FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

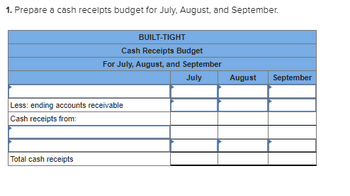

Transcribed Image Text:1. Prepare a cash receipts budget for July, August, and September.

BUILT-TIGHT

Cash Receipts Budget

For July, August, and September

July

Less: ending accounts receivable

Cash receipts from:

Total cash receipts

August September

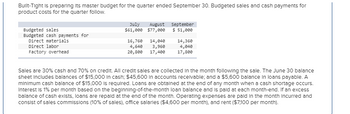

Transcribed Image Text:Built-Tight is preparing its master budget for the quarter ended September 30. Budgeted sales and cash payments for

product costs for the quarter follow.

Budgeted sales

Budgeted cash payments for

Direct materials

Direct labor

Factory overhead

July August

$61,000 $77,000

16,760 14,040

4,640 3,960

20,800 17,400

September

$ 51,000

14,360

4,040

17,800

Sales are 30% cash and 70% on credit. All credit sales are collected in the month following the sale. The June 30 balance

sheet Includes balances of $15,000 in cash; $45,600 in accounts receivable; and a $5,600 balance in loans payable. A

minimum cash balance of $15,000 is required. Loans are obtained at the end of any month when a cash shortage occurs.

Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. If an excess

balance of cash exists, loans are repaid at the end of the month. Operating expenses are paid in the month incurred and

consist of sales commissions (10% of sales), office salaries ($4,600 per month), and rent ($7,100 per month).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Assets Cash Minden Company Balance Sheet April 30 Accounts receivable Inventory Buildings and equipment, net of depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Note payable Common stock Retained earnings Total liabilities and stockholders' equity $ 11, 100 72,500 37,500 238,000 $ 359,100 $ 68,000 19,400 180,000 91,700 $ 359,100 The company is in the process of preparing a budget for May and assembled the following data: a. Sales are budgeted at $255,000 for May. Of these sales, $76,500 will be for cash; the remainder will be credit sales. One-half of a month's credit sales are collected in the month the sales are made, and the remainder are collected in the following month. All of the April 30 accounts receivable will be collected in May. b. Purchases of inventory are expected to total $189,000 during May. These purchases will all be on account. Forty percent of all purchases are paid for in the month of purchase; the remainder are paid in the following…arrow_forwardPreparing a Cash Budget La Famiglia Pizzeria provided the following information for the month of October: a. Sales are budgeted to be $163,000. About 85% of sales is cash; the remainder is on account. b. La Famiglia expects that, on average, 70% of credit sales will be paid in the month of sale, and 28% will be paid in the following month. c. Food and supplies purchases, all on account, are expected to be $103,000. La Famiglia pays 25% in the month of purchase and 75% in the month following purchase. d. Most of the work is done by the owners, who typically withdraw $6,000 a month from the business as their salary. (Note: The $6,000 is a payment in total to the two owners, not per person.) Various part-time workers cost $7,300 per month. They are paid for their work weekly, so on average 90% of their wages are paid in the month incurred and the remaining 10% in the next month. e. Utilities average $5,950 per month. Rent on the building is $4,100 per month. f. Insurance is paid…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Do not give solution in imagrarrow_forwardQUESTION 4 REQUIRED Use the information provided by empire Traders to prepare the following for March and April 2024: 4.1 Debtors Collection schedule 4.2 Cash Budget INFORMATION The following information was provided by Empire Traders: 1. Empire Traders expects to have a favourable bank balance of R60 000 on 28 february 2024. 2. Budgeted sales figures for 2024 are as follows: January February March April Cash Sales R320 000 R370 000 R310 000 R 250 000 Credit Sales R370 000 R390 000 R320 000 R300 000 3. Thirty percent (30%) of the cash sales is to informal traders who are entitled to a discount of 10%. Collections from debtors are usually as follows: 80% is collected in the month after sale 20% is collected two months after the sale 4. Purchases of inventory are expected to be as follows: January February March April Total Purchases R410 000 R460 000 R400 000 R380 000 5. Sixty percent (60) of then purchases is for cash to take advantage of a discount of 15%. The balance is purchased on…arrow_forwardA-2arrow_forward

- K Video Brian's Restaurant Supply is preparing its cash budgets for the first two months of the upcoming year. Here is the information about the company's upcoming cash receipts and cash disbursements: (Click the icon to view the information.) Requirements 1. Prepare schedules of (a) budgeted cash collections, (b) budgeted cash payments for purchases, and (c) budgeted cash payments for operating expenses. Show totals for each month and totals for January and February combined. 2. Prepare a combined cash budget. If no financing activity takes place, what is the budgeted cash balance on February 28? Requirement 1a. Prepare a schedule of budgeted cash collections for January and February. Show totals for each month and totals for January and February combined. Brian's Restaurant Supply Cash Collections Budget For the Months Ended January 31 and February 28 Cash sales Collection on credit sales Total cash collections January More info a. Sales are 60% cash and 40% credit. Credit sales are…arrow_forwardPlease do not give solution in image format thankuarrow_forwardRaghubhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education