The display cupboards require two direct materials: oak shelving wood and hickory

plywood backing board.

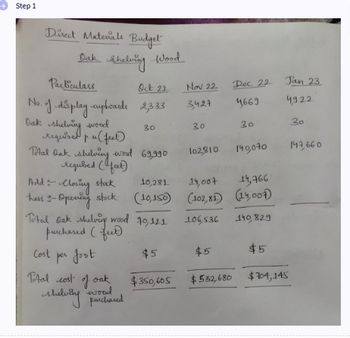

Oak shelving wood:

Thirty (30) feet of 12x1 oak shelving wood are required for each cupboard produced.

Management desires to have materials on hand at the end of each month equal to 10

percent of the following month's cupboard production needs. The beginning

inventory of oak wood, October 2022, was 10,150 feet of wood. Oak wood is

expected to cost $5.00 per foot.

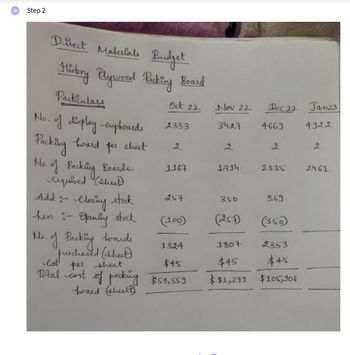

Hickory plywood backing board:

Hickory plywood backing board is purchased by the sheet and 2 backing boards can

be cut from each sheet. Management desires to have plywood on hand at the end of

each month equal to 15 percent of the following month's production needs. The

beginning inventory of plywood, October 2022, was 100 sheets. Hickory plywood is

expected to cost $45 per sheet. (Note, budgeted production in January is required in

order to complete the direct materials budget for December. Also, use the @ROUND

function to round up to the nearest whole number the number of sheets of plywood

to purchase – “DM quantities to purchase”).

!!QUESTION: CAN SOMEONE PLEASE BREAK DOWN THE CALCULATIONS FOR THESE DIRECT MATERIALS BUDGETS?

Step by stepSolved in 2 steps

- Sheffield, Inc. is planning to produce 2,560 units of product in 2022. Each unit requires 3 pounds of materials at $6 per pound and a half hour of labor at $16 per hour. The overhead rate is 75% of direct labor. (a) Your answer has been saved. See score details after the due date. Compute the budgeted amounts for 2022 for direct materials to be used, direct labor, and applied overhead. Direct Materials $ (b) Direct Labor Overhead Standard Cost Save for Later $ $ $ 46080 Compute the standard cost of one unit of product. (Round answer to 2 decimal places, e.g. 52.75.) 20480 15360 Attempts: 1 of 1 used Attempts: 0 of 1 used Submit Answerarrow_forwardWhispering Winds Company has developed the following standard costs for its product for 2022: WHISPERING WINDSCOMPANY Standard Cost Card Product A Cost Component Standard Quantity Standard Price Standard Cost Direct materials 4 pounds $3 $12 Direct labor 3 hours 8. 24 Manufacturing overhead 3 hours 4 12 $48 The company expected to produce 31,700 units of Product A in 2022 using 95,900 direct labor hours. Actual results for 2022 are as follows: 33,000 units of Product A were produced. Actual direct labor costs were $794,580 for 96,900 direct labor hours worked. Actual direct materials purchased and used during the year cost $369,875 for 134,500 pounds. Actual variable overhead incurred was $165,000 and actual fixed overhead incurred was $220,000. Compute the following variances showing all computations to support your answers. Indicate whether the variances are unfavorable. Compute the following variances showing all computations to support your answers. Indicate whether the variances…arrow_forwardUse the information below for Mandy Corporation to answer the question that follow. Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 696,000 units, estimated beginning inventory is 106,000 units, and desired ending inventory is 89,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below.Material A: 0.50 lb. per unit @ $0.71 per poundMaterial B: 1.00 lb. per unit @ $1.89 per poundMaterial C: 1.20 lb. per unit @ $0.84 per poundThe dollar amount of Material B used in production during the year isarrow_forward

