FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need answer the question

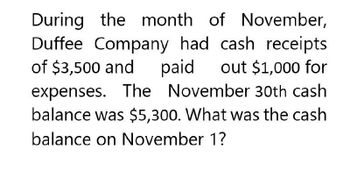

Transcribed Image Text:During the month of November,

Duffee Company had cash receipts

of $3,500 and paid out $1,000 for

expenses. The November 30th cash

balance was $5,300. What was the cash

balance on November 1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gregg Corp. reported revenue of $1,450,000 in its cash basis income statement for the year ended Dec. 31, Year 7. Additional information was as follows: Accounts receivable, Jan 1, Year 7 $400,000 Accounts receivable, Dec 31, Year 7 $530,000 Under the accrual basis, Gregg would report revenue of O $1,580,000 O $1,035,000 $1,335,000 O $1,505,000arrow_forwardDuring the year, Tempo Inc. has monthly cash expenses of $144,468. On December 31, its cash balance is $1,829,210. The ratio of cash to monthly cash expenses (rounded to one decimal place) is Oa. 13.7 months Ob. 12.7 months Oc. 6.4 months Od. 7.9 monthsarrow_forwardGibson Company engaged in the following transactions for Year 1. The beginning cash balance was $28,100 and the ending cash balance was $74,991. 1. Sales on account were $283,100. The beginning receivables balance was $94,700 and the ending balance was $77,000. 2. Salaries expense for the period was $55,460. The beginning salaries payable balance was $3,815 and the ending balance was $2,180. 3. Other operating expenses for the period were $120,170. The beginning other operating expenses payable balance was $4,860 and the ending balance was $9,181. 4. Recorded $19,330 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $14,340 and $33,670, respectively. 5. The Equipment account had beginning and ending balances of $211,970 and $238,570, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $48,500 and $150,500, respectively. There were no payoffs of…arrow_forward

- Bailey Co earns $27,792 of revenue on account and in $6,256 cash revenue transactions in Year 1. Cash collections of receivables amount to $7,152 in Year 1 with the remainder being collected in Year 2. Based on this information alone the company’s financial statements would show Total Revenue in Year 1 of $_arrow_forwardYork Company engaged in the following transactions for Year 1. The beginning cash balance was $86,000 and the ending cash balance was $59,100. 1. Sales on account were $548,000. The beginning receivables balance was $128,000 and the ending balance was $90,000. 2. Salaries expense for the period was $232,000. The beginning salaries payable balance was $16,000 and the ending balance was $8,000. 3. Other operating expenses for the period were $236,000. The beginning other operating expenses payable balance was $16,000 and the ending balance was $10,000. 4. Recorded $30,000 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $12,000 and $42,000, respectively. 5. The Equipment account had beginning and ending balances of $44,000 and $56,000, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $36,000 and $44,000, respectively. There were no payoffs of…arrow_forwardBarga Company's net sales for Year 1 and Year 2 are $666,000 and $747,000, respectively. Its year-end balances of accounts receivable follow: Year 1, $62,000; and Year 2, $95,000. a. Complete the below table to calculate the days' sales uncollected at the end of each year. b. Did days' sales uncollected improve or worsen in Year 2 versus Year 1? Complete this question by entering your answers In the tabs below. Required A Required B Complete the below table to calculate the days' sales uncollected at the end of each year. (Do not round intermediate calculations. Round your "Da Sales Uncollected" answers to 1 decimal place.) Days' Sales Uncollected Choose Denominator: Days Days' Sales Uncollected %3D Choose Numerator: Days' sales uncollected !! days Year 1: days Year 2: Required B >arrow_forward

- Barga Company's net sales for Year 1 and Year 2 are $669,000 and $750,000, respectively. Its year-end balances of accounts receivable follow: Year 1, $56,000; and Year 2, $91,000.a. Complete the below table to calculate the days' sales uncollected at the end of each year.b. Did days’ sales uncollected improve or worsen in Year 2 versus Year 1?arrow_forwardcalculate the unknown amount. Corentine Co. had $152,000 of accounts payable on September 30 and $132,500 on October 31. Total purchases on account during October were $281,000. Determine how much cash was paid on accounts payable during October.arrow_forwardThe balance in Accounts Receivable at the beginning of the year was $520,000. The balance in Accounts Receivable at the end of the year was $780,000. Customer accounts of $420,000 were written off. The company collected $4,060,000 from credit customers and $1,010,000 from cash customers. What are credit sales for the year? A) $4,740,000 B) $4,480,000 C) $4,060,000 D) $4,220,000arrow_forward

- On May 1, your firm had a beginning cash balance of $ 140. Please provide answer the general accounting questionarrow_forwardGiven answer financial accountingarrow_forwardBarga Company's net sales for Year 1 and Year 2 are $665,000 and $743,000, respectively. Its year-end balances of accounts receivable follow: Year 1, $57,000; and Year 2, $97,000. a. Complete the below table to calculate the days' sales uncollected at the end of each year. b. Did days' sales uncollected improve or worsen in Year 2 versus Year 1? Complete this question by entering your answers in the tabs below. Required A Required B Complete the below table to calculate the days' sales uncollected at the end of each year. Note: Do not round intermediate calculations. Round your "Days" Sales Uncollected" answers to 1 decimal place. Year 1: Year 2: Choose Numerator: Days' Sales Uncollected Choose Denominator: X Days = Days' Sales Uncollected X == Days' sales uncollected X days X days Required A Requiredarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education