FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

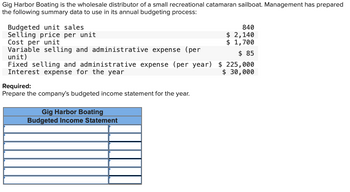

Transcribed Image Text:Gig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared

the following summary data to use in its annual budgeting process:

Budgeted unit sales

Selling price per unit

Cost per unit

Variable selling and administrative expense (per

unit)

Fixed selling and administrative expense (per year)

Interest expense for the year

Required:

Prepare the company's budgeted income statement for the year.

Gig Harbor Boating

Budgeted Income Statement

840

$ 2,140

$ 1,700

$ 85

$ 225,000

$ 30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the production budget including quarterly and yearly totals?arrow_forwardGig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process: Budgeted unit sales Selling price per unit Cost per unit Variable selling and administrative expense (per unit) Fixed selling and administrative expense (per year) Interest expense for the year 680 $ 2,060 $ 1,680 $50 $ 200,000 $22,000 Required: Prepare the company's budgeted income statement for the year. Gig Harbor Boating Budgeted Income Statement < Prev 9 of 9 Next ........arrow_forwardGardner Corporation manufactures skateboards and is in the process of preparing next year's budget. The pro forma income statement for the current year is presented below. Sales $ 1,500,000 Cost of sales: Direct Material $ 250,000 Direct labor 150,000 Variable Overhead 75,000 Fixed Overhead 100,000 575,000 Gross Profit $ 925,000 Selling and G&A Variable 200,000 Fixed 250,000 450,000 Operating Income $ 475,000 The break-even point (rounded to the nearest dollar) for Gardner Corporation for the current year is:arrow_forward

- Gig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process:arrow_forwardRequired information [The following information applies to the questions displayed below] Phoenix Company's 2019 master budget included the following fixed budget report. It is based on an expected production and sales volume of 15,000 units. Sales Cost of goods sold Direct materials Direct labor PHOENIX COMPANY Fixed Budget Report For Year Ended December 31, 2019 Machinery repairs (variable cost) Depreciation Plant equipment (straight-line) Utilities ($30, 000 is variable) Plant management salaries Gross profit $3,150,000 $ 915,000 225,000 45,000 300,000 195,000 200,000 1,880,000 1,270,000 Selling expenses 75,000 Shipping 90,000 Sales salary (fixed annual amount) 236,000 400,000 General and administrative expenses Advertising expense 150,000 Salaries 241,000 Entertainment expense Income from operations 75,000 466,000 $ 404, 000 Packaging 3. The company's business conditions are improving. One possible result is a sales volume of 18,000 units. The company president is confident that…arrow_forwardPreparing a Selling and Administrative Expenses Budget Fazel Company makes and sells paper products. In the coming year, Fazel expects total sales of $20,000,000. There is a 3% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following: Salaries $ 960,000 Utilities 365,000 Office space 230,000 Advertising 1,200,000 Required: Prepare a selling and administrative expenses budget for Fazel Company for the coming year. Fazel Company Selling and Administrative Expenses Budget For the Coming Year Variable selling expenses $fill in the blank 1 Fixed expenses: Salaries $fill in the blank 2 Utilities fill in the blank 3 Office space fill in the blank 4 Advertising fill in the blank 5 Total fixed expenses fill in the blank 6 Total selling and administrative expenses $fill in the blank 7arrow_forward

- Required information Use the following information for the Problems below. (Algo) Skip to question [The following information applies to the questions displayed below.] Phoenix Company reports the following fixed budget. It is based on an expected production and sales volume of 15,300 units. PHOENIX COMPANY Fixed Budget For Year Ended December 31 Sales $ 3,213,000 Costs Direct materials 1,009,800 Direct labor 244,800 Sales staff commissions 61,200 Depreciation—Machinery 300,000 Supervisory salaries 197,000 Shipping 229,500 Sales staff salaries (fixed annual amount) 245,000 Administrative salaries 534,920 Depreciation—Office equipment 198,000 Income $ 192,780 Problem 21-1A (Algo) Preparing and analyzing a flexible budget LO P1 Required:1&2. Prepare flexible budgets at sales volumes of 14,300 and 16,300 units.3. The company’s business conditions are improving. One possible result is a sales volume of 18,300 units. Prepare a simple budgeted…arrow_forwardGiven the following information, prepare an annual income statement budget for the Great Student Corporation as of 12/31/2018. 1. Sales: 1000 Units; Price $1,000 per Unit 2. Cost of Goods Sold (COGS): 60% of Sales 3. Wages: 15 Employees; Average Cost per Employee $15000 4. SGA Expenses: 12% of Sales 5. Depreciation: Straight Line $4000 per year 6. Interest Expense: 1% of Sales What was the company's budgeted gross profit? O A. $403,000 O B. $400,000 O C. $41,000 O D. $359,000arrow_forwardSheridan Company makes and sells artistic frames for pictures. The controller is responsible for preparing the master budget and has accumulated the following information for 2022. Estimated unit sales Unit selling price Direct labor hours per unit Direct labor cost per hour January 10,560 (a) $60 2.0 $6.0 Your Answer Correct Answer February March April 12,320 9,680 $57.5 $57.5 2.0 $6.0 11,440 $57.5 1.5 1.5 May 9,680 $57.5 1.5 Sheridan has a labor contract that calls for a wage increase to $7.0 per hour on April 1. New labor-saving machinery has been installed and will be fully operational by March 1. $6.0 $7.0 $7.0 Sheridan expects to begin the year with 15,488 frames on hand and has a policy of carrying an end-of-month inventory of 100% of the following month's sales, plus 40% of the second following month's sales.arrow_forward

- Gig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process: Budgeted unit sales Selling price per unit Cost per unit Variable selling and administrative expense (per unit) Fixed selling and administrative expense (per year) Interest expense for the year Required: Prepare the company's budgeted income statement for the year. Gig Harbor Boating Budgeted Income Statement 600 $ 2,020 $ 1,670 $ 55 $ 107,000 $ 18,000arrow_forwardArberg Company’s controller prepared the following budgeted income statement for the coming year: Sales $417,000 Variable cost 287,730 Contribution margin $129,270 Fixed cost 75,950 Operating income $53,320 2. Suppose Arberg’s actual revenues are $29,900 more than budgeted. By how much will operating income increase?arrow_forwardes Required information [The following information applies to the questions displayed below.] Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July, August, and September are 9,000, 21,000, 23,000, and 24,000 units, respectively. All sales are on credit. b. Thirty percent of credit sales are collected in the month of the sale and 70% in the following month. c. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.70 per pound. e. Twenty percent of raw materials purchases are paid for in the month of purchase and 80% in the following month. f. The direct labor wage rate is $14 per hour. Each unit of finished goods requires two…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education