- Suppose a company has 1,000 units of a raw material part on hand. If 750 of these units are routed into production, should the company place an order to stock up on more of these parts? (Show calculations). Determine the economic order quantity (EOQ) for this part, assuming the following:The company plans to use 10,000 units during the coming year.The company orders this part in lots of 1,000 units, and each order placed carries a processing cost of $2.50.Each unit of inventory carries an annual holding cost of $6.40.arrow_forwardHelp pleasearrow_forwardFriday Night, Inc. manufactures high-quality 5-liter boxes of wine which It sells for $14 per box. Below is some information related to Friday Night's capacity and budgeted foed marufacturing costs for 2021; Denominator Level Capacity Concept Days of Hours of Fixed Manufacturing Production ProductionBoxes per Overhead per Period per Perlod per Day Hour Theoretical capacity Practical capacity Normal capacity Master budget capacity $2,500,000 $2.500.000 $2,500.000 $2.500,000 22 300 362 310 310 310 16 250 175 16 16 200 Production during 2021 was 990,000 boxes of wine, with 15,000 remaining in ending inventory at 12/31/21. Actual varlable manufacturing costs were $1,762,200 (there are no varlable cost variances). Actual foed manufacturing overhead costs were $2.500.000. Fixed manufacturing overhead cost variances are written off to cost of goods sold in the period in which they occur. What is gross margin under practical capacity? Hint: don't forget the production-volume variance…arrow_forward

- Leeds Corp. produces product BR500. Shamokin expects to sell 10,000 units of BR500 and to have an ending finished inventory of 2,000 units. Currently, it has a beginning finished inventory of 800 units. Each unit of BR500 requires two labor operations, one labor hour of assembling and two labor hours of polishing. The direct labor rate for assembling is $10 per assembling hour and the direct labor rate for polishing is $12.50 per polishing hour. The expected number of hours of direct labor for BR500 for this period are O 8,800 hours of assembling; 17,600 hours of polishing O 11,200 hours of assembling: 22,400 hours of polishing 17,600 hours of assembling: 8,800 hours of polishing O 22,400 hours of assembling: 11,200 hours of polishingarrow_forwardManajiarrow_forwardCeder Company has compiled the following data for the upcoming year: Sales are expected to be 16,000 units at $52 each. Each unit requires 4 pounds of direct materials at $2.40 per pound. Each unit requires 2.1 hours of direct labor at $13 per hour. Manufacturing overhead is $4.90 per unit. Beginning direct materials inventory is $5,400. Ending direct materials inventory is $6,950. Selling and administrative costs totaled $138,720. Determine Ceder's budgeted cost of goods sold. Complete Ceder's budgeted income statement.arrow_forward

- Coronado Industries determines that 63000 pounds of direct materials are needed for production in July. There are 4200 pounds of direct materials on hand at July 1 and the desired ending inventory is 3600 pounds. If the cost per unit of direct materials is $3, what is the budgeted total cost of direct materials purchases? O 183600. O 190800. O 187200. O 194400.arrow_forwardOak Industrial has estimated that production for the next five quarters will be:. Production Information 1st quarter, 2020 44,100 units 2nd quarter, 2020 40,000 units 3rd quarter, 2020 48,200 units 4th quarter, 2020 37,600 units 1st quarter, 2021 45,700 units Finished units of production require 6 pounds of raw material per unit. The raw material cost is $7 per pound. There is $277,830 of raw material on hand at the beginning of the first quarter, 2020. Oak desires to have 15 percent of next quarter's material requirements on hand at the end of each quarter.Prepare quarterly direct materials purchases budgets for Oak Industrial for 2020.arrow_forwardUse the information below for Mandy Corporation to answer the question that follow. Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 643,000 units, estimated beginning inventory is 105,000 units, and desired ending inventory is 84,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below.Material A: 0.50 lb. per unit @ $0.61 per poundMaterial B: 1.00 lb. per unit @ $2.37 per poundMaterial C: 1.20 lb. per unit @ $0.86 per poundThe dollar amount of Material C used in production during the year is a.$577,714 b.$770,285 c.$706,094 d.$641,904arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education