FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

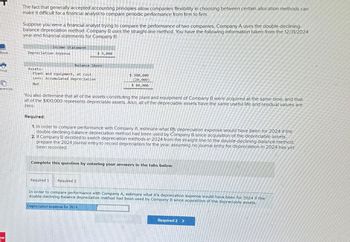

Transcribed Image Text:The fact that generally accepted accounting principles allow companies flexibility in choosing between certain allocation methods can

make it difficult for a financial analyst to compare periodic performance from firm to firm.

Suppose you were a financial analyst trying to compare the performance of two companies. Company A uses the double-declining-

balance depreciation method. Company B uses the straight-line method. You have the following information taken from the 12/31/2024

year-end financial statements for Company B:

Income Statement

Book

Depreciation expense

$ 5,000

Balance Sheet

Assets:

Print

Plant and equipment, at cost

Less: Accumulated depreciation

Net

$ 100,000

(20,000)

Ferences

$ 80,000

You also determine that all of the assets constituting the plant and equipment of Company B were acquired at the same time, and that

all of the $100,000 represents depreciable assets. Also, all of the depreciable assets have the same useful life and residual values are

zero.

Required:

1. In order to compare performance with Company A, estimate what Bs depreciation expense would have been for 2024 if the

double-declining-balance depreciation method had been used by Company B since acquisition of the depreciable assets.

2. If Company B decided to switch depreciation methods in 2024 from the straight line to the double-declining-balance method,

prepare the 2024 journal entry to record depreciation for the year, assuming no journal entry for depreciation in 2024 has yet

been recorded.

aw

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

In order to compare performance with Company A, estimate what B's depreciation expense would have been for 2024 if the

double-declining-balance depreciation method had been used by Company B since acquisition of the depreciable assets.

Depreciation expense for 2024

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Industry standards for financial statement onalysis: Multiple Choice Are used to compare a company's performance to industry performance. Are based on rules of thumb. Are set by the government. Compare a company's income with its prior year's income. Are based on a single competitor's financial performance.arrow_forwardWhat is Market Value? A. Any cost that has not yet been charged to the expense B. The amount of money a business must currently spend to replace an essential asset C. Maintaining an account tied to a certain asset D. The value of a company according to the stock marketarrow_forwardat the bottom. Had there been a loss for the In reviewing the income statement of a profitable company, one can see that it begins with at the top and ends with year, the final result would have been a What exactly does the word balance mean in the title of the balance sheet? Why do we balance the two halves? (Select all the answers that apply.) A. The balance sheet balances the firm's assets against its financing, which can be either debt or equity. B. The total value of all of the firm's assets should equal the sum of its short- and long-term debt plus stockholder's equity. C. In order for the balance sheet to balance, stockholder's equity must exclude preferred stock, common stock at par value, paid in capital in excess of par on common stock and retained earnings from previous profitable years in which some of the earnings were held back and not paid out as dividends. D. When the balance sheet does not balance, the difference must be reported as an "off-balance sheet" account for…arrow_forward

- Question: When preparing financial statements, which involve the culmination of various accounting principles and concepts, the process is crucial in portraying a company's financial health and performance. Among the key components, the income statement and the balance sheet stand as fundamental snapshots. The income statement delineates a company's revenues, expenses, and ultimately its profitability over a specific period, employing either the accrual basis or cash basis accounting. On the other hand, the balance sheet provides an overview of a company's assets, liabilities, and shareholders' equity at a given point in time, adhering to the accounting equation where assets are equal to liabilities plus shareholders' equity. Furthermore, the matching principle necessitates that expenses be recorded in the same period as the related revenues they helped generate, facilitating a more accurate representation of the company's financial performance. In the context of accounting…arrow_forwardDo not give image formatarrow_forwardNonearrow_forward

- 24arrow_forwardTHIS IS ALL ONE QUESTION, Thanks! The income statement, also known as the profit and loss (P&L) statement, provides a snapshot of the financial performance of a company during a specified period of time. It reports a firm’s gross income, expenses, net income, and the income that is available for distribution to its preferred and common shareholders. The income statement is prepared using the generally accepted accounting principles (GAAP) that match the firm’s revenues and expenses to the period in which they were incurred, not necessarily when cash was received or paid. Investors and analysts use the information given in the income statement and other financial statements and reports to evaluate the company’s financial performance and condition. Consider the following scenario: Cold Goose Metal Works Inc.’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year. 1. Cold Goose is able to achieve this level…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education