FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

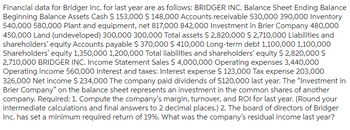

Transcribed Image Text:Financial data for Bridger Inc. for last year are as follows: BRIDGER INC. Balance Sheet Ending Balance

Beginning Balance Assets Cash $ 153,000 $ 148,000 Accounts receivable 530,000 390,000 Inventory

540,000 580,000 Plant and equipment, net 817,000 842,000 Investment in Brier Company 480,000

450,000 Land (undeveloped) 300,000 300,000 Total assets $2,820,000 $2,710,000 Liabilities and

shareholders' equity Accounts payable $ 370,000 $ 410,000 Long-term debt 1,100,000 1,100,000

Shareholders' equity 1,350,000 1,200,000 Total liabilities and shareholders' equity $ 2,820,000 $

2,710,000 BRIDGER INC. Income Statement Sales $ 4,000,000 Operating expenses 3,440,000

Operating income 560,000 Interest and taxes: Interest expense $ 123,000 Tax expense 203,000

326,000 Net income $ 234,000 The company paid dividends of $120,000 last year. The "Investment in

Brier Company" on the balance sheet represents an investment in the common shares of another

company. Required: 1. Compute the company's margin, turnover, and ROI for last year. (Round your

intermediate calculations and final answers to 2 decimal places.) 2. The board of directors of Bridger

Inc. has set a minimum required return of 19%. What was the company's residual income last year?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Vertical Analysis of Balance Sheet Balance sheet data for Kwan Company on December 31, the end of two recent fiscal years, