FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

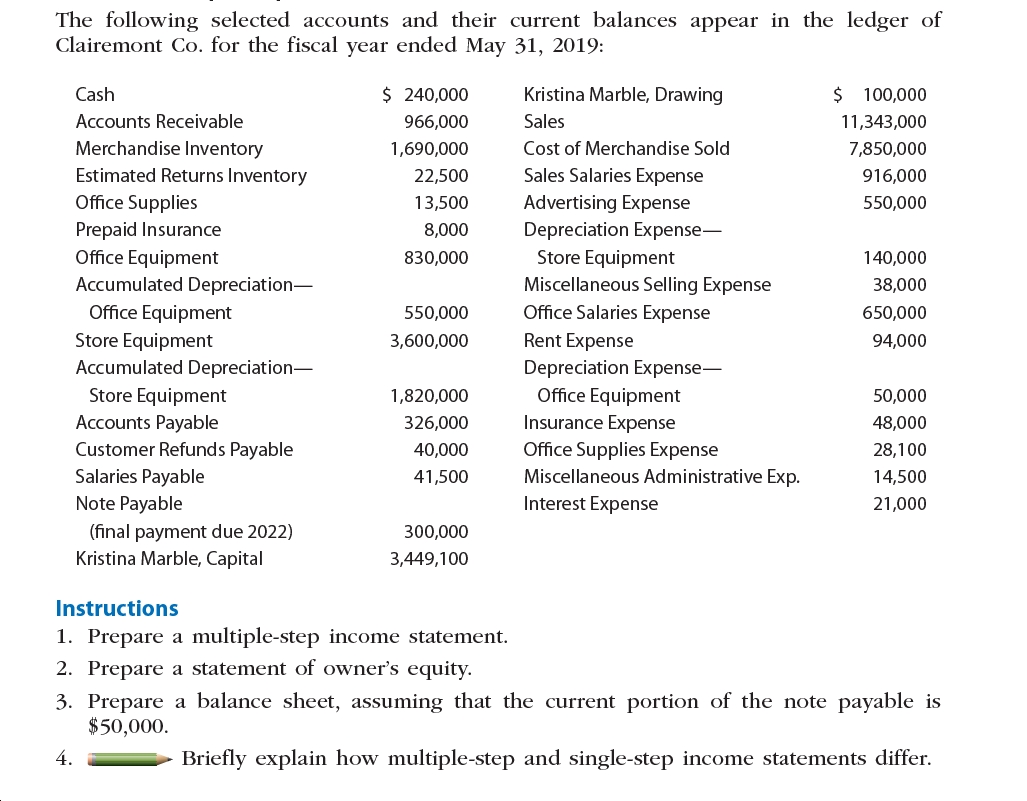

Transcribed Image Text:The following selected accounts and their current balances appear in the ledger of

Clairemont Co. for the fiscal year ended May 31, 2019:

Kristina Marble, Drawing

$ 100,000

$ 240,000

Cash

Sales

Accounts Receivable

966,000

11,343,000

Merchandise Inventory

Cost of Merchandise Sold

1,690,000

7,850,000

Estimated Returns Inventory

Sales Salaries Expense

916,000

22,500

Office Supplies

Prepaid Insurance

Office Equipment

Advertising Expense

Depreciation Expense-

Store Equipment

Miscellaneous Selling Expense

13,500

550,000

8,000

140,000

830,000

Accumulated Depreciation-

38,000

Office Salaries Expense

Office Equipment

Store Equipment

Accumulated Depreciation-

650,000

550,000

Rent Expense

3,600,000

94,000

Depreciation Expense-

Office Equipment

Insurance Expense

Office Supplies Expense

Store Equipment

Accounts Payable

50,000

1,820,000

48,000

326,000

Customer Refunds Payable

40,000

28,100

Salaries Payable

Note Payable

Miscellaneous Administrative Exp.

41,500

14,500

Interest Expense

21,000

(final payment due 2022)

Kristina Marble, Capital

300,000

3,449,100

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a statement of owner's equity.

3. Prepare a balance sheet, assuming that the current portion of the note payable is

$50,000.

Briefly explain how multiple-step and single-step income statements differ.

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Similar questions

- Presented below is selected information for Bramble Company for the month of March 2022. Cost of goods sold $194, 510 Rent expense $32, 720 Freight - out 7,150 Sales discounts 8, 000 Insurance expense 5, 680 Sales returns and allowances 12, 000 Salaries and wages expense 57, 060 Sales revenue 387,000 complete a multistep income statementarrow_forwardInventory at the beginning of the year cost $13,900. During the year, the company purchased (on account) inventory costing $86,500. Inventory that had cost $82,500 was sold on account for $97,000. Required: a. Calculate the amount of ending inventory. b. What was the amount of gross profit? c. Prepare journal entry to record sale of inventory assuming a perpetual system is used. Debit Credit Accountarrow_forwardVaughn Company reported the following balances at June 30, 2022:Sales RevenueSales Returns andAllowancesSales DiscountsCost of Goods Sold$164007002907500 Net sales for the month is $ 16400. $7910. $15700. $15410.arrow_forward

- The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 2017: Cash Accounts Receivable Inventory Estimated Returns Inventory Office Supplies Prepaid Insurance Office Equipment 10,500 8,100 245,400 Accumulated Depreciation Office Equipment 166,800 Store Equipment 766,100 Accumulated Depreciation-Store Equipment 245,400 Accounts Payable 166,800 Salaries Payable 10,800 Customer Refunds Payable 10,000 Estimated Coupons Payable 3,000 Note Payable (final payment due in 20 years) 357,500 61,400 491,600 66,800 Common Stock Retained Earnings Dividends Sales Cost of Goods Sold Sales Salaries Expense Advertising Expense Depreciation Expense-Store Equipment Miscellaneous Selling Expense Office Salaries Expense Rent Expense $111,500 297,400 339,000 5,000 4,085,000 2,362,800 Insurance Expense Depreciation Expense- Office Equipment Office Supplies Expense Miscellaneous Administrative Expense Interest Expense Required: 1. Prepare…arrow_forwardDuring 2021, your company completed the following summarized transactions. Prepare journal entries for the following events. 1. Your company sold $60,000 of merchandise to various customers for $150,000 on account, terms 2/10, n/30. Assume your company uses a PERIODIC inventory system and the GROSS method of discounts. 2. Accounts from transaction “#1." above for which the original amount was $70,000 were collected within the 10 day period. 3. Accounts from transaction "#1." above for which the original amount was $40,000 were collected 27 days after the sale. 4. One customer from transaction “#1" above returned a product which cost $410 and had been sold for $1,000. This customer had NOT paid his account so you credited his account. On December 1, 2021, you loaned $80,000 to another company and received a nine- month, 6% note. 5. 6. Your company wrote off $2,100 of past due accounts receivable. 7. At the end of the year, your company estimated bad debts would be 1% of GROSS sales for…arrow_forwardPrepare Statement of Financial Position as of December 31, 2019.arrow_forward

- Record the following selected transactions: a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510. b. Paid $436 to the state sales tax department for taxes collected. Required: Journalize the entries. Refer to the Chart of Accounts for exact wording of account titles. Chart of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Inventory 131 Estimated Returns Inventory 140 Supplies 142 Prepaid Insurance 180 Land 190 Equipment 191 Accumulated Depreciation LIABILITIES 210 Accounts Payable 216 Salaries Payable 221 Sales Tax Payable 222 Customers Refunds Payable 231 Unearned Rent 241 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends REVENUE 410 Sales EXPENSES 510 Cost of Goods Sold 521 Delivery Expense 522…arrow_forwardPrepare an income statement for Hansen Realty for the year ended December 31, 2023. Beginning inventory was $1,244. Ending inventory was $1,596. Note: Input all amounts as positive values. Sales $ 34,500 Sales returns and allowances 1,088 Sales discount 1,148 Purchases 10,312 Purchase discounts 536 Depreciation expense 111 Salary expense 5,000 Insurance expense 2,400 Utilities expense 206 Plumbing expense 246 Rent expense 176arrow_forwardValley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Adjusted Account Balances Debit Credit Merchandise inventory (ending) $ 34,000 Other (non-inventory) assets 136,000 Total liabilities $ 39,270 Common stock 67,851 Retained earnings 45, 768 Dividends 8,000 Sales 232, 560 Sales discounts 3,558 Sales returns and allowances 15,349 Cost of goods sold 90, 401 Sales salaries expense 31,861 Rent expense-Selling space 10, 930 Store supplies expense 2, 791 Advertising expense 19,768 Office salaries expense 29,070 Rent expense-Office space 2,791 Office supplies expense 930 Totals $385, 449 $385, 449 Beginning merchandise inventory was $27,438. Supplementary records of merchandising activities for the year ended…arrow_forward

- Ayayai Company had the following account balances at year-end: Cost of Goods Sold $63,840; Inventory $14,610; Operating Expenses $30,650; Sales Revenue $121,130; Sales Discounts $1,130; and Sales Returns and Allowances $1,850. A physical count of inventory determines that merchandise inventory on hand is $13,080.arrow_forwardConsider the following financial statement information for the Newk Corporation: Beginning $10,382 Ending $ 11,180 6,181 6,293 Item Inventory Accounts receivable Accounts payable Net sales. Cost of goods sold 5,651 5,952 Operating cycle Cash cycle $ 139,303 87,113 Assume all sales are on credit. Calculate the operating and cash cycles. Note: Do not round intermediate calculations and round your answers to 2 decimal pla 2.19 days daysarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education