College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:es

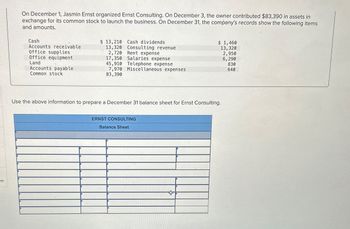

On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $83,390 in assets in

exchange for its common stock to launch the business. On December 31, the company's records show the following items

and amounts.

Cash

$ 13,210

Cash dividends

Accounts receivable

13,320

Consulting revenue

Office supplies

2,720

Rent expense

Office equipment

Land

17,350

Salaries expense

45,910 Telephone expense

Accounts payable

Common stock

7,970 Miscellaneous expenses

83,390

$ 1,460

13,320

2,950

6,290

830

640

Use the above information to prepare a December 31 balance sheet for Ernst Consulting.

ERNST CONSULTING

Balance Sheet

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please need answer the general accounting questionarrow_forwardRodgers Company compiled the following financial information as of December 31, 20XX:Sales revenue $1,120,000Common stock 240,000Buildings 320,000Operating expenses 1,000,000Cash 280,000Dividends 80,000Inventory 40,000Accounts payable 160,000Accounts receivable 120,000Retained earnings, 1/1/20XX 600,000Rodger’s assets on December 31, 20XX area. $1,880,000.b. $1,360,000.c. $640,000.d. $760,000.arrow_forward1. Shown below are the account balances for Barnie Corp. for their year-end December 31, 2022: Cash $ 10,475 Accounts receivable 16,640 Inventory 98,220 Building 188,600 Accumulated amortization—building 72,600 Accounts payable 9,400 Income taxes payable 5,450 Common shares 154,525 Retained earnings, beginning 40,720 Dividends declared 7,500 Sales revenue 265,000 Cost of goods sold 143,600 Salaries and wages expense 56,900 Amortization expense 12,850 Utilities expense 3,300 Supplies expense 1,970 Income taxes expense 7,640 Required: prepare the: i) the income statement, ii) the statement of retained earnings, and iii) the classified balance sheet for Barnie Corporation.arrow_forward

- On June 1, Cline Co. paid $800,000 cash for all of the issued and outstanding common stock of Renn Corp. The carrying amounts for Renn’s assets and liabilities on June 1 follow:Cash . . . . . . . . . . . . . . . . . . $150,000 Accounts receivable . . . . . . . . .180,000Capitalized software costs . . . 320,000Goodwill . . . . . . . . . . . . . . . . . 100,000Liabilities . . . . . . . . . . . . .. . . (130,000)Net assets . . . . . . . . . . . . .. . $620,000 On June 1, Renn’s accounts receivable had a fair value of $140,000. Additionally, Renn’s in-process research and development was estimated to have a fair value of $200,000. All other items were stated at their fair values. On Cline’s June 1 consolidated balance sheet, how much is reported for goodwill?arrow_forwardSubject- accountingarrow_forwardFreiman Corporation's most recent balance sheet and income statement appear below: Balance Sheet December 31, Year 2 and Year 1 (in thousands of dollars) Year 2 Year 1 Assets Current assets: Cash $ 170 $ 130 Accounts receivable, net 245 265 Inventory 130 140 Prepaid expenses 45 45 Total current assets 590 580 Plant and equipment, net 750 750 Total assets $ 1,340 $ 1,330 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 140 $ 160 Accrued liabilities 95 95 Notes payable, short term 65 75 Total current liabilities 300 330 Bonds payable 295 305 Total liabilities 595 635 Stockholders' equity: Common stock, $2 par value 110 110 Additional paid-in capital 225 225 Retained earnings 410 360 Total stockholders' equity 745 695 Total liabilities & stockholders' equity $ 1,340 $ 1,330 Income Statement For the Year Ended December 31, Year 2 (in thousands of dollars) Sales (all…arrow_forward

- Hyrkas Corporation's most recent balance sheet and income statement appear below: Balance Sheet December 31, Year 2 and Year 1 (in thousands of dollars) Year 2 Year 1 Assets Current assets: Cash $ 210 $ 310 Accounts receivable, net 340 360 Inventory 310 280 Prepaid expenses 20 20 Total current assets 880 970 Plant and equipment, net 1,120 1,220 Total assets $ 2,000 $ 2,190 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 280 $ 310 Accrued liabilities 50 50 Notes payable, short term 40 40 Total current liabilities 370 400 Bonds payable 270 440 Total liabilities 640 840 Stockholders’ equity: Common stock, $2 par value 200 200 Additional paid-in capital 330 330 Retained earnings 830 820 Total stockholders’ equity 1,360 1,350 Total liabilities & stockholders’ equity $ 2,000 $ 2,190 Income Statement For the Year Ended December 31, Year 2 (in thousands of dollars)…arrow_forwardThe following data were taken from the comparative balance sheet of Osborn Sisters Company for the years ended December 31, 20Y9 and December 31, 20Y8: Dec. 31, 20Y9 Dec. 31, 20Y8 Cash $295,200 $218,900 Temporary investments 315,000 239,800 Accounts and notes receivable (net) 289,800 261,300 Inventories 405,000 324,000 Prepaid expenses 345,000 126,000 Total current assets $1,650,000 $1,170,000 Accounts payable $290,000 $315,000 Accrued liabilities 210,000 135,000 Total current liabilities $500,000 $450,000arrow_forwardOn June 1, Cline Co. paid $1,098,500 cash for all of the issued and outstanding common stock of Renn Corp. The carrying amounts for Renn’s assets and liabilities on June 1 follow: Cash $ 223,000 Accounts receivable 232,500 Capitalized software costs 362,000 Goodwill 182,000 Liabilities (137,000 ) Net assets $ 862,500 On June 1, Renn’s accounts receivable had a fair value of $189,000. Additionally, Renn’s in-process research and development was estimated to have a fair value of $288,000. All other items were stated at their fair values. On Cline’s June 1 consolidated balance sheet, how much is reported for goodwill?arrow_forward

- The following income statement and selected balance sheet account data are available for Treece, ties than for operating activities? Explain. Inc., at December 31, 2018. sh nod TREECE, INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2018 Revenue: - Net sales $2,850,000 - Dividend income 104,000 Interest income 70,000 Gain on sales of marketable securities 4,000 Total revenue and gains $3,028,000 Costs and expenses: - Cost of goods sold $1,550,000 Operating expenses 980,000 - Interest expense . 185,000 Income tax expense 90,000 Total costs and expenses 2,805,000 Net income $ 223,000 Beginning of Year End of Year Selected account balances: Accounts receivable 650,000 $ 720,000 Accrued interest receivable 9,000 6,000 Inventories ... 800,000 765,000 20,000 15,000 Short-term prepayments - Accounts payable (merchandise suppliers) Accrued operating expenses payable 570,000 562,000 65,000 94,000 21,000 12,000 Accrued interest payable 22,000 35,000 Accrued income taxes payablearrow_forwardFollowing are the income statement and balance sheet items for Faison Corporation from the company’s books and records at the end of fiscal year-end 20x1: ($ millions) Contributed capital $1,702 Cost of sales 13,567 Cash 1,393 Long-term liabilities 3,719 Accounts receivable 2,662 Other current assets 604 Other long-term assets 2,079 Other current liabilities 1,299 Other operating expenses 1,212 Other non-operating expenses 161 Inventory 1,093 Accounts payable 2,595 Property, net 3,216 Retained earnings 1,209 Sales 16,463 Tax expense 256 Equity income, net of tax 34 Other equity 523 Required: Using the information above, prepare the company’s year-end income statement and a balance sheet.arrow_forwardWaddle company had the following balances in its accounting records as of December 31st, year 1.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,