FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

infoPractice Pack

Question

infoPractice Pack

i have completed this in excel but would like to compare my answers

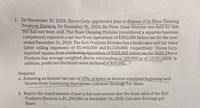

Transcribed Image Text:1. On November 30, 2020, Clorox Corp. approved a plan to dispose of its Floor Cleaning

Products Division, On December 31, 2020, the Floor Clean Division was held for sale

but had not been sold. The Floor Cleaning Division (considered a separate business

component) reported a net loss from operations of $202,000 before tax for the year

ended December 31, 2020. The Knit Products Division has a book value and fair value

(after selling expenses) of $1,440,000 and $1,320,000, respectively. Clorox Corp.

reported income from.continuing.operations of $360,000 before tax for 2020. Clorox

Products has average weighted shares outstanding of 100,000 as of 12/31/2020. In

addition, preferred dividends were declared of $20,000.

Required

a. Assuming an income tax rate of 25%, prepare an income statement beginning with

Income from Continuing Operations. Calculate Earnings Per Share.

b. Repeat the requirements of part a but now assume that the book value of the Knit

Products Division is $1,280,000 on December 31, 2020. Calculate Earnings per

Share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Includes step-by-step video

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Is it possible to get a solution with formulas instead of excel?arrow_forwardI'm stuck on how to do the excel formulasarrow_forwardEducate these stakeholders on the advantages of utilizing a spreadsheet solution and how simple it was to process data in order to generate the information provided in the report in Excelarrow_forward

- Can i have the answers for all in formula steps not excel please. Kind of hard to understand.arrow_forwardDraw out a trial balance using the above trasnsactions . Thank you .arrow_forwardYou guys provided me an expert answer? Cuz the table for the part 1 of the p missing as well on volum PR what do i enter? and the part 2 has a table but c utilized.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education