Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

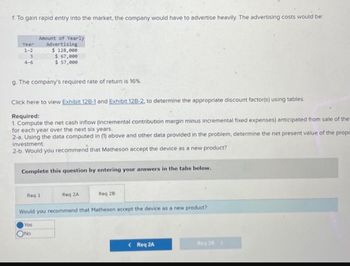

Transcribed Image Text:f. To gain rapid entry into the market, the company would have to advertise heavily. The advertising costs would be:

Year

1-2

3

4-6

Amount of Yearly

Advertising

g. The company's required rate of return is 16%.

$ 128,000

$ 67,000

$ 57,000

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

Required:

1. Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the

for each year over the next six years.

2-a. Using the data computed in (1) above and other data provided in the problem, determine the net present value of the propc

investment.

2-b. Would you recommend that Matheson accept the device as a new product?

Complete this question by entering your answers in the tabs below.

Req 1

ONO

Req 2A

Req 28

Would you recommend that Matheson accept the device as a new product?

Yes

< Req 2A

Req 28 >

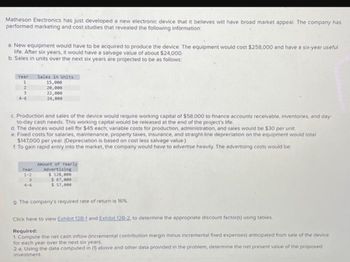

Transcribed Image Text:Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has

performed marketing and cost studies that revealed the following information:

a. New equipment would have to be acquired to produce the device. The equipment would cost $258,000 and have a six-year useful

life. After six years, it would have a salvage value of about $24,000.

b. Sales in units over the next six years are projected to be as follows:

Year

1

2

3

4-6

Sales in Units

15,000

20,000

22,000

24,000

c. Production and sales of the device would require working capital of $58,000 to finance accounts receivable, inventories, and day-

to-day cash needs. This working capital would be released at the end of the project's life.

d. The devices would sell for $45 each; variable costs for production, administration, and sales would be $30 per unit.

e. Fixed costs for salaries, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total

$147,000 per year. (Depreciation is based on cost less salvage value.)

f. To gain rapid entry into the market, the company would have to advertise heavily. The advertising costs would be:

Year

1-2

3

4-6

Amount of Yearly

Advertising

$ 128,000

$ 67,000

$ 57,000

g. The company's required rate of return is 16%.

Click here to view Exhibit 128-1 and Exhibit 128-2, to determine the appropriate discount factor(s) using tables.

Required:

1. Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device

for each year over the next six years,

2-a. Using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed

investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- The financial manager of Tepung Berhad, Encik Danial, is considering a project which requiresan investment of RM53,000 in a machine. This machine in which will improve the performanceand production quantities of the company’s range of biscuits. At the end of the five-year period,this machine will be scrapped.Encik Danial expects that this project will lead to increased sales for the next five years as follows:Year Sales (‘000 units)1 8002 9003 1,0004 1,1005 1,200The selling price per unit is RM20. Labor and utilities costs are estimated to be RM8 and RM4 perunit respectively. The project requires an increase in net working capital of RM10,000 in the initialyear and will be fully recovered at the end of the project. The company’s required return oninvestment of 15%.Encik Danial thinks that the unit sales, selling price, labor, and utilities cost projections areaccurate to within 15%.Note: The calculation on depreciation, fixed cost and the effect on tax is ignored for this question.…arrow_forwardLukow Products is investigating the purchase of a piece of automated equipment that will save $150,000 each year in direct labor and inventory carrying costs. This equipment costs $800,000 and is expected to have a 5-year useful life with no salvage value. The company’s required rate of return is 12% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. What minimum dollar value per year must be provided by the equipment’s intangible benefits to justify the $800,000 investment? (Do not round intermediate…arrow_forwardvaibhavarrow_forward

- TopCap Co. is evaluating the purchase of another sewing machine that will be used to manufacture sport caps. The invoice price of the machine is $123,000. In addition, delivery and installation costs will total $5,500. The machine has the capacity to produce 12,000 dozen caps per year. Sales are forecast to increase gradually, and production volumes for each of the five years of the machine's life are expected to be as follows: Use Table 6-4. (Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.) 2019 3,600 dozen 2020 5,600 dozen 2021 8,500 dozen 2022 11,300 dozen 2023 12,000 dozen The caps have a contribution margin of $8.00 per dozen. Fixed costs associated with the additional production (other than depreciation expense) will be negligible. Salvage value and the investment in working capital should be ignored. TopCap Co.'s cost of capital for this capacity expansion has been set at 14%. Required: The caps have a…arrow_forwardLukow Products is investigating the purchase of a piece of automated equipment that will save $130,000 each year in direct labor and inventory carrying costs. This equipment costs $780,000 and is expected to have a 6-year useful life with no salvage value. The company's required rate of return is 10% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? Note: Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount. 2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $780,000 investment? Note: Do not round…arrow_forwardA marketing company intends to 0 distribute a new product. It is expected to produce net returns of $17,000 per year for the first four yoars and $13,000 per year for the following throe yoars Tha faciltios roquirodto distribute the product will cost $70,000 with a disposal value of $9,000 after seven years. The facilities will require a major facelift costing $10,000 each after three years and after five years. If the companyrequires a return on investment of 10%, should the company distribute the new product?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education