Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

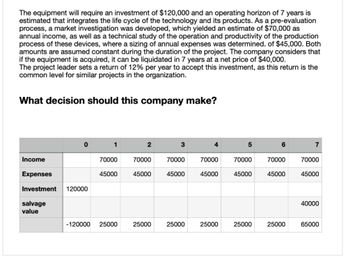

Transcribed Image Text:The equipment will require an investment of $120,000 and an operating horizon of 7 years is

estimated that integrates the life cycle of the technology and its products. As a pre-evaluation

process, a market investigation was developed, which yielded an estimate of $70,000 as

annual income, as well as a technical study of the operation and productivity of the production

process of these devices, where a sizing of annual expenses was determined. of $45,000. Both

amounts are assumed constant during the duration of the project. The company considers that

if the equipment is acquired, it can be liquidated in 7 years at a net price of $40,000.

The project leader sets a return of 12% per year to accept this investment, as this return is the

common level for similar projects in the organization.

What decision should this company make?

Income

0

Expenses

Investment 120000

salvage

value

1

70000

45000

-120000 25000

2

70000

45000

25000

3

70000

45000

25000

70000

45000

25000

5

70000

45000

25000

6

70000

45000

25000

7

70000

45000

40000

65000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- An investment project will involve spending $300,000 at time zero and $450,000 at the end of year one. These investments will generate gross revenues of $420,000 at the end of year one and $660,000 at the end of each year two through eight. A royalty of $42,000 in year one and $66,000 in year two through eight will be incurred along with operating costs of $250,000 in year one and $350,000 at the end of each year two through eight.Calculate the project before-tax cash flow for each year.arrow_forwardThe Chief Operations Officer (COO) of a manufacturing firm recommends one of the manufacturing sites to undergo a process improvement initiative. He claims that this project will enable the company to realize a net savings of at least $3.25 Mln. The Chief Financial Officer (CFO) of the company tasked you to conduct a financial analysis to verify the claims of the COO. After performing cost analysis, you estimated that the project will require an initial investment of $2 Mln today and $1 Mln in Year 1. Afterwards, the initiative will yield an annual cost savings of $850k from Year 2 to Year 10. You assume that these cost savings are realized at the end of each year. (a) Suppose that you use a discount rate of 5%. Will the resulting net savings support the claim of the COO? (b) Determine the Internal Rate of Return (IRR) of the process improvement initiative. (c) Show the NPV profile of the project.arrow_forwardThe manager of the West Division of Beach Clothing Company is evaluating the acquisition of a new embroidery machine. The budgeted operating income of the West Division was $4,000,000 with total assets of $22, 000, 000 and noninterest - bearing current liabilities of $1,000,000. The proposed investment would add $750,000 to operating income and would require an additional investment of $3,500,000. The targeted rate of return for the West Division is 14 percent and the cost of capital is 9 percent. Ignoring taxes, how much is the residual income of the West division if the embroidery machine is purchased?arrow_forward

- The manager of an electronics manufacturing plant was asked to approve the purchase of a surface mount placement (SMP) machine having an initial cost of $500,000 in order to reduce annual operating and maintenance costs by $92,500 per year. At the end of the 10-year planning horizon, it was estimated that the SMP machine would be worth $50,000. Using a 10% MARR and internal rate of return analysis, should the investment be made?arrow_forwardInstructions An evaluation is needed for a sock production project that requires an initial investment of $50,000,000°, of which 80% corresponds to depreciable fixed assets, and 20% to working capital. The unit production cost is $10,000°°, and a unit sale value of $13,500°° is estimated. The market study revealed a potential demand of 20,000 units for the first year. The fixed assets are depreciated straight-line over a useful life of 10 years. Operational expenses are estimated at $4,000,000° for the first year. The fixed costs amount to $10,000,000° for the first year. The following increments are estimated: sales increase by 2% annually, variable unit cost by 3% annually, unit sale price by 3% annually, operational expenses by 6% annually, and fixed costs by 5% annually. The project has a useful life of 5 years. 1. Build the project's cash flow. 2. Calculate the Internal Rate of Return (IRR) and determine if the project is profitable or not, considering an opportunity rate of…arrow_forwardInformation for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $130,900. Project 2 requires an initial investment of $97,200. Assume the company requires a 10% rate of return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income Project 1 Years 1-7 Initial investment Net present value Compute the net present value of each potential investment. Use 7 years for Project 1 and 5 years for Project 2. (Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.) Net Cash Flows X Answer is complete but not entirely correct. Present Value of Annuity at 10% 26,460 X Project 1 $ 105,300 X 70,200…arrow_forward

- Two techniques can be used to produce expansion anchors. Technique A costs $90,000 initially and will have a $12,000 salvage value after 3 years. The operating cost with this method will be $33,000 in year 1, increasing by $2600 each year. Technique B will have a first cost of $113,000, an operating cost of $7000 in year 1, increasing by $7000 each year,and a $43,000 salvage value after its 3-year life. At an interest rate of 13% per year, which technique should be used on the basis of a present worth analysis? Notice that there are no revenues. Please work out and do not use excel, however if you use excel please show how to input everything needed down to the formula, thank you!arrow_forwardAn interest rate of 15% is used to evaluate a new system that has a first cost of $212,400, annual operating and maintenance costs of $41,200, annual savings of $94,600, a life of 6 years, and a salvage value of $32,500. After initial evaluation, the firm receives word from the vendor that the first cost is 5% higher than originally quoted. The percentage error in the system' s present worth from this is closest to what value? (a) 5% (b) 15% (c) 100% (d) 300%arrow_forwardA new solid waste treatment plant is to be constructed in Washington County. The initial installation will cost $30 million (M). After 10 years, minor repair and renovation (R&R) will occur at a cost of $14M will be required; after 20 years, a major R&R costing $18M will be required. The investment pattern will repeat every 20 years. Each year during the 20-year period, operating and maintenance (O&M) costs will occur. The first year, O&M costs will total $3M. Thereafter, O&M costs will increase at a compound rate of 6% per year. Based on a 6% MARR, what is the capitalized cost for the solid waste treatment plant? Click here to access the TVM Factor Table calculator. Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±25,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education