FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Do not use Ai

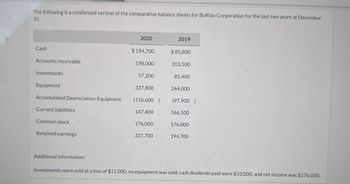

Transcribed Image Text:The following is a condensed version of the comparative balance sheets for Buffalo Corporation for the last two years at December

31.

2020

2019

Cash

$194,700

$ 85,800

Accounts receivable

198,000

203,500

Investments

57,200

81,400

Equipment

327,800

264,000

Accumulated Depreciation-Equipment

(116,600) (97,900)

Current liabilities

147,400

166,100

Common stock

176,000

176,000

Retained earnings

337,700

194,700

Additional information:

Investments were sold at a loss of $11,000; no equipment was sold; cash dividends paid were $33,000; and net income was $176,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Condensed financial data of Martinez Company for 2020 and 2019 are presented below. MARTINEZ COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,780 $1,130 Receivables 1,740 1,290 Inventory 1,610 1,870 Plant assets 1,930 1,710 Accumulated depreciation (1,210 ) (1,150 ) Long-term investments (held-to-maturity) 1,290 1,440 $7,140 $6,290 Accounts payable $1,180 $900 Accrued liabilities 190 240 Bonds payable 1,410 1,590 Common stock 1,920 1,690 Retained earnings 2,440 1,870 $7,140 $6,290 MARTINEZ COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,880 Cost of goods sold 4,650 Gross margin 2,230 Selling and administrative expenses 940 Income from…arrow_forwardCondensed financial data of Flounder Company for 2020 and 2019 are presented below. FLOUNDER COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,830 $1,140 Receivables 1,720 1,280 Inventory 1,610 1,900 Plant assets 1,870 1,690 Accumulated depreciation (1,210 ) (1,190 ) Long-term investments (held-to-maturity) 1,270 1,410 $7,090 $6,230 Accounts payable $1,230 $910 Accrued liabilities 200 250 Bonds payable 1,410 1,540 Common stock 1,880 1,710 Retained earnings 2,370 1,820 $7,090 $6,230 FLOUNDER COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,880 Cost of goods sold 4,680 Gross margin 2,200 Selling and administrative expenses 930 Income from…arrow_forwardCondensed financial data of Flounder Company for 2020 and 2019 are presented below. FLOUNDER COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,760 $1,180 Receivables 1,780 1,280 Inventory 1,610 1,920 Plant assets 1,880 1,660 Accumulated depreciation (1,220 ) (1,190 ) Long-term investments (held-to-maturity) 1,310 1,400 $7,120 $6,250 Accounts payable $1,170 $880 Accrued liabilities 190 240 Bonds payable 1,390 1,540 Common stock 1,910 1,730 Retained earnings 2,460 1,860 $7,120 $6,250 FLOUNDER COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $7,020 Cost of goods sold 4,780 Gross margin 2,240 Selling and administrative expenses 910 Income from…arrow_forward

- Pharoah Corporation’s comparative balance sheet is presented below. PHAROAH CORPORATIONBalance SheetDecember 31 Assets 2021 2020 Cash $12,010 $8,980 Accounts receivable 17,810 19,660 Land 16,800 21,840 Buildings 58,800 58,800 Accumulated depreciation—buildings (12,600 ) (8,400 ) Total $92,820 $100,880 Liabilities and Shareholders’ Equity Accounts payable $10,390 $26,120 Common shares 63,000 57,960 Retained earnings 19,430 16,800 Total $92,820 $100,880 Additional information: 1. Profit was $19,010. Dividends declared and paid were $16,380. 2. No noncash investing and financing activities occurred during 2021. 3. The land was sold for cash of $4,120 resulting in a loss of $920 on the sale of the land. Prepare a cash flow statement for 2021 using the indirect method. Lu…arrow_forwardGiven the data in the following table, the entry for Inventories on the 2023 common-sized balance sheet was %.arrow_forwardCondensed financial data of Waterway Company for 2020 and 2019 are presented below. WATERWAY COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,820 $1,130 Receivables 1,730 1,280 Inventory 1,590 1,870 Plant assets 1,940 1,690 Accumulated depreciation (1,220 ) (1,180 ) Long-term investments (held-to-maturity) 1,300 1,450 $7,160 $6,240 Accounts payable $1,200 $920 Accrued liabilities 190 230 Bonds payable 1,430 1,530 Common stock 1,930 1,710 Retained earnings 2,410 1,850 $7,160 $6,240 WATERWAY COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,840 Cost of goods sold 4,630 Gross margin 2,210 Selling and administrative expenses 930 Income from…arrow_forward

