Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

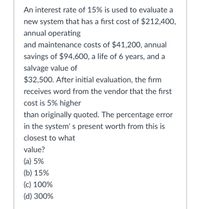

Transcribed Image Text:An interest rate of 15% is used to evaluate a

new system that has a first cost of $212,400,

annual operating

and maintenance costs of $41,200, annual

savings of $94,600, a life of 6 years, and a

salvage value of

$32,500. After initial evaluation, the firm

receives word from the vendor that the first

cost is 5% higher

than originally quoted. The percentage error

in the system' s present worth from this is

closest to what

value?

(a) 5%

(b) 15%

(c) 100%

(d) 300%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- GeoWorld Systems uses a subset of the following questions during the interview process for new engineers. For each of the following cases, determine if “the project” or “do nothing” is preferred. The value of MARR in each case is 14%.arrow_forwardFactor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $495,000 cost with an expected four-year life and a $10,000 salvage value. Additional annual information for this new product line follows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Required: 1. Determine income and net cash flow for each year of this machine's life. $ 1,960,000 1,502,000 121,250 167,000 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 8%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine income and net cash flow for each year of this machine's…arrow_forwardAn interest rate of 15% is used to evaluate a new system that has a first cost of $212,400, annual operating and maintenance costs of $41,200, annual savings of $94,600, a life of 6 years, and a salvage value of $32,500. After initial evaluation, the firm receives word from the vendor that the first cost is 5% higher than originally quoted. The percentage error in the system’s present worth from this is closest to what value? (a) 5% (b) 15% (c) 100% (d) 300%arrow_forward

- Compare two alternatives, 1 and 2, on the basis of a present worth evaluation using 10% per year and a study period of 8 years. Alternative First Cost Annual Operating Cost Overhaul in Year 4 Salvage Value Life Answer to the nearest whole dollars for currency, and the nearest percentage (no decimals) for interest, and a whole number for the number of years. Do NOT enter commas. DO enter minus signs for negative values. 1) What is the Present Worth of Project 1? $ 1 2 ($13,000) ($49,000) ($6,000) ($5,000) $0 ($3,350) $1,800 $6,800 4 years 8 yearsarrow_forwardThe production department is proposing the purchase ONE automatic insertion machine. It has identified three machines (A, B and C). Each machine has an estimated useful life of 10 years. minimum desired rate of return of 10%. The accountant has identified the following data: Machine A Machine B Machine C Present value of future cash flows computed using 10% rate of return $305,000 $295,000 $300,500 Amount of initial investment 300,000 300,000 300,000 Based on net present value method, which machine do you recommend?arrow_forwardif a company is considering buying a system that costs 450,000 with an estimated 10-year life and a salvage value of 70,000, the estimated operating results with the new machine are, incremental revenue = 180,000, incremental expenses = 123,000 which is made up by, expenses other than depreciation = 85,000, depreciation (straight-line basis) = 38,000, and incremental income = 57,000, and all revenue and expenses other than depreciation use cash, how do I find the annual net cash flow, time of the payback period, return on investment percentage, and the Net present value, discounted at an annual rate of 6% (present value of $1 due in 10 years, discounted at 6%, is 0.558; present value of $1 received annually for 10 years, discounted at 6%, is 7.360)?arrow_forward

- Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $491,000 cost with an expected four-year life and a $20,000 salvage value. Additional annual information for this new product line follows. (PV of $1. EV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided.) Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Required: 1. Determine income and net cash flow for each year of this machine's life. 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 7%. $ 1,990,000 1,509,000 117,750 162,000 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute net present value…arrow_forward1. Determine the NPV of the new computer system (use 3 decimal places for the PV factor)arrow_forwardThe manager of an electronics manufacturing plant was asked to approve the purchase of a surface mount placement (SMP) machine having an initial cost of $500,000 in order to reduce annual operating and maintenance costs by $92,500 per year. At the end of the 10-year planning horizon, it was estimated that the SMP machine would be worth $50,000. Using a 10% MARR and internal rate of return analysis, should the investment be made?arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardFind the expected EUAW from the financial data provided in the table for new equipment. Because of the uncertainty of technology being used in this equipment, it has not been possible to get the initial cost accurately. The annual benefit, however, is estimated to be $25,000 with a possible equipment life of 5 years. The salvage value is expected to be 10% of the initial cost. MARR = 8%. First Cost, $ $60,000 $80,000 $100,000 $120,000 Probability 0.25 0.35 0.30 0.10 Choices: A. $3957 B. $2977 C. $4628 D. $5157 Determine the associated risk measure in this equipment investmest in terms of standard deviation. A. $6,123 B. $4437.80 C. $8,523 D. $4,923arrow_forwardеВook You must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is $270,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after 3 years for $49,000. The equipment would require a $12,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $20,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. a. What is the initial investment outlay for the spectrometer after bonus depreciation is considered, that is, what is the Year 0 project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar. b. What are the project's annual cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year 1: $ Year 2: $ Year 3: $ c. If the WACC is 12%,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education