FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

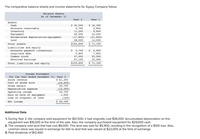

Transcribed Image Text:The comparative balance sheets and income statements for Gypsy Company follow:

Balance Sheets

As of December 31

Year 2

Year 1

Assets

$ 16,300

$ 32,500

4,750

11,200

45,000

(17,800)

28,000

Cash

Accounts receivable

2,800

9,800

52,000

(21,800)

12,000

Inventory

Equipment

Accumulated depreciation-equipment

Land

Total assets

$103,650

$ 71,100

Liabilities and equity

Accounts payable (inventory)

Long-term debt

$

3,750

$

5,800

47,000

47,100

4,900

7,800

25,000

33,400

Common stock

Retained earnings

Total liabilities and equity

$103,650

$ 71,100

Income Statement

For the Year Ended December 31, Year 2

$ 61,200

(24,500)

36,700

(12,000)

24,700

Sales revenue

Cost of goods sold

Gross margin

Depreciation expense

Operating income

Gain on sale of equipment

Loss on disposal of land

1,500

(100)

$ 26,100

Net income

Additional Data

1. During Year 2, the company sold equipment for $21,500; it had originally cost $36,000. Accumulated depreciation on this

equipment was $16,000 at the time of the sale. Also, the company purchased equipment for $29,000 cash.

2. The company sold land that had cost $6,000. This land was sold for $5,900, resulting in the recognition of a $100 loss. Also,

common stock was issued in exchange for title to land that was valued at $22,000 at the time of exchange.

3. Paid dividends of $12,400.

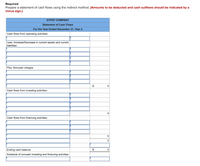

Transcribed Image Text:Required

Prepare a statement of cash flows using the indirect method. (Amounts to be deducted and cash outflows should be indicated by a

minus sign.)

GYPSY COMPANY

Statement of Cash Flows

For the Year Ended December 31, Year 2

Cash flows from operating activities:

Less: Increase/Decrease in current assets and current

liabilities:

Plus: Noncash charges

$

Cash flows from investing activities:

Cash flows from financing activities:

Ending cash balance

$

Schedule of noncash investing and financing activities:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- * Question Completion Status: Presented below is selected data from the financial statements of Morgan Corporation for the current and prior year: Current assets Total assets Current liabilities Total liabilities Total stockholders' equity Net sales Cost of Goods Sold Wages expense Supplies expense Depreciation expense Interest expense Net income 12/31/X2 $430,000 $2,500,000 $210,000 $1,210,000 $1,290,000 $4,800,000 $3,200,000 $973,000 $60,000 $35,000 $12,000 $520,000 12/31/X1 $220,000 e $1,950,000 $180,000 $1,180,000 $770,000 $3,900,000 $2,690,000 $869,000 $50,000 $32,000 $9,000 $250,000 Calculate the debt ratio for 20X2. Calculate the Debt Ratio as a percentage and round to the nearest whole percent. DO NOT enter your answer as a decimal and DO NOT include the % sign. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answarrow_forwardBalance Sheet December 31, 2021 Current Assets: Cash 46,200 Accounts Receivable (net) 260,000 Raw materials inventory (4,500 yards) 11,250 Finished goods inventory (1,500 units) 32,250 Total current assets 349,700 Plant and equipment: Buildings and equipment 900,000 Accumulated depreciation (292,000) Plant and equipment, net 608,000 Total Assets 957,700 Liabilities and Stockholders' Equity Current liabilities: 158,000 Accounts Payable Stockholders' equity: Common stock 419,800 Retained earnings 379,900 Total stockholders; equty 799,700 Total liabilities and stockholder's equity 957,700 Additional Information The company's chief financial officer (CFO), in consultation with various managers across the organization has developed the following set of assumptions to help create the 2022 budget: 1 The budgeted unit sales are 12,000 units, 37,000 units, 15,000 units and 25,000 units for quarters 1-4, respectively. Notice that the company experiences peak sales in the second and fourth…arrow_forwardCondensed financial data of Concord Inc. follow. CONCORD INC.Comparative Balance SheetsDecember 31 Assets 2022 2021 Cash $80,500 $48,700 Accounts receivable 87,900 38,600 Inventory 111,900 102,100 Prepaid expenses 29,400 27,900 Long-term investments 139,800 113,700 Plant assets 284,200 241,900 Accumulated depreciation (47,700) (49,100) Total $686,000 $523,800 Liabilities and Stockholders’ Equity Accounts payable $106,000 $63,700 Accrued expenses payable 16,500 21,200 Bonds payable 117,100 149,500 Common stock 219,000 175,100 Retained earnings 227,400 114,300 Total $686,000 $523,800 CONCORD INC.Income StatementFor the Year Ended December 31, 2022 Sales revenue $382,500 Less: Cost of goods sold…arrow_forward

- The following are financial data taken from the annual report of Foundotos Company: Year 2 $134,448 51,981 37,154 57,504 Net sales Gross property, plant and equipment Accumulated depreciation Intangible assets (net) A. Calculate the following ratios for Year 1 and Year 2: 1. Fixed asset turnover 2. Accumulated depreciation divided-by-gross fixed assets B. What do the trends in these ratios reveal about Foundotos? Year 1 $130,060 47,744 34,180 36,276arrow_forwardSeaforce Manufacturing Inc. Income Statement Year Ended December 31, 20X5 Sale $ 340,000 Cost of goods sold $ 250,100 Gross Profit $ 89,900 Operating Expenses $ 55,000 Loss on Sale of equipment $ 2,500 $ 57,500 Profit from Operations $ 32,400 Other expenses Interest Expense $ 3,500 Profit before Income Tax $ 28,900 Income Tax Expense $ 12,000 Profit $ 16,900 Additional Information: Operating expenses include depreciation expense of $10,000 Accounts Payable related to the purchase of inventory Equipment that cost $12,500 was sold at a loss of $2,500 New equipment was purchased during the year for $8,500 Dividends declared and paid in 20X5 totaled $3,000 Common shares were sold for $12,000 cash Interest payable in 20X5 was $800 greater than interest payable in 20X4 The company uses IFRS and do not treat dividends as part of operations Seaforce Manufacturing Inc. comparative balance sheet at December 31 20X5…arrow_forwardLarge Company $ Net sales 379,420 163,100 216,320 Cost of sales Gross profit Selling, general, and administrative $ 146,610 expenses Operating income $ 69,720 Net income 41,610 50,480 Cash and cash equivalents Net receivables 17,400 Inventories 223,430 315,160 Total current assets Property and equipment 81,880 Other assets 66,040 Total assets 463,090 29,540 Accounts payable Stockholder equity 261,130 What is the value of C2C in weeks? (Choose the closest) 31.47 -12.81 -5.82 64.20 4.arrow_forward

- Forecast an Income Statement Following is the income statement for Medtronic PLC. Consolidated Statement of Income ($ millions) For Fiscal Year Ended April 26, 2019 Net sales $27,807 Costs and expenses Cost of products sold 8,331 Research and development expense 2,330 Selling, general, and administrative expense 9,480 Amortization of intangible assets 1,605 Restructuring charges, net 198 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 5,439 Other nonoperating income, net (373) Interest expense 1,314 Income before income taxes 4,498 Income tax provision 547 Net income 3,951 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $3,932 Use the following assumptions to prepare a forecast of the company’s income statement for FY2020. Note: Complete the entire question in Excel using the following template: Excel Template. Format each answer to two decimal…arrow_forwardFinancial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc.Balance Sheet BeginningBalance EndingBalance Assets Cash $ 129,000 $ 137,000 Accounts receivable 336,000 477,000 Inventory 580,000 488,000 Plant and equipment, net 875,000 858,000 Investment in Buisson, S.A. 406,000 431,000 Land (undeveloped) 252,000 251,000 Total assets $ 2,578,000 $ 2,642,000 Liabilities and Stockholders' Equity Accounts payable $ 387,000 $ 331,000 Long-term debt 1,039,000 1,039,000 Stockholders' equity 1,152,000 1,272,000 Total liabilities and stockholders' equity $ 2,578,000 $ 2,642,000 Joel de Paris, Inc.Income Statement Sales $ 4,850,000 Operating expenses 4,122,500 Net operating income 727,500 Interest and taxes: Interest expense $ 121,000 Tax expense 208,000 329,000 Net income…arrow_forwardIncome statement net sales $51,407.00 cost of products sold $25,076.00 gross profit $26,331.00 marketing, research, administrative exp $15,746.00 Depreciation $758.00 operating income(loss) $9,827.00 Interest expense $477.00 Earnings (loss)before income taxes $9,350.00 Income taxes $2,869.00 Net earnings(loss) $6,481.00 Balance Sheet Assets: Liablilites and Equity: cash and marketable securities $5,469.00 accounts payable $3,617.00 investment securities $423.00 accrued and other liablilties $7,689.00 accounts receivable $4,062.00 taxes payable $2,554.00 inventory $4,400.00 debt due within one year $8,287.00 deffered income taxes $958.00 total current liabilite $22,147.00 prepaid expense and other receivables $1,803.00 long term debt $12,554.00 total current assets $17,115.00 deferrred income taxes…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education