FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

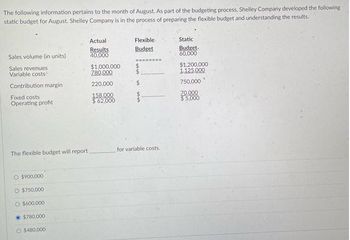

Transcribed Image Text:The following information pertains to the month of August. As part of the budgeting process, Shelley Company developed the following

static budget for August. Shelley Company is in the process of preparing the flexible budget and understanding the results.

Actual

Flexible

Static

Results

Budget

Budget.

Sales volume (in units)

40,000

60,000

Sales revenues

$1,000,000

Variable costs

780,000

$1,200,000

1.125.000

Contribution margin.

220,000

Fixed costs

Operating profit

158,000

$ 62,000

S

ԵՒ ԵԴ

750,000

70,000

$5,000

The flexible budget will report

O $900,000

O $750,000

O $600,000

$780,000

O $480,000

for variable costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July, August, and September are 9,000, 21,000, 23,000, and 24,000 units, respectively. All sales are on credit. b. Thirty percent of credit sales are collected in the month of the sale and 70% in the following month. c. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.70 per pound. e. Twenty percent of raw materials purchases are paid for in the month of purchase and 80% in the following month. f. The direct labor wage rate is $14 per hour. Each unit of finished goods requires two…arrow_forwardanswer must be correctarrow_forwardjagdisharrow_forward

- Adger Corporation is a service company that measures its output based on the number of customers served. The company provided the following fixed and variable cost estimates for budgeting purposes and the actual results for May as shown below: Revenue Employee salaries and wages Travel expenses Other expenses Foundational 9-14 (Algo) Fixed Element per Month $ 55,000 $ 34,000 When preparing its planning budget, the company estimated it would serve 30 customers per month; however, during May the company actually served 35 customers. Answer is complete but not entirely correct. 5,283,600 F Activity variance Variable Element per Customer Served $ 5,600 $ 1,600 $ 850 $ Actual Total for May $ 182,000 $ 110,300 14. What activity variance would Adger report in May with respect to its revenue? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. $ 27,200 $ 32,600arrow_forwardGig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process: Budgeted unit sales Selling price per unit Cost per unit Variable selling and administrative expense (per unit) Fixed selling and administrative expense (per year) Interest expense for the year 680 $ 2,060 $ 1,680 $50 $ 200,000 $22,000 Required: Prepare the company's budgeted income statement for the year. Gig Harbor Boating Budgeted Income Statement < Prev 9 of 9 Next ........arrow_forwardPlease give answer the questionarrow_forward

- ! Required information [The following information applies to the questions displayed below.] Morganton Company makes one product and provided the following information to help prepare its master budget: a. The budgeted selling price per unit is $60. Budgeted unit sales for June, July, August, and September are 9,800, 29,000, 31,000, and 32,000 units, respectively. All sales are on credit. b. Thirty percent of credit sales are collected in the month of the sale and 70% in the following month. c. The ending finished goods inventory equals 20% of the following month's unit sales. d. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 4 pounds of raw materials. The raw materials cost $2.50 per pound. e. Thirty percent of raw materials purchases are paid for in the month of purchase and 70% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two…arrow_forward! Required information [The following information applies to the questions displayed below.] Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July, August, and September are 9,000, 21,000, 23,000, and 24,000 units, respectively. All sales are on credit. b. Thirty percent of credit sales are collected in the month of the sale and 70% in the following month. c. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.70 per pound. e. Twenty percent of raw materials purchases are paid for in the month of purchase and 80% in the following month. f. The direct labor wage rate is $14 per hour. Each unit of finished goods requires two…arrow_forward. Flexible budget for selling and administrative expenses for a service company Digital Solutions Inc. uses flexible budgets that are based on the following data: Sales commissions 15% of sales 18% of sales $5,000 per month plus 12% of sales $28,000 per month $12,000 per month plus 20% of sales $30,000 per month Advertising expense Miscellaneous administrative expense Office salaries expense Customer support expenses Research and development expense Prepare a flexible selling and administrative expenses budget for October for sales volumes of $400,000, $500,000, and $600,000. (Use Exhibit 4 as a model.) Digital Solutions Inc. Flexible Selling and Administrative Expenses Budget For the Month Ending October 31 Line Item Description Total sales Variable cost: Total variable cost Fixed cost: Total fixed cost Total selling and administrative expenses Amount Amount Amount $400,000 $500,000 $600,000 $ $ $ $ $arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July, August, and September are 8,400, 15,000, 17,00O, and 18,000 units, respectively. All sales are on credit. b. Thirty percent of credit sales are collected in the month of the sale and 70% in the following month. c. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.50 per pound. e. Thirty percent of raw materials purchases are paid for in the month of purchase and 70% in the following month. f. The direct Ilabor wage rate is $12 per hour. Each unit of finished goods requires two…arrow_forwarddo fast.arrow_forwardRoger Company’ sells one product, and has provided the following variable and fixed estimates for budgetingpurposes.Variable element per unit Fixed element per monthRevenue $25Operating costs $4.75 $3,150For the month of August, it planned on selling 200 units, but actual units sold were 180 units. Actual revenuefor the month was $4,410 and actual operating costs were $3,865. a. What is the amount shown for revenue under the flexible and planning budget for August? b. What is the amount shown for total operating costs under the flexible and planning budgets for August?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education