FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

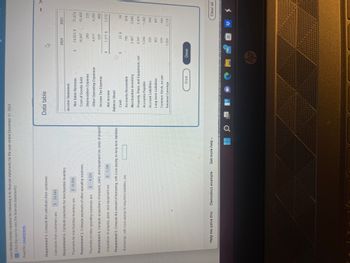

Transcribed Image Text:Luxe Mobile Homes reported the following in its financial statements for the year ended December 31, 2024:

(Click the icon to view the financial statements)

Read the requirements.

Data table

Requirement 1. Compute the collections from customers.

Collections from customers are $ 24,444

Requirement 2. Compute payments for merchandise inventory.

Payments for merchandise inventory are $ 18,560

Requirement 3. Compute payments of other operating expenses.

Payments of other operating expenses are $ 4,324

Requirement 4. Compute acquisitions of property, plant, and equipment (no sales of property

Acquisitions of property, plant, and equipment are S 1,186

Requirement 5. Compute the amount of borrowing, with Luxe paying no long-term liabilities.

Borrowings, with Luxe paying no long-term liabilities, are

Help me solve this

Demodocs example

Get more help -

Income Statement

$

CA

$

Net Sales Revenue

Cost of Goods Sold

Depreciation Expense

Other Operating Expenses

Income Tax Expense

Net Income

Balance Sheet

Cash

Accounts Receivable

Merchandise Inventory

Property, Plant, and Equipment, net

Accounts Payable

Accrued Liabilities

Long-term Liabilities

Common Stock, no par

Retained Earnings

Print

Done

Clear all

opyright © 20ZZ Pearson Foundation Inc. All rights reserved. Terms o

3

0

hp

19

2024

2023

24,623 $ 21,674

18,097

15,458

233

269

4,411

4,283

535

488

1,311 S

1,212

19

795

616

3,487

2,840

4,341

3,424

1,546

1,362

935

848

467

444

3,778

483

676

5,005

X

H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following statements is not true about mortgages? O The ending balance of an amortized loan contract will be zero. O If the payment is less than the interest due, the ending balance of the loan will decrease. Mortgages are examples of amortized loans. O Every payment made toward an amortized loan consists of two parts-interest and repayment of principal.arrow_forwardWhat is the most obvious difference between debt and equity financing? a. Principal and interest must be repaid for debt financing. b. Dividend payments are mandatory. c. Debt financing can result in loss of control. d. Equity financing is revenue and thus taxable.arrow_forwardA CDO is a debt security collateralized by debt obligations, such as residential and commercial mortgage backed securities. Question 19 options: True Falsearrow_forward

- What does it mean to amortize a bond premium or discount? Why is it necessary?arrow_forwardMezzanine Debt is generally collateralized by O A first deed of trust A high rate of interest O A second trust deed O A non-mortgage loan secured by a pledge of borrower's ownership interestarrow_forwardIf bonds are issued at a discount, it means that the a. bondholder will receive effectively less interest than the contractual rate of interest b. market interest rate is lower than the contractual interest rate c. financial strength of the issuer is suspect d. market interest rate is higher than the contractual interest ratearrow_forward

- How does Lease payments often are lower than installment payments?arrow_forwardAmortized loans with equal principal repayments will result in less interest being paid over the life of a loan than alternative types of amortized loans. True or Falsearrow_forwardWhich of the following is not a reason for the issuance of long-term liabilities? Debt financing dilutes ownership interest. Debt may be the only available source of funds. Debt financing may have a lower cost. Debt financing offers an income tax advantage.arrow_forward

- Govenments are prevented from barrowing unlimited funds through the enforcement of debt limits. Explain the concept of a debt limit. How is the concept of barrowing power or debt margin connected to debt limits?arrow_forwardIn a troubled-debt situation, why might the creditor grant concessions to the debtor?arrow_forwardWhen a lessee makes periodic cash payments for a finance lease, which of the following accounts is decreased? A.Right-of-Use Asset B.Lease Rental Expense C.Interest Expense D.Lease Liabilityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education