Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

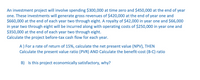

Transcribed Image Text:An investment project will involve spending $300,000 at time zero and $450,000 at the end of year

one. These investments will generate gross revenues of $420,000 at the end of year one and

$660,000 at the end of each year two through eight. A royalty of $42,000 in year one and $66,000

in year two through eight will be incurred along with operating costs of $250,000 in year one and

$350,000 at the end of each year two through eight.

Calculate the project before-tax cash flow for each year.

A) For a rate of return of 15%, calculate the net present value (NPV), THEN

Calculate the present value ratio (PVR) AND Calculate the benefit-cost (B-C) ratio

B) Is this project economically satisfactory, why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If the net present value of a project is zero based on a discount rate of 16%, then the internal rate of return is: Select one: O a. equal to 16% O b. greater than 16% O c. less than 16% O d. cannot be determined from this dataarrow_forwardA2. (PaybackandNPV)Threeprojectshavethecashflowsgivenhere.Thecostofcapitalis10%. a. Calculate the paybacks for all three projects. Rank the projects from best to worst based on their paybacks. Calculate the NPVs for all three projects. Rank the projects from best to worst based on their NPVs c. Why are these two sets of rankings different? YEAR 0 1 2 3 4 5Project 1 −10 4 3 2 1 5 Project 2 −10 1 2 3 4 5 Project 3 −10 4 3 2 1 10arrow_forwarde. IMPORTANT Note that from this example that a higher IRR for a nindividual alternative does not gurantee that the alternatvie is more economical than the one with a lower IRR. It is the incremental IRR value relative to the MARR that determines which alternative is more economical. The result of the incremental analysis are always the same as those of the PW,AW, or FW anaylsisarrow_forward

- Use these data to compute for each (a) the NPV at discount rates of 10 and 5 percent, (b) the BCR at the same rates, and (c) the internal rate of return for each. Describe the facts about the projects that would dictate which criterion is appropriate, and indicate which project is preferable under each circumstance.arrow_forwardQ1) How much is the Profitability Index? Q2) What is the Discounted Payback period of the project? Q3) What is the NPV of the Project?arrow_forwardJust need b-1, d-1, and e-1 answered.arrow_forward

- Project Analysis. Assume that you are evaluating the following three mutually exclusive projects: A. Complete the following analyses. (For the last two lines, Terminal Value, please write in the dollar amount of the terminal value.) B. Compare and explain the conflicting rankings of the NPVs and TRRs versus the IRRs. C. Using different discount rates, is it possible to get different rankings within the NPV calculation? Why or why not? D. If 10 percent is the required return, which project is preferred? E. Which is the fairer representation of these two projects, TRR or IRR? Why?arrow_forwardQUANTITATIVE. Fill in the following statements based on the below project financial analysis. a. The Net Present Value is b. The Return on Investment is c. The project will break even (make back its costs) in Year d. This project Created by: Praju Manageski Note: Change the inputs, such as discount rate, number of years, costs, and benefits. Be sure to Discount rate Costs Discount factor Discounted costs Benefits Discount factor Discounted benefits profitable because the ROI and NPV are both Financial Analysis for Project GGU Assume the project is completed in Year 0 Discounted benefits -costs Cumulative benefits - costs ROI 5% 10,000 1.00 10,000 0 1.00 0 (10,000) (10,000) 16% 0 0.95 2,000 0.95 1,905 Year 0 0.91 5000 0.91 4,535 1,905 4,535 (8,095) (3,560) 0 0.86 . 6000 0.86 5,183 5,183 1,623 10,000 11,623 1,623 NPVarrow_forward46. Clayton Industries is planning its operations for next year. Ronnie Clayton, the CEO, wants you to forecast the firm's additional funds needed (AFN). Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? Dollars are in millions.Last year's sales = S0 $350 Sales growth rate = g 30% Last year's total assets = A*0 $580 Last year's profit margin = M 5% Last year's accounts payable $40 Last year's notes payable $50 $500 Last year's accruals $30 Target payout ratio 60%a. $139.6b. $130.9c. $143.9d. $120.9arrow_forward

- Thank you for calculating the IRR. Could you also answer the question "If the required return is 11 percent, should the firm accept the following project?". An explanation would also be extremely helpful. Thank you!arrow_forwardGiven mutually exclusive projects, which project should be selected given the MARR - 9%? Note that the actual rate of return for each of the project is greater than or equal to the MARR. The notation shows the project with the higher first cost minus the project with the lower first cost. (i.e. Ain-A = 8.2%neans that Project B has the higher first cost). The projects in order of smallest to largest first costs are Project A, then Project B and lastly Project C. Ain-A = 8.2% Aic-A = 10.1% Aie u = 10.5% O Project A O Project 8 O Project Carrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education