FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Prepare Statement of Financial Position as of December 31, 2019.

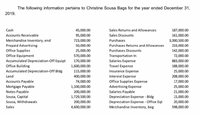

Transcribed Image Text:The following information pertains to Christine Sousa Bags for the year ended December 31,

2019.

Cash

45,000.00

Sales Returns and Allowances

187,000.00

Accounts Receivable

95,000.00

Sales Discounts

161,000.00

Merchandise Inventory, end

Prepaid Advertising

Office Supplies

723,000.00

Purchases

3,000,500.00

50,000.00

Purchases Returns and Allowances

233,000.00

25,000.00

Purchases Discounts

142,000.00

Office Equipment

570,000.00

Transportation In

72,000.00

Accumulated Depreciation-Off Equipt

Office Building

Accumulated Depreciation-Off Bldg

170,000.00

Salaries Expense

883,000.00

1,600,000.00

Travel Expense

188,000.00

115,000.00

Insurance Expense

25,000.00

Land

400,000.00

Interest Expense

208,000.00

Accounts Payable

74,000.00

Office Supplies Expense

17,000.00

Mortgage Payable

1,100,000.00

Advertising Expense

25,000.00

Notes Payable

Sousa, Capital

200,000.00

Salaries Payable

21,000.00

Depreciation Expense - Bldg

Depreciation Expense - Office Eqt

1,729,500.00

15,000.00

Sousa, Withdrawals

200,000.00

20,000.00

Sales

4,600,000.00

Merchandise Inventory, beg

598,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Analyze and review the following items and determine the appropriate journal entry. Record the journal entry Please include all the calculations for my reference. Thanksarrow_forwardCalculate 2019 debt interest based on the information below. Opening Debt Balance Additions (Repayments) Interest Rate Closing Debt Balance Debt Interest 1,750 2,500 1,500 1,250 2018 Actual 25,000 0 5% 25,000 1,250 2019 Estimate 10,000 5%arrow_forwardCoulson Company is refinancing long-term debt. Accessed March 15, 2022. Its fiscal year ends December 31, 2021. The refinancing is scheduled to be completed on December 15, 2021. What if it's finished on January 15, 2022?arrow_forward

- Total capital as of December 31, 2019arrow_forwardSubject: acountingarrow_forwardThe summarized balance sheet of WIPRO Itd forthe year ended 31/03/2020 and 31/03/2021 are given below. Prepare funds flow statement. Liabilities Equity share capital General Reserve Pro fit&loss a/c Sundry Creditor Provision for Tax 2020 5,00,000 2,00,000 40,000 1,58,000 45,000 2021 Assets 2020 2021 Land & Building 6,00,000 2,20,000 1,32,000 1,72,000 30,000 1,80,000 Plant and Machinery 2,10,000 80,000 2,00,000 1,70,000 1,03,000 9,43,000 3,00,000 2,76,000 95,000 1,90,000 1,95,000 98,000 11,54,000 Other fixed Assets Stock Debtors Cash at bank Total 9,43,000 The following adjustment the company faces during the year. 11,54,000 Total Dividend Rs. 30,000 was paid during the year. An old machinery costing 1,20.000 was sold for 1,00,000 and the depreciation Rs 50,000.arrow_forward

- View Policies Current Attempt in Progress At December 31, 2020, Coronado Corporation has the following account balances: Bonds payable, due January 1, 2029 $2,600,000 Discount on bonds payable 71,000 Interest payable 62,000 Show how the above accounts should be presented on the December 31, 2020, balance sheet, including the proper classifications. (Enter account name only and do not provide descriptive information.) Coronado Corporation Balance Sheet (Partial) December 31, 2020 $arrow_forwardhttps://www.republictt.com/pdfs/annual-reports/RFHL-Annual-Report-2022.pdf Financial Reporting Analysis: Use Republic Bank Limited Annual Report 2022 to answer the Questions. a) Evaluate the company’s latest annual financial statements (balance sheet, income statement, and cash flow statement) and comment on the company's financial performance and position. In your response, use the requirements of IAS 1 as a guide. b) Identify and discuss key accounting principles and standards applied in the company’s financial reporting process indicating their reasons for choosing these and how they were applied. Comment briefly on the appropriateness of the choices made given the company’s industry, location and type (e.g. MNC, regional conglomerate, etc.) c) Critically analyze any significant accounting policies and estimates disclosed in the notes to the financial statements. In your answer, indicate whether the company complied with the accounting standards and conventions.arrow_forwardHowever, conducting a financial statement analysis does provide a better understanding of the federal government to assist in the financial statement analysis, use Illustration 17-2 and Illustration 17-3 along with the following excerpts from the 2019 Financial Report of the United States Government. (Hint: When using revenues or net costs, use the consolidated amounts, which are adjusted for intra- entity activity) UNITED STATES GOVERNMENT Statements of Changes in Cash Balance from Budget and Other Activities For the Years Ended September 30, 2019, and 2018 (In billions of dollars) Cash flow from budget activities Total budget receipts Total budget out lays Budget deficit Adjustments for non-cash outlays included in the budget Non-cash flow amounts in the budget related to federal debt securities Accrued interest Net amortization Other Subtotal adjustments for non-cash flow amounts in the budget related to federal debt securities Non-cash flow amounts in the budget related to loan…arrow_forward

- Planning Wizards, LLC is an event-planning company. Which of the following would be included in the current asset section of a classified balance sheet dated December 31, 2019? a. 15-month certificate of deposit b. Customer advances on New Year's parties c. Last month rent payment (lease expires in 2021) d. Investment in stocks, to be sold in 2020 e. Income tax refund receivable f. Inventory Select one: d, e, and f e and f a, b, c, e, and f a, b, c, d, e, and f b, e, farrow_forwardWhat interest income should reported for 2017arrow_forwardSweet home Inc., includes the following selected accounts in its general ledger at December 31, screenshot attacahed thanks fas fakopearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education