Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve the problem.

Do not use Ai

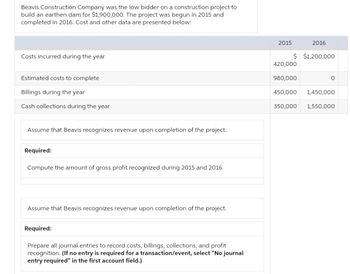

Transcribed Image Text:Beavis Construction Company was the low bidder on a construction project to

build an earthen dam for $1,900,000. The project was begun in 2015 and

completed in 2016. Cost and other data are presented below:

Costs incurred during the year

Estimated costs to complete

Billings during the year

Cash collections during the year

Assume that Beavis recognizes revenue upon completion of the project.

Required:

Compute the amount of gross profit recognized during 2015 and 2016.

Assume that Beavis recognizes revenue upon completion of the project.

Required:

Prepare all journal entries to record costs, billings, collections, and profit

recognition. (If no entry is required for a transaction/event, select "No journal

entry required" in the first account field.)

2015

2016

$ $1,200,000

420,000

980,000

0

450,000 1,450,000

350,000

1,550,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Heart, Inc. consistently uses the percentage of completion method of recognizing income. During 2018, Heart started work on a P3,000,000 fixed price project. The accounting records disclosed the following data for the year ended December 31, 2018: Costs incurred, P930,000; Estimated cost to complete, P2,170,000; Progress billings, P1,100,000; Collections, P700,000. How much is the balance of Construction in Progress account in 2018?arrow_forwardUsing the percentage-of-completion method and the cost-to-cost basis, prepare the journal entry to record progress billings of$1,638,800 during 2023. Using the percentage-of-completion method and the cost-st basis, prepare the journal entries to record the revenue andgross proft for 2023. Transcribed Image Text:Crane Corp. contracted to build a bridge for $4,820,000. Construction began in 2023 and was completed in 2024. Data relating to the construction are: 2023 2024 Costs incurred $1,561,680 $1,349,600 Estimated costs to complete 1,330,320 Using the percentage-of-completion method and the cost-to-cost basis, how much gross proft should be reported for 2024?arrow_forwardBlue Construction Company began work on a $979,000 construction contract in 2017. During 2017, Blue incurred costs of $402,000, billed its customer for $318,000, and collected $238,000. At December 31, 2017, the estimated future costs to complete the project total $630,000. Prepare Archer's journal entry to record profit or loss, if any, using (a) the percentage-of-completion method and (b) the completed-contract method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. Round percent value to 2 decimal places, eg. 52.75 and final answers to O decimal places, eg.5,275) Account Titles and Explanation Debit Credit (a) (b)arrow_forward

- In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Westgate recognizes revenue over time according to percentage of completion. Revenue Gross profit (loss) Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. Note: Do not round intermediate calculations. Loss amounts should be indicated with a minus sign. Answer is complete and correct. 2024 $ 2,400,000 5,600,000 2,000,000 1,800,000 2024 $ 3,000,000 $ $ 600,000 $ 2025 2026 4,500,000 $ 2,500,000 900,000 $ 300,000 2025 $ 3,600,000 2,000,000 4,000,000 3,600,000 2026 $ 2,200,000 0 4,000,000 4,600,000arrow_forwardCastro Construction signs a contract to build a hotel. The construction is scheduled to begin on January 1, 2016 and is estimated to take four years to complete. Castro expects that its total cost for this project would be $108 million and charges its client $151 million in total. Based on the given actual costs incurred, complete the following table showing the percentage of completion, revenue recognized and gross profit for each year. Assume the company uses the percentage-of-completion method for revenue recognition. Do not enter dollar signs or commas in the input boxes. Round all numbers to 1 decimal place. Costs Revenue Percentage of Completion Year Gross Profit* Incurred* Recognized* 2016 $12.96 % $ 2017 $28.08 % 2018 $36.72 2019 $30.24 Total $108.00 % *The numbers are in million dollars. %24 %24 %24 %24 %24 %24 %24 %24arrow_forwardDuring 2016, Green Love Company started a construction work with a contract price of $4,500,000,000. The work was completed in 2018. The following information is available on picture below. (a) Compute the application of the percentage of completion method on a cost to cost basis. (b) Calculate the amount of revenue and gross profit to be recognized annually using the percentage of completion and cost-recovery methods.arrow_forward

- (Analysis of Percentage-of-Completion Financial Statements) In 2017, Steinrotter Construction Corp. began construction work under a 3-year contract. The contract price was $1,000,000. Steinrotter uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of cost incurred to total estimated costs for completing the contract. The financial statement presentations relating to this contract at December 31, 2017, are shown below. Check the below image for financial statements : Instructions(a) How much cash was collected in 2017 on this contract?(b) What was the initial estimated total income before tax on this contract?arrow_forwardArcher Construction Company began work on a $420,000 construction contract in 2017. During 2017, Archer incurred costs of $278,000, billed its customer for $215,000, and collected $175,000. At December 31, 2017, the estimated additional costs to complete the project total $162,000. Prepare Archer’s journal entry to record profit or loss, if any, using (a) the percentage-of-completion method and (b) the completed-contract method.arrow_forwardroad was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Assume that Westgate Construction's contract with Santa Clara County does not qualify for revenue recognition over time. Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. 2-a. In the journal below, complete the necessary journal entries for the year 2024 (credit "Cash, Materials, etc." for construction costs incurred). 2-b. In the journal below, complete the necessary journal entries for the year 2025 (credit "Cash, Materials, etc." for construction costs incurred). Cost incurred during the year. Estimated costs to complete as of year-end 2-c. In the journal below, complete the necessary journal entries for the year 2026 (credit "Cash,…arrow_forward

- Using the percentage-of-completion method and the cost-to-cost basis, prepare the journal entry to record progress billings of$1,638,800 during 2023. Using the percentage-of-completion method and the cost-st basis, prepare the journal entries to record the revenue andgross proft for 2023.arrow_forwardPlease help me with calculationarrow_forwardplease answer do not image.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning