ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

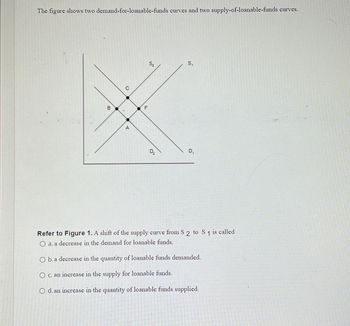

Transcribed Image Text:The figure shows two demand-for-loanable-funds curves and two supply-of-loanable-funds curves.

B

*

C

D

F

S₂

D₂

S₁

D₁

Refer to Figure 1. A shift of the supply curve from S 2 to S 1 is called

O a. a decrease in the demand for loanable funds.

O b. a decrease in the quantity of loanable funds demanded.

O c. an increase in the supply for loanable funds.

O d. an increase in the quantity of loanable funds supplied.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardFigure 32-1 percent 8 10 20 30 40 50 60 70 $billions Refer to Figure 32-1. In the Figure shown, if the real interest rate is 6 percent, the quantity of loanable funds demanded is O A. $20 billion, and the quantity supplied is $40 billion. O B. $20 billion, and the quantity supplied is $60 billion. O C. $60 billion, and the quantity supplied is $20 billion. O D. $60 billion, and the quantity supplied is $40 billion.arrow_forward1arrow_forward

- Where does the demand for loanable funds come from in a closed economy? How does a government adopting a policy of taxing investment from the private sector impact the demand for loanable funds? What happens to the equilibrium interest rate following this policy? Illustrate using the supply and demand in the market for loanable funds.arrow_forward66arrow_forward14) What could explain what is happening in the graph to the right? a. The government has given investors an investment tax credit, increasing investors appetite for savings. b. The government has removed the tax protected status of IRA accounts, increasing savings. c. The government balances the interest rate Το r1 Eo E1 So $1 budget reducing its debt, and the "crowding out" effect disappears. business desire to obtain funds. 90 91 quantity of loanable funds d. A new technology makes industry much more productive, therefore increasing e. There are many things that could explain what the graph shows us, but we don't have enough information to decide on any of a. thru d. above.arrow_forward

- C wrongarrow_forwardSuppose that the demand for laonable funds for car in the Milwaukee area is $11million per month at an interest rate of 10 percent per year, $12million at an interest rate of 9 percent per year, $13million at an interest rate of 8 percent per year and so on. a. If the supply of loanable funds is fixed at $17million, what will be the equilibrium interest rate? b. If the government imposes a usury law and says that car loans cannot exceed 3 percent per year, how big will the monthly shortage (or excess demand) for car loans be? c. How big will the monthly shortage for car loans be if the usury limit is raised to 7 percent per year?arrow_forward4.5arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education