FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

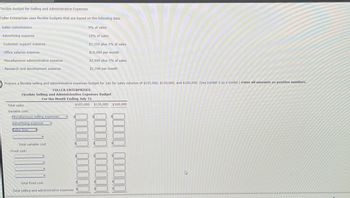

Transcribed Image Text:Flexible Budget for Selling and Administrative Expenses

Fuller Enterprises uses flexible budgets that are based on the following data:

Sales commissions

Advertising expense

Customer support expense

Office salaries expense

Miscellaneous administrative expense

Research and development expense

Total sales

Variable cost:

Miscellaneous selling expenses

Advertising expense

Prepare a flexible selling and administrative expenses budget for July for sales volumes of $105,000, $130,000, and $160,000. (Use Exhibit 5 as a model.) Enter all amounts as positive numbers.

FULLER ENTERPRISES

Sales fees

Flexible Selling and Administrative Expenses Budget

For the Month Ending July 31

Total variable cost

Fixed cost:

9% of sales

Total fixed cost

19% of sales

Total selling and administrative expenses

$2,350 plus 3% of sales

$16,000 per month

$2,900 plus 2% of sales

$1,700 per month

$105,000 $130,000 $160,000

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- olander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month’s budget appear below: Selling price per unit $ 30 Variable expense per unit $ 13 Fixed expense per month $ 14,110 Unit sales per month 980 Required: 1. What is the company’s margin of safety? (Do not round intermediate calculations.) 2. What is the company’s margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. .1234 should be entered as 12.34).)arrow_forwardPlease answer in text form without imagearrow_forwardPlease helparrow_forward

- . Flexible budget for selling and administrative expenses for a service company Digital Solutions Inc. uses flexible budgets that are based on the following data: Sales commissions 15% of sales 18% of sales $5,000 per month plus 12% of sales $28,000 per month $12,000 per month plus 20% of sales $30,000 per month Advertising expense Miscellaneous administrative expense Office salaries expense Customer support expenses Research and development expense Prepare a flexible selling and administrative expenses budget for October for sales volumes of $400,000, $500,000, and $600,000. (Use Exhibit 4 as a model.) Digital Solutions Inc. Flexible Selling and Administrative Expenses Budget For the Month Ending October 31 Line Item Description Total sales Variable cost: Total variable cost Fixed cost: Total fixed cost Total selling and administrative expenses Amount Amount Amount $400,000 $500,000 $600,000 $ $ $ $ $arrow_forwardFlexible budget for selling and administrative expenses for a service company Digital Solutions Inc. uses flexible budgets that are based on the following data: Sales commissions 6% of sales Advertising expense 14% of sales Miscellaneous administrative expense $11,000 per month plus 4% of sales Office salaries expense $52,000 per month Customer support expenses $18,000 per month plus 31% of sales Research and development expense $78,000 per month This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the question below. Open spreadsheet Prepare a flexible selling and administrative expenses budget for October for sales volumes of $600,000, $900,000, and $1,000,00o. (Use Exhibit 5 as a model.) Enter all amounts as positive numbers. Digital Solutions Inc. Flexible Selling and Administrative Expenses Budget For the Month Ending October 31 Total sales $600,000 $900,000 $1,000,000 Variable cost:…arrow_forwardRefer to the picture for the problem and template.arrow_forward

- Molander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ 23 2416 $ 5,810 980 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (l.e. 1234 should be entered as 12.34).) . Margin of safety (in dollars) 2. Margin of salety percentagearrow_forwardFlexible Budget for Selling and Administrative Expenses for a Service Companyarrow_forwardBailee Company combines its operating expenses for budget purposes in a selling and administrative expense budget. For the first 6 months of 2017, the following data are available. 1. Sales: 33,000 units quarter 1; 35,000 units quarter 2. 2. Variable costs per dollar of sales: Sales commissions $33,000 quarter 1; $35,000 quarter 2, delivery expense $13,200 quarter 1 and $14,000 quarter 2, and advertising $19,800 quarter 1 and $21,000. 3. Fixed costs per quarter: Sales salaries $15,000, office salaries $6,000, depreciation $4,200, insurance $1,500, utilities $800, and repairs expense $600. 4. Unit selling price: $20. Instructions: Prepare a selling and administrative expense budget by quarters for the first 6 months of 201arrow_forward

- Rooney Company produces two products. Budgeted annual income statements for the two products are provided as follows. Power Lite Total Budgeted Per Budgeted Budgeted Per Budgeted Budgeted Budgeted Number Unit Amount Number Unit Amount Number Amount @ $ 700 @ 380 $ 319,200 (168,000) 151,200 $ 487,200 (259,200) 228,000 (114,000) $ 114,000 Sales 240 $168,000 560 @ $ 570 800 Variable cost (91,200) 76,800 |(19,000) $ 57,800 240 560 @ 300 = 800 %3D Contribution margin 240 320 560 @ 270 800 Fixed cost (95,000) Net income $ 56,200 Required: a. Based on budgeted sales, determine the relative sales mix between the two products. b. Determine the weighted-average contribution margin per unit. c. Calculate the break-even point in total number of units. d. Determine the number of units of each product e. Verify the break-even point by preparing an income statement for each product as well as an income statement for the combined products. f. Determine the margin of safety based on the combined sales…arrow_forwardPrepare a monthly flexible selling expense budget for Podism Company for sales volumes of $270,000, $350,000, and $480,000, based on the following data: Sales commissions 7% of sales Sales manager's salary $62,000 per month Advertising expense $70,000 per month Shipping expense 2% of sales Miscellaneous selling expense $2,500 per month plus 1/2% of sales Podism Company Monthly Selling Expense Budget Sales volume $270,000 $350,000 $480,000 Variable expense: Sales commissions х X Shipping expense X Miscellaneous selling expense Total variable expense Fixed expense: Sales manager's salary x $ Advertising expense X Miscellaneous selling expense Total fixed expense %$4 Total selling expense $ Xarrow_forward(J)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education