EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Solve question

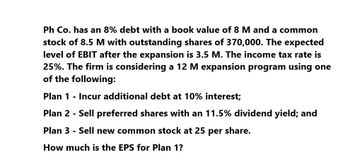

Transcribed Image Text:Ph Co. has an 8% debt with a book value of 8 M and a common

stock of 8.5 M with outstanding shares of 370,000. The expected

level of EBIT after the expansion is 3.5 M. The income tax rate is

25%. The firm is considering a 12 M expansion program using one

of the following:

Plan 1 - Incur additional debt at 10% interest;

Plan 2 - Sell preferred shares with an 11.5% dividend yield; and

Plan 3 - Sell new common stock at 25 per share.

How much is the EPS for Plan 1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ph Co. has an 8% debt with a book value of 8 M and a common stock of 8.5 M with outstanding shares of 370,000. The expected level of EBIT after the expansion is 3.5 M. The income tax rate is 25%. The firm is considering a 12 M expansion program using one of the following: Plan 1 - Incur additional debt at 10% interest; Plan 2 - Sell preferred shares with an 11.5% dividend yield; and Plan 3 - Sell new common stock at 25 per share. How much is the EPS for Plan 1?arrow_forwardIRIS Corp. has determined its optimal capital structure as follows. Debt: The firm can sell a 10-year, $1,000 par value, 7 percent bond for $950. A flotation cost of 3percent of the par value would be required in addition to the discount of $50. Preferred Stock: The firm has determined it can issue preferred stock at $45 per share par value. The stock will pay an $6.5 annual dividend. The cost of issuing and selling the stock is $2.5 per share. Common Stock: The firm's common stock is currently selling for $25 per share. The dividend expected to be paid at the end of the coming year is $3.75. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $1.45. It is expected that to sell, a new common stock issue must be underpriced at $2 per share and the firm must pay $0.75 per share in flotation costs. Additionally, the firm's marginal tax rate is 20 percent. Calculate the firm's weighted average cost of capital assuming the…arrow_forwardNeed answerarrow_forward

- Please help with this questionarrow_forwardSadaplast has a target capital structure of 65% common equity, 30% debt, and 5% preferred stock. The cost of retained earnings is 14%, and the cost of new equity is 15.5%. Sadaplast expects to have a net income of $85 million in the coming year. If the firm sells bonds, up to $25 million can be sold at par value to yield an after-tax cost of 5.4%. An additional $20 million of debentures could be sold to yield an after-tax cost of 7.0%. The after-tax cost of preferred stock financing is estimated to be 11%. Sadaplast has a dividend payout ratio of 25%. What is Sadaplast's weighted Average cost of capital between the first and second break points?arrow_forwardA firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions: Debt: The firm can sell a 20-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required in addition to the discount of $20. Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value. The stock will pay an $8.00 annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock: The firm's common stock is currently selling for $40 per share. The dividend expected to be paid at the end of the coming year is $5.07. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.45. It is expected that to sell, a new common stock issue must be underpriced at $1 per share and the firm must pay $1 per share in flotation costs. Additionally, the firm's marginal tax rate is 40 percent.…arrow_forward

- Oranda Corp. has 1 million shares of stock outstanding. Oranda has a target capital structure with 60% equity and 40% debt. The company projects net income of P5 million and investment projects requiring P6 million in the upcoming year. QUESTION::a. Oranda uses the residual distribution model and pays all distributions in the form of dividends. What is the projected DPS? b. What is the projected payout ratio?arrow_forwardIRIS Corp. has determined its optimal capital structure as follows: (ATTACHED) Debt: The firm can sell a 10-year, $1,000 par value, 7 percent bond for $950. A flotation cost of 3percent of the par value would be required in addition to the discount of $50. Preferred Stock: The firm has determined it can issue preferred stock at $45 per share par value. The stock will pay an $6.5 annual dividend. The cost of issuing and selling the stock is $2.5 per share. Common Stock: The firm's common stock is currently selling for $25 per share. The dividend expected to be paid at the end of the coming year is $3.75. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $1.45. It is expected that to sell, a new common stock issue must be underpriced at $2 per share and the firm must pay $0.75 per share in flotation costs. Additionally, the firm's marginal tax rate is 20 percent. Calculate the firm's weighted average cost of capital…arrow_forwardA firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions. Debt: The firm can obtain a 5-year loan from Colorful Bank for $2,500,000, at an annual rate of 10%. Preferred Stock: The firm has determined it can issue $100 par value preferred stock at $103 per share for a total of $3,500,000. The stock will pay a 10% annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock: The firm’s common stock is currently selling for $150 per share. The dividend expected to be paid at the end of the coming year is $15. Its dividend payments have been growing at a constant rate of 5%, total common stock is $4,000,000. Additionally, the firm’s marginal tax rate is 30 percent. The firm is currently studying the feasibility of investing in a machine worth $6,000,000 which will reduce cash operating costs for $2,600,000 yearly, it will have a 3-year life and will be depreciated on a straight-line…arrow_forward

- A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions. Debt: The firm can obtain a 5-year loan from Colorful Bank for $2,500,000, at an annual rate of 10%. Preferred Stock: The firm has determined it can issue $100 par value preferred stock at $103 per share for a total of $3,500,000. The stock will pay a 10% annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock: The firm’s common stock is currently selling for $150 per share. The dividend expected to be paid at the end of the coming year is $15. Its dividend payments have been growing at a constant rate of 5%, total common stock is $4,000,000. Additionally, the firm’s marginal tax rate is 30 percent. The firm is currently studying the feasibility of investing in a machine worth $6,000,000 which will reduce cash operating costs for $2,600,000 yearly, it will have a 3-year life and will be depreciated on a straight-line…arrow_forwardA firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions. Debt: The firm can obtain a 5-year loan from Colorful Bank for $2,500,000, at an annual rate of 10%. Preferred Stock: The firm has determined it can issue $100 par value preferred stock at $103 per share for a total of $3,500,000. The stock will pay a 10% annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock: The firm’s common stock is currently selling for $150 per share. The dividend expected to be paid at the end of the coming year is $15. Its dividend payments have been growing at a constant rate of 5%, total common stock is $4,000,000. Additionally, the firm’s marginal tax rate is 30 percent. The firm is currently studying the feasibility of investing in a machine worth $6,000,000 which will reduce cash operating costs for $2,600,000 yearly, it will have a 3-year life and will be depreciated on a straight-line…arrow_forwardHastings Corporation is interested in acquiring Vandell Corporation. Vandell has 1.5 million shares outstanding and a target capital structure consisting of 30% debt; its beta is 1.60 (given its target capital structure). Vandell has $8.57 million in debt that trades at par and pays a 7.4% interest rate. Vandell’s free cash flow (FCF0) is $1 million per year and is expected to grow at a constant rate of 5% a year. Vandell pays a 25% combined federal-plus-state tax rate, the same rate paid by Hastings. The risk-free rate of interest is 4%, and the market risk premium is 6%. Hasting’s first step is to estimate the current intrinsic value of Vandell.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT