Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

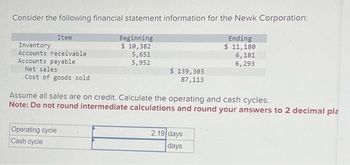

Transcribed Image Text:Consider the following financial statement information for the Newk Corporation:

Beginning

$10,382

Ending

$ 11,180

6,181

6,293

Item

Inventory

Accounts receivable

Accounts payable

Net sales.

Cost of goods sold

5,651

5,952

Operating cycle

Cash cycle

$ 139,303

87,113

Assume all sales are on credit. Calculate the operating and cash cycles.

Note: Do not round intermediate calculations and round your answers to 2 decimal pla

2.19 days

days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 8 images

Knowledge Booster

Similar questions

- Calculate the accounts receivable period, accounts payable period, inventory period, and cash conversion cycle for the following firm: Income statement data: Sales 5,000 Cost of goods sold 4,200 Balance Sheet Data: Beginning of Year End of Year Inventory 500 600 Accounts Receivable 100 120 Accounts Payable 250 290arrow_forwardExcerpts from Sydner Corporation's most recent balance sheet appear below: Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Total current liabilities Year 2 Year 1 $ 140 $ 160 210 230 240 200 10 10 $ 600 $ 600 $360 $ 330 Sales on account in Year 2 amounted to $1,390 and the cost of goods sold was $900. The accounts receivable turnover for Year 2 is closest to:arrow_forwardThe following data is available for Quick Serve Trading Ltd. Required: a) Calculate the operating cycle and the cash cycle b) Interpret and explain the outcomesarrow_forward

- The following selected account balances appeared on the financial statements of Washington Company: Accounts Receivable, January 1 $15,102 Accounts Receivable, December 31 7,937 Accounts Payable, January 1 5,381 Accounts Payable, December 31 9,511 Merchandise Inventory, January 1 9,855 Merchandise Inventory, December 31 15,185 Sales 68,703 Cost of Merchandise Sold 32,106 Washington Company uses the direct method to calculate net cash flow from operating activities. Cash collections from customers werearrow_forwardEMM, Inc. has the following balance sheet: EMM, Incorporated Balance Sheet as of 12/31/X0 Assets Liabilities and Equity Cash $ 1,200 Accounts payable $ 4,900 Accounts receivable 8,900 Bank note payable 7,700 Inventory 6,100 Long-term assets 4,400 Equity 8,000 $ 20,600 $ 20,600 It has estimated the following relationships between sales and the various assets and liabilities that vary with the level of sales: Accounts receivable = $3,560 + 0.35 Sales, Inventory = $2,356 + 0.28 Sales, Accounts payable = $1,449 + 0.20 Sales. If the firm expects sales of $27,000, what are the forecasted levels of the balance sheet items above? Round your answers to the nearest dollar. Accounts receivable: $ Inventory: $ Accounts payable: $ Will the expansion in accounts payable cover the expansion in inventory and accounts receivable? Round your answers to the nearest dollar. The expansion in accounts payable of $ the total…arrow_forwardPlease read and enter answers carefully using the table provided.arrow_forward

- answer in text form please (without image)arrow_forwardThe following items are reported on a company's balance sheet: Line Item Description Amount Cash $277,000 Marketable securities 101,400 Accounts receivable 234,300 Inventory 217,800 Accounts payable 315,500 Determine the (a) current ratio and (b) quick ratio. Round answers to one decimal place.arrow_forwardPlease help me with show all calculation thankuarrow_forward

- The following information relates to SE10-5 through SE10-7: (in millions) Net sales... Cost of goods sold SE10-7. Gross profit. Selling and administrative expenses Income from operations Interest expense.. EVANS & SONS, INC. Income Statement For Years Ended December 31, 2019 and 2018 Income before income taxes Income tax expense. Net income (in millions) Assets Current assets Cash and cash equivalents Accounts receivable Inventory.. Other current assets. Total current assets Property, plant, & equipment (net) Other assets. Total Assets Liabilities and Stockholders' Equity Current liabilities. Long-term liabilities. Total liabilities.. EVANS & SONS, INC. Balance Sheet December 31, 2019 and 2018 Stockholders' equity - common. Total Liabilities and Stockholders' Equity.. 2019 9,800 (5,500) 4,300 (2,800) 1,500 (300) $ 1,200 2019 100 900 500 400 2018 1,900 2,600 5,700 $10,200 9,300 (5,200) 4,100 (2,700) (220) (200) $980 $950 1,400 $ (250) 1,150 2018 300 800 650 250 2,000 2,500 5,900 $10,400…arrow_forwardNonearrow_forwardDetermine the financial statement effects of Accounts Payable Transactions, when Hobson Company has the following items: Purchases $1,250 of inventory on credit. Sells inventory for $1,650 on credit. Records $1,260 cost of sales for transaction b. Receives $1,650 cash towards accounts receivable. Pays $1,260 cash to settle accounts payable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education