ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

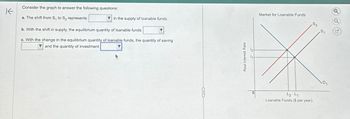

Consider the graph to answer the following questions:

a. The shift from S, to S₂ represents

in the supply of loanable funds.

b. With the shift in supply, the equilibrium quantity of loanable funds

c. With the change in the equilibrium quantity of loanable funds, the quantity of saving

and the quantity of investment

▼

C

Real Interest Rate

Market for Loanable Funds

L241

Loanable Funds ($ per year)

S2

S1

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Michael works in communications. On December 31, 2017, he bought an existing business with servers and a building worth $300,000. During 2018, he bought new servers for $500,000. The market value of his older servers fell by $200,000. What was Michael's gross investment during 2018?arrow_forwardIn the loanable funds market, if firms become more optimistic about future profitability, then the a demand for loanable funds will increase, interest rates will increase, and private sector investment spending will increase. b demand for loanable funds will decrease, interest rates will decrease, and the equilibrium quantity of borrowing will decrease. c supply of loanable funds will increase, interest rates will decrease, and the equilibrium quantity of borrowing will increase. d supply of loanable funds will increase, interest rates will increase, and private sector investment spending will increase.arrow_forward9arrow_forward

- Suppose that the government changes the tax code to allow additional amounts of money to be placed in 401(k) retirement accounts, increasing the extent to which people can delay their tax obligations. Show the effect by shifting the appropriate curve in the market for loanable funds. What are the new equilibrium real interest rate and the quantity of loanable funds? 5.0 4.5 4.0 3.5 3.0 Supply Real interest rate: Interest rate 2.5 2.0 1.5 1.0 0.5 0.0 0 20 40 40 % Loanable funds: $ Demand 60 80 100 120 Loanable funds (millions) 140 160 180 200 millionarrow_forwardQUESTION 9 Use the following diagram to answer this question The accompanying graph shows the market for loanable funds in equilibrium. Interest rate (%) 12 10 8 6 4 0 XH 2 3 E 4 6 5 Quantity of loanable funds (trillions of dollars) S Which of the following might produce a new equilibrium interest rate of 2% and a new equilibrium quantity of loanable funds of $5 trillion? OA. Firms become pessimistic about the future and, as a result, they cut back on their plans to buy new equipment and build new factories. ⒸB. Congress decreases the tax rate on interest income. C. Capital inflows from foreign citizens are declining. D. The U.S. government offers a tax credit for firms that built new factories in the U.S.arrow_forwardShow the effect on the real interest rate and equilibrium quantity of loanable funds of a decrease in the demand for loanable funds and a smaller decrease in the supply of loanable funds. Draw a demand for loanable funds curve. Label it DLF0. Draw a supply of loanable funds curve. Label it SLF0. Draw a point at the equilibrium real interest rate and quantity of loanable funds. Label it 1. Draw a curve that shows a decrease in the demand for loanable funds. Label it DLF1. Draw a curve that shows a smaller decrease in the supply of loanable funds. Label it SLF1. Draw a point at the new equilibrium real interest rate and quantity of loanable funds. Label it 2.arrow_forward

- Indicate the Quantity demanded and Quantity supplied of loanable funds if the Interest rates increases by 2% (from the equilibrium rate). would changed in interest rate cause a movement along the curve or shift? Interest rate 24% 22 20 ' 18 16 14 12 10 a 6 4 2 Y S ° $200 $400 600 D 800 1,000 1,200 Quantity of leanable funds (billions of dollars) Indicate the Quantity demanded and Quantity supplied of loanable funds if the Interest rates increases by 2% (from the equilibrium rate). would changed in interest rate cause a movement along the curve or shift?arrow_forward1arrow_forwardSuppose there are two types of investment in the economy: business fixed investment and residential investment. Suppose that loanable fund market is in equilibrium and the government grants an investment tax credit only for business investment. How does this policy affect the supply and demand for loanable funds, the equilibrium interest rate and equilibrium quantity of loanable funds? Use graph to explain your answer.arrow_forward

- 8arrow_forwardplease answer part 3arrow_forwardThis figure shows the loanable funds market for a closed economy. INTEREST RATE (Percent) 09 2 E с 50 100 150 LOANABLE FUNDS (Dollars) D₂ o Refer to Figure 26-4. Starting at point A, the enactment of an investment tax credit would likely cause the quantity of loanable funds traded to increase to $150 and the interest rate to rise to 6% (point C). decrease to $50 and the interest rate to fall to 2% (point B). decrease to $50 and the interest rate to rise to 6% (point E). increase to $150 and the interest rate to fall to 2% (point D).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education