward

- Please stepwise all partsarrow_forwardI bought ANF stock on 8/14/2018 for $29.26 and then collected $0.20 dividends on 09/06/2018 and then sold my stock on 11/30/2018 for $20.91. What has been my annualized return from this transaction? (Please use IRR) -67.07% -45.20% +3.25% -78.45%arrow_forwardSuppose you invested $56 in the Ishares Dividend Stock Fund (DVY) a month ago. It paid a dividend of $0.80 today and then you sold it for $67. What was your return on the investment? OA. 23.18% OB. 16.86% O C. 14.75% O D. 21.07%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education