FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

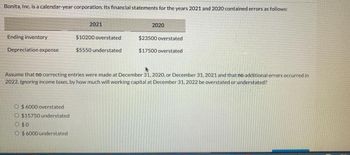

Transcribed Image Text:Bonita, Inc. is a calendar-year corporation. Its financial statements for the years 2021 and 2020 contained errors as follows:

Ending inventory

Depreciation expense

O $6000 overstated

O $15750 understated

O

O $6000 understated

2021

$0

$10200 overstated

$5550 understated

2020

Assume that no correcting entries were made at December 31, 2020, or December 31, 2021 and that no additional errors occurred in

2022. Ignoring income taxes, by how much will working capital at December 31, 2022 be overstated or understated?

$23500 overstated

$17500 overstated

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marigold Inc. reported total assets of $2391000 and net income of $318000 for the current year. Marigold determined that inventory was overstated by $23500 at the beginning of the year (this was not corrected). Ignoring income taxes, what is the corrected amount for total assets and net income for the year?arrow_forwardThe following errors were discovered on the books of Nash Corporation, during the 2024 year-end process, prior to the books being closed for the year. Prepare the journal entries required to correct the below errors, assuming that Nash follows IFRS and has a perpetual inventory system. For this question, ignore income tax. (a) While conducting the year-end inventory count in December 2024, it was discovered that $7,400 of product was omitted from the December 2023 inventory count. The product had been shipped to a customer early in 2024, but had not been included in the 2023 ending inventory. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.)arrow_forward12. Casillas, Inc. is a calendar-year corporation. Its financial statements for the years 2011 and 2010 contained errors as follows: 2010 Ending Inventory$3,000 overstated$8,000 overstated $2,000 understated$6,000 overstated 2011 Depreciation Expense Assume that no correcting entries were made at December 31, 2010, or December 31, 2011 and that no additional errors occurred in 2012. Ignoring income taxes, by how much will working capital at December 31, 2012 be overstated or understated? a. $0 b. $2,000 overstated c. $2,000 understated d. $5,000 understatedarrow_forward

- BE6-9 Creole Company reports net income of $90,000 in 2002. Ending inventory was understated by $7,000. What is the correct net income for 2002? What effect, if any, will this error have on total assets and owner's equity reported in the balance sheet at December 31, 2002?arrow_forwardBonita, Inc., changed from the LIFO cost flow assumption to the FIFO cost flow assumption in 2025. The increase in the prior year's income before taxes is $1,300,500. The tax rate is 20%. Prepare Bonita's 2025 journal entry to record the change in accounting principle. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation eTextbook and Media Debit Creditarrow_forwardc. Assume the same facts as above and in part (b), except that Washi’s net income included a loss on discontinued operations of $33,000 (net of tax). Prepare the journal entries necessary to record Flounder’s equity in the net income of Washi for 2023. Ignore income taxes. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit enter an account title to record investment income and loss enter a debit amount enter a credit amount enter an account title to record investment income and loss enter a debit amount enter a credit amount enter an account title to record investment income and loss enter a debit amount enter a credit amount (To record investment income and loss) enter an account title to record depreciation…arrow_forward

- ії. Casillas, Inc. is a calendar-year corporation. Its financial statements for the years 2011 and 2010 contained errors as follows: 201141 Ending Inventory Depreciation Expense 2010 $3,000 overstated S8,000 overstated $2,000 understated| $6,000 overstated Assume that no correcting entries were made at December 31, 2010. Ignoring income taxes, by how much will retained earnings at December 31, 2011 be overstated or understated? a. $1,000 understated b. $5,000 overstated c. S5,000 understated d. $9,000 understatedarrow_forwardDr. Drake Ramoray is a calendar-year corporation whose financial statements for 2020 and 2021 included errors as follows: Year Ending Inventory Sales Revenue 2020 $40,000 understated $25,000 understated 2021 24,000 understated 37,000 understated Assume that purchases were recorded correctly and that have been no correcting entries made to either 2020, or 2021. It is now January 1, 2022, and suppose the books are closed for 2020, but not 2021. Ignoring income taxes, by how much should Drake directly adjust retained earnings in their correcting journal entry? O $15,000 decrease O $38,000 decrease $15,000 increase O $65,000 increase O $86,000 increase O $126,000 decrease O None of the given answers O $38,000 increase O $126,000 increase O $9,000 increasearrow_forwardYou have been assigned to examine the financial statements of Zarle Company for the year ended December 31, 2020. You discover the following situations. 1. Depreciation of $3,200 for 2020 on delivery vehicles was not recorded. 2. The physical inventory count on December 31, 2019, improperly excluded merchandise costing $19,000 that had been temporarily stored in a public warehouse. Zarle uses a periodic inventory system. 3. A collection of $5,600 on account from a customer received on December 31, 2020, was not recorded until January 2, 2021. 4. In 2020, the company sold for $3,700 fully depreciated equipment that originally cost $25,000. The company credited the proceeds from the sale to the Equipment account. 5. During November 2020, a competitor company filed a patent-infringement suit against Zarle claiming damages of $220,000. The company's legal counsel has indicated that an unfavorable verdict is probable and a reasonable estimate of the court's award to the competitor is…arrow_forward

- Using direct method, ZARA company decided on December 2, 2019 to write-off 370$ that owned to HH company Ltd. The journal entry to record this transaction is O a. Bad debt expense 370 Account receivable 370 O b. Bad debt expense 370 Cash 370 Oc Bad debt expense 370 C. Allowance for doubtful account 370 O d. Cash370 Bad debt expense 370arrow_forwardThe following errors were discovered in the preparation of the financial statements of Uni-Focus Company for the year ended November 30, 2021. Goods held on consignment from Tri-Facet Ltd. with a cost of $17,940 were incorrectly included in Uni-Focus Company’s inventory on November 30, 2020. The goods were not sold during the 2021 year and were returned to Tri-Facet. The goods were not included in Uni-Focus Company’s November 30, 2021 inventory count. Assume that Uni-Focus Company’s Inventory account accurately reflects the results of the November 30, 2021 count. During the first week of December 2017, office furniture was purchased for $18,505. The entire purchase was recorded with a debit to Office Supplies Expense, and a credit to Cash. Uni-Focus expected to keep the furniture for 10 years and sell it for $675 at the end of the asset’s useful life. Uni-Focus Company uses the straight-line method of depreciation for furniture. On December 1, 2019, Uni-Focus Company paid an…arrow_forwardDuring year 3, Mayorca Corp. decided to change from the FIFOmethod of inventory valuation to the weighted-average method. Inventory balances under each method were as follows: FIFO Weighted-average January 1, year 3 P71,000 P77,000 December 31, year 3 79,000 83,000 Orca’s income tax rate is 30%. In its year 3 financial statements, what amount should Mayorca report as the gain or loss on the cumulative effect of this accounting change?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education