- Presented below is the balance sheet of Pina Corporation for the current year, 2020. PINA CORPORATIONBALANCE SHEETDECEMBER 31, 2020 Current assets $ 486,360 Current liabilities $ 381,360 Investments 641,360 Long-term liabilities 1,001,360 Property, plant, and equipment 1,721,360 Stockholders’ equity 1,771,360 Intangible assets 305,000 $3,154,080 $3,154,080 The following information is presented. 1. The current assets section includes cash $151,360, accounts receivable $171,360 less $11,360 for allowance for doubtful accounts, inventories $181,360, and unearned rent revenue $6,360. Inventory is stated on the lower-of-FIFO-cost-or-net realizable value. 2. The investments section includes the cash surrender value of a life insurance contract $41,360; investments in common stock, short-term $81,360 and long-term $271,360; and bond sinking fund $247,280. The cost and fair value of investments in common stock are the same.…arrow_forwardPresented below is the balance sheet of Novak Corporation for the current year, 2020. NOVAK CORPORATIONBALANCE SHEETDECEMBER 31, 2020 Current assets $ 488,570 Current liabilities $ 383,570 Investments 643,570 Long-term liabilities 1,003,570 Property, plant, and equipment 1,723,570 Stockholders’ equity 1,773,570 Intangible assets 305,000 $3,160,710 $3,160,710 The following information is presented. 1. The current assets section includes cash $153,570, accounts receivable $173,570 less $13,570 for allowance for doubtful accounts, inventories $183,570, and unearned rent revenue $8,570. Inventory is stated on the lower-of-FIFO-cost-or-net realizable value. 2. The investments section includes the cash surrender value of a life insurance contract $43,570; investments in common stock, short-term $83,570 and long-term $273,570; and bond sinking fund $242,860. The cost and fair value of investments in common stock are the…arrow_forwardCondensed financial data of Cullumber Company for 2020 and 2019 are presented below. CULLUMBER COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,790 $1,170 Receivables 1,780 1,310 Inventory 1,580 1,900 Plant assets 1,900 1,720 Accumulated depreciation (1,180 ) (1,140 ) Long-term investments (held-to-maturity) 1,310 1,420 $7,180 $6,380 Accounts payable $1,220 $880 Accrued liabilities 210 240 Bonds payable 1,380 1,550 Common stock 1,930 1,660 Retained earnings 2,440 2,050 $7,180 $6,380 CULLUMBER COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,690 Cost of goods sold 4,650 Gross margin 2,040 Selling and administrative expenses 930 Income from…arrow_forward

- Condensed financial data of Sweet Company for 2020 and 2019 are presented below. SWEET COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,800 $1,130 Receivables 1,770 1,320 Inventory 1,560 1,890 Plant assets 1,900 1,700 Accumulated depreciation (1,220 ) (1,180 ) Long-term investments (held-to-maturity) 1,300 1,430 $7,110 $6,290 Accounts payable $1,220 $890 Accrued liabilities 190 250 Bonds payable 1,410 1,520 Common stock 1,870 1,730 Retained earnings 2,420 1,900 $7,110 $6,290 SWEET COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,860 Cost of goods sold 4,710 Gross margin 2,150 Selling and administrative expenses 920 Income from operations…arrow_forwardCondensed financial data of Waterway Company for 2020 and 2019 are presented below. WATERWAY COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,790 $1,150 Receivables 1,780 1,330 Inventory 1,620 1,890 Plant assets 1,930 1,700 Accumulated depreciation (1,200 ) (1,180 ) Long-term investments (held-to-maturity) 1,310 1,420 $7,230 $6,310 Accounts payable $1,210 $920 Accrued liabilities 210 240 Bonds payable 1,370 1,530 Common stock 1,860 1,670 Retained earnings 2,580 1,950 $7,230 $6,310 WATERWAY COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,970 Cost of goods sold 4,680 Gross margin 2,290 Selling and administrative expenses 940 Income from…arrow_forwardCondensed financial data of Novak Company for 2020 and 2019 are presented below. NOVAK COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,830 $1,180 Receivables 1,710 1,320 Inventory 1,590 1,920 Plant assets 1,890 1,710 Accumulated depreciation (1,220 ) (1,190 ) Long-term investments (held-to-maturity) 1,320 1,440 $7,120 $6,380 Accounts payable $1,190 $890 Accrued liabilities 210 260 Bonds payable 1,400 1,580 Common stock 1,940 1,660 Retained earnings 2,380 1,990 $7,120 $6,380 NOVAK COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,720 Cost of goods sold 4,680 Gross margin 2,040 Selling and administrative expenses 920 Income from operations…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education