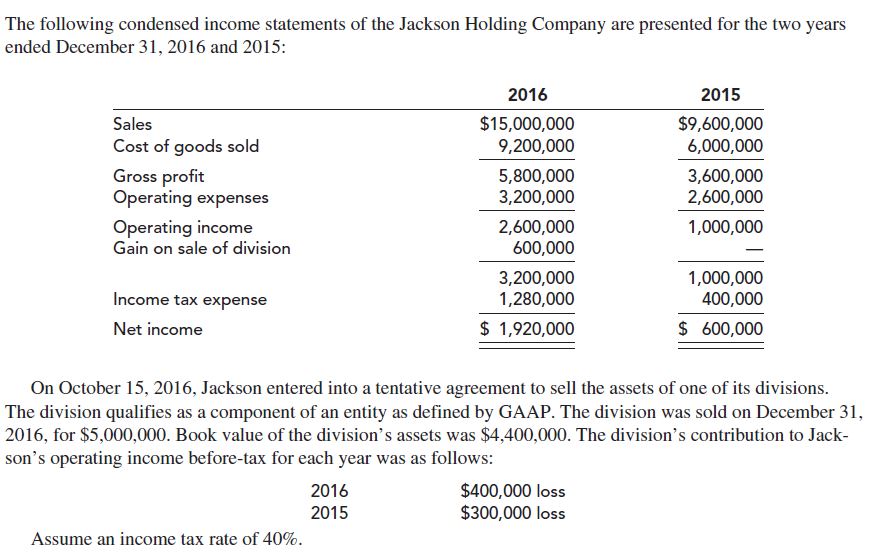

Required: 1. Prepare revised income statements according to generally accepted accounting principles, beginning with income from continuing operations before income taxes. Ignore EPS disclosures. 2. Assume that by December 31, 2016, the division had not yet been sold but was considered held for sale. The fair value of the division’s assets on December 31 was $5,000,000. How would the presentation of discontinued operations be different from your answer to requirement 1? 3. Assume that by December 31, 2016, the division had not yet been sold but was considered held for sale. The fair value of the division’s assets on December 31 was $3,900,000. How would the presentation of discontinued operations be different from your answer to requirement 1?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

- After conducting a thorough review of the company’s fi nancial statements, Martinez concludes the following:Conclusion 1 Although Stellar’s fi nancial statements adhere to generally accepted accounting principles (GAAP), Stellar understates earnings in periods whenthe company is performing well and overstates earnings in periods whenthe company is struggling.Conclusion 2 Stellar most likely understated the value of amortizable intangibles whenrecording the acquisition of Solar, Inc. last year. No goodwill impairmentcharges have been taken since the acquisition.Conclusion 3 Over time, the accruals component of Stellar’s earnings is large relative tothe cash component.Conclusion 4 Stellar reported an unusually sharp decline in accounts receivable in thecurrent year, and an increase in long-term trade receivables.2 . Based on Conclusion 2, after the acquisition of Solar, Stellar’s earnings are most likely :A . understated.B . fairly stated.C . overstatedarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardRay Solutions decided to make the following changes in its accounting policies on January 1, 2016: a. Changed from the cash to the accrual basis of accounting for recognizing revenue on its service contracts. b. Adopted straight-line depreciation for all future equipment purchases, but continued to use accelerated depreciation for all equipment acquired before 2016. c. Changed from the LIFO inventory method to the FIFO inventory method. Required: For each accounting change Ray undertook, indicate the type of change and how Ray should report the change. Be specific.arrow_forward

- On June 30, Pronghorn Corp discontinued its operations in Mexico. During the year, the operating income was $270,000 before taxes. On September 1, Pronghorn disposed of the Mexico facility at a pretax loss of $670,000. The applicable tax rate is 30%. Show the discontinued operations section of Pronghorn’s income statement. PRONGHORN CORPPartial Income Statement select an opening section name enter an income statement item $enter a dollar amount enter an income statement item $enter a dollar amount $enter a total dollar amountarrow_forwardWildhorse, Inc. is a calendar-year corporation whose financial statements for 2020 and 2021 included errors as follows: Year Ending Inventory Depreciation Expense 2020 $414000 overstated $360000 overstated 2021 137000 understated 103500 understated Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2020, or at December 31, 2021. Ignoring income taxes, by how much should Wildhorse's retained earnings be retroactively adjusted at January 1, 2022? $87500 increase $33500 decrease $20500 increase $393500 increasearrow_forwardGardiner, Inc. reported a retained earnings balance of $190,000 at December 31, 2024. In June 2025, Gardiner discovered that merchandise costing $20,000 had been improperly included in ending inventory in its 2024 financial statements. Also, a $50,000 accrued expense was omitted on 12/31/24. Gardiner has a 20% tax rate. Assuming the correcting journal entry net of tax was recorded, what amount should Gardiner report as adjusted beginning retained earnings in its 2025 statement of retained earnings? Select one: O a. $226,000 O b. $120,000 C. $166,000 d. $160,000 e. $134,000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education