Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

s

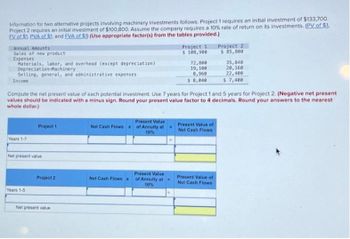

Transcribed Image Text:Information for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $133,700.

Project 2 requires an initial investment of $100,800. Assume the company requires a 10% rate of return on its investments. (PV of $1.

EV of $1. PVA of $1. and EVA of $1) (Use appropriate factor(s) from the tables provided.)

Annual Amounts

Sales of new product

Expenses

Materials, labor, and overhead (except depreciation)

Depreciation-Machinery

Selling, general, and administrative expenses

Income

Years 1-7

Project 1

Net present value

Years 1-5

Compute the net present value of each potential investment. Use 7 years for Project 1 and 5 years for Project 2. (Negative net present

values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest

whole dollar.)

Project 2

Net present value

Net Cash Flows

Net Cash Flows x

Present Value

of Annuity at

10%

Project 1

$ 108,900

Present Value

of Annuity at

10%

72,800

19,100

8,960

$ 8,040

Present Value of

Net Cash Flows

Project 2

$ 85,800

Present Value of

Net Cash Flows

35,840

20,160

22,400

$ 7,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is APR?arrow_forwardCan you answer part E of this quarrow_forwardWord Problem 10-23 (Algo) [LU 10-3 (1)] Max Wholesaler borrowed $4,500 on a 11%, 120-day note. After 45 days, Max paid $1,575 on the note. Thirty days later, Max paid an additional $1,350. Use ordinary interest. a. Determine the total interest using the U.S. Rule. Note: Round your intermediate balances and interest amounts to the nearest cent. Round your final answer to the nearest cent. Total interest amount b. Determine the ending balance due using the U.S. Rule. Note: Round your intermediate balances and interest amounts to the nearest cent. Round your final answer to the nearest cent. Ending balance duearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education