FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Flexible budget for assembly department

Cabinaire Inc. is one of the largest manufacturers of office furniture in the United States. In Grand Rapids, Michigan, it assembles filing cabinets in an Assembly Department. Assume

the following information for the Assembly Department:

Direct labor per filing cabinet

Supervisor salaries

Depreciation

Direct labor rate

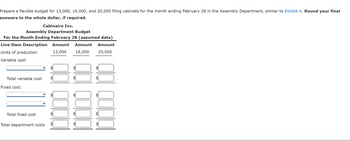

Prepare a flexible budget for 13,000, 16,000, and 20,000 filing cabinets for the month ending February 28 in the Assembly Department, similar to Exhibit 4. Round your final

answers to the whole dollar, if required.

Cabinaire Inc.

Total variable cost

30 minutes

Assembly Department Budget

For the Month Ending February 28 (assumed data)

Line Item Description Amount Amount Amount

Units of production

13,000 16,000

20,000

Variable cost:

Fixed cost:

$111,000 per month

$21,000 per month

$15 per hour

Total fixed cost

A

LA

Transcribed Image Text:Prepare a flexible budget for 13,000, 16,000, and 20,000 filing cabinets for the month ending February 28 in the Assembly Department, similar to Exhibit 4. Round your final

answers to the whole dollar, if required.

Cabinaire Inc.

Assembly Department Budget

For the Month Ending February 28 (assumed data)

Line Item Description Amount Amount Amount

Units of production

13,000

16,000 20,000

Variable cost:

Total variable cost

Fixed cost:

Total fixed cost

Total department costs

LA

QOOQ

+A

LA

LA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How to solve the blanksarrow_forwardAccounting Capstone - Master Budgetarrow_forwardDirect Labor Budget-Service Business Ambassador Suites Inc., operates a downtown hotel property that has 600 rooms. On average, 90% of Ambassador Suites's rooms are occupied on weekdays, and 60% are occupied during the weekend. The manager has asked you to develop a direct labor budget for the housekeeping and restaurant staff for weekdays and weekends. You have determined that the housekeeping staff requires 40 minutes to clean each occupied room. The housekeeping staff is paid $12 per hour. The restaurant has 12 full-time staff (eight-hour day) on duty, regardless of occupancy. However, for every 20 occupied rooms, an additional person is brought in to work in the restaurant for the eight-hour day. The restaurant staff is paid $10 per hour. Determine the estimated housekeeping, restaurant, and total direct labor cost for an average weekday and average weekend day. Enter percentages as whole numbers. Ambassador Suites Inc. Direct Labor Cost Budget For a Weekday or a Weekend Day…arrow_forward

- Required: Complete the company's flexible budget for August.arrow_forwardPrint Item Sales, Production, Direct Materials Purchases, and Direct Labor Cost Budgets The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for July is summarized as follows: a. Estimated sales for July by sales territory: Maine: Backyard Chef 310 units at $700 per unit Master Chef 150 units at $1,200 per unit Vermont: Backyard Chef 240 units at $750 per unit Master Chef 110 units at $1,300 per unit New Hampshire: Backyard Chef 360 units at $750 per unit Master Chef 180 units at $1,400 per unit b. Estimated inventories at July 1: Direct materials: Grates 290 units Stainless steel 1,500 lbs. Burner subassemblies 170 units Shelves 340 units Finished products: Backyard Chef 30 units Master Chef 32 units c. Desired inventories at July 31: Direct materials: Grates 340 units…arrow_forwardFlexible Budget for Assembly Department Cabinaire Inc. is one of the largest manufacturers of office furniture in the United States. In Grand Rapids, Michigan, it assembles filing cabinets in an Assembly Department. Assume the following information for the Assembly Department: Direct labor per filing cabinet 30 minutes Supervisor salaries $117,000 per month Depreciation $32,000 per month Direct labor rate $15 per hour Prepare a flexible budget for 11,000, 14,000, and 17,000 filing cabinets for the month of August in the Assembly Department, similar to Exhibit 5. Cabinaire Inc-Assembly Department Flexible Production Budget For the Month Ending August 31 (assumed data) Units of production 11,000 14,000 17,000 Variable cost: Direct labor Fixed cost: Supervisor salaries Depreciation Total fixed cost Total department costarrow_forward

- ! Required information Miami Solar manufactures solar panels for industrial use. The company budgets production of 5,000 units (solar panels) in July and 5,300 units in August. Each unit requires 4 hours of direct labor at a rate of $16 per hour. The company applies variable overhead at the rate of $12 per direct labor hour. Budgeted fixed factory overhead is $180,000 per month. Prepare a factory overhead budget for August. MIAMI SOLAR Factory Overhead Budget Direct labor hours needed Variable overhead rate per direct labor hour Budgeted variable overhead Budgeted fixed overhead Budgeted total factory overhead August $ 0arrow_forwardFlexible Budget Performance Report AirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February: The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $2,900 plus $35 per job, and the actual mobile lab operating expenses for February were $4,530. The company expected to work 50 jobs in February, but actually worked 52 jobs. Required: Using Exhibit 9–8 as your guide, prepare a flexible budget performance report showing AirQual Test corporation’s revenue and spending variances and activity variances for February. Exhibit 9–8 Performance Report Combining Activity Variances with Revenue and Spending Variancesarrow_forwardPreparing an Overhead Budget Patrick Inc. makes industrial solvents. Budgeted direct labor hours for the first 3 months of the coming year are: January 13,140 February 12,300 March 15,075 The variable overhead rate is $0.70 per direct labor hour. Fixed overhead is budgeted at $2,890 per month. Required: Prepare an overhead budget for the months of January, February, and March, as well as the total for the first quarter. Do not include a multiplication symbol as part of your answer. Round total variable overhead and total overhead to the nearest dollar. Overhead: January February March Total Total direct labor hrs fill in the blank 1 fill in the blank 2 fill in the blank 3 fill in the blank 4 Variable overhead rate $fill in the blank 5 $fill in the blank 6 $fill in the blank 7 $fill in the blank 8 Total variable overhead $fill in the blank 9 $fill in the blank 10 $fill in the blank 11 $fill in the blank 12 Add: Fixed overhead fill in the blank 13 fill in the…arrow_forward

- Flexible Budget for Assembly Department Steelcase Inc. is one of the largest manufacturers of office furniture in the United States. In Grand Rapids, Michigan, it assembles filing cabinets in an Assembly Department. Assume the following information for the Assembly Department: Direct labor per filing cabinet 12 minutes Supervisor salaries $150,000 per month Depreciation $24,500 per month Direct labor rate $22 per hour Prepare a flexible budget for 18,000, 20,000, and 22,000 filing cabinets for the month of August in the Assembly Department, similar to Exhibit 5. Steelcase Inc.-Assembly Department Flexible Production Budget For the Month Ending August 31 (assumed data) Units of production 18,000 20,000 22,000 Variable cost: Direct labor Fixed cost: Supervisor salaries $4 $4 Depreciation Total fixed cost $4 $ Total department cost $4 $ $4arrow_forwardSales, Production, Direct Materials Purchases, and Direct Labor Cost Budgets The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for March is summarized as follows: a. Estimated sales for March by sales territory: Maine: Backyard Chef 350 units at $800 per unit Master Chef 200 units at $1,400 per unit Vermont: Backyard Chef 400 units at $825 per unit Master Chef 240 units at $1,500 per unit New Hampshire: Backyard Chef 320 units at $850 per unit Master Chef 200 units at $1,600 per unit b. Estimated inventories at March 1: Direct materials: Grates 320 units Stainless steel 1,700 lb. Burner subassemblies 190 units Shelves 350 units Finished products: Backyard Chef 30 units Master Chef 36 units c. Desired inventories at March 31: Direct materials:…arrow_forwardFlexible Budgeting At the beginning of the period, the Assembly Department budgeted direct labor of $64,800 and property tax of $36,000 for 3,600 hours of production. The department actually completed 4,300 hours of production. Determine the budget for the department, assuming that it uses flexible budgeting. 120,400 X Feedback Check My Wirk Remember that a flexible budget is constructed by first identifying the relevant activity levels, secondly identifying the fixed and variable cost components of the costs being budgeted, and then preparing the budget for each activity level.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education