FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

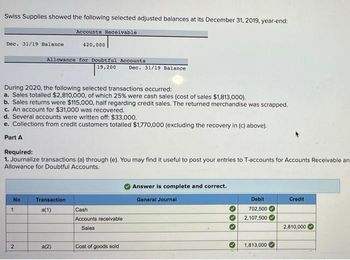

Transcribed Image Text:Swiss Supplies showed the following selected adjusted balances at its December 31, 2019, year-end:

Accounts Receivable

Dec. 31/19 Balance

During 2020, the following selected transactions occurred:

a. Sales totalled $2,810,000, of which 25% were cash sales (cost of sales $1,813,000).

b. Sales returns were $115,000, half regarding credit sales. The returned merchandise was scrapped.

c. An account for $31,000 was recovered.

No

Allowance for Doubtful Accounts

d. Several accounts were written off: $33,000.

e. Collections from credit customers totalled $1,770,000 (excluding the recovery in (c) above).

Part A

1

420,000

Required:

1. Journalize transactions (a) through (e). You may find it useful to post your entries to T-accounts for Accounts Receivable and

Allowance for Doubtful Accounts.

2

19,200 Dec. 31/19 Balance

Transaction

a(1)

a(2)

Cash

Accounts receivable

Sales

Cost of goods sold

Answer is complete and correct.

General Journal

>

Debit

702,500

2,107,500

1,813,000

Credit

2,810,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ivanhoe Company provides for doubtful accounts based on 4.0% of credit sales. The following data are available for 2020: Credit sales during 2020 $3,020,000 Allowance for doubtful accounts 1/1/20 37,700 Collection of accounts written off in prior years (customer credit was re-established) 15,500 Customer accounts written off as uncollectible during 2020 36,100 What is the balance in Allowance for Doubtful Accounts at December 31, 2020? Allowance for doubtful accounts 12/31/20 $Enter your answer in accordance to the question statementarrow_forwardSpace Tech Inc. total annual sales in 2020 were $ 40,000,000 The year ending 12/31/20 account balance for Accounts Receivable (prior to any adjustments) is $ 9,500,000 The year ending 12/31/20 account balance for Allowance for Doubtful Accounts (prior to any adjustme nts) is $ 350,000 The C.F.O. (Chief Finandal Officer) has informe d the accounting departme nt that the year ending 12/31/20 All owance for Doubtful Accounts balance should be 2.5% of annual sales. Required: 1Prepare the necessary year-end adjusting journalentry necessary to reflect the balance expected by the C.F.O. 2 Calculate the Net Accounts Receivable balance (after adjustment).arrow_forwardSuzuki Supply reports the following amounts at the end of 2021 (before adjustment). Credit Sales for 2021 $ 251,000 Accounts Receivable, December 31, 2021 46,000 Allowance for Uncollectible Accounts, December 31, 2021 1,100 (Credit) Required: 1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 12% of receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

- Novak Corp. has accounts receivable of $111,000 at March 31, 2022. An analysis of the accounts shows these amounts. Balance, March 31 Month of Sale 2022 2021 March $61,000 $81,000 February 13,300 8,300 December and January 11,300 2,700 November and October 7,200 1,400 $92,800 $93,400 Credit terms are 2/10, n/30. At March 31, 2022, there is a $3,700 credit balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage of receivables basis for estimating uncollectible accounts. The company's estimates of bad debts are as shown below Age of Accounts Estimated PercentageUncollectible Current 2 % 1–30 days past due 7 31–90 days past due 25 Over 90 days past due 50 Determine the total estimated uncollectible accounts receivable. Total estimated uncollectibles accounts receivable $Enter the total estimated uncollectibles…arrow_forwardSuppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forwardAn analysis and aging of Marigold Corp.’s accounts receivable at December 31, 2020, disclosed the following: Amounts estimated to be uncollectible $156,000 Accounts receivable 1,810,000 Allowance for doubtful accounts (per books) 140,000 What is the net realizable value of Marigold Corp.’s receivables at December 31, 2020? Net realizable valarrow_forward

- The financial statements of the Sunland Company report net sales of $384000 and accounts receivable of $50400 and $33600 at the beginning of the year and the end of the year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardTyla's bakery estimates the allowance for uncollectible accounts at 1% of the ending balance of accounts receivable. During 2024, Tyla's credit sales and collections were $117,000 and $141,000, respectively. What was the balance of accounts receivable on January 1, 2024, if $240 in accounts receivable were written off during 2024 and if the allowance account had a balance of $750 on December 31, 2024? A.) $41,000 B.) $480 C.) $99,240 D.) None of these answer choices are correct.arrow_forwardChez Fred Bakery estimates the allowance for uncollectible accounts at 3% of the ending balance of accounts receivable. During 2021, Chez Fred's credit sales and collections were $ 125,000 and $131,000, respectively. What was the balance of accounts receivable on January 1, 2021, if $180 in accounts receivable were written off during 2021 and if the allowance account had a balance of $750 on December 31, 2021? A) $5,820. B) $31,000. C) $31,180. D) None of these answer choices are correct.arrow_forward

- At January 1, 2024, Tarjee Inc. reported the following information on its statement of financial position: Accounts receivable $530,000 40,000 Allowance for expected credit losses ,40,000 During 2024, the company had the following summary transactions for receivables: Sales on account, $1,930,000; cost of goods sold, $1,061,500; return rate, 5% Selling price of goods returned, $76,000; cost of goods returned to inventory, $41,800 Collections of accounts receivable, $1,700,000 Write-offs of accounts receivable deemed uncollectible, $53,000 Collection of accounts previously written off as uncollectible, $12,000 After considering all of the above transactions, total estimated uncollectible accounts, $32,000 Prepare the journal entries to record each of the above summary transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forwardSuzuki Supply reports the following amounts at the end of 2021 (before adjustment).Credit Sales for 2021 $260,000 Accounts Receivable, December 31, 2021 55,000 Allowance for Uncollectible Accounts, December 31, 2021 1,100 (credit )Required: 1. Record the adjustment for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 12% of receivables will not be collected. 2. Record the adjustment for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates 3% of credit sales will not be collected. 3. Calculate the effect on net income (before taxes) and total assets in 2021 for each method.arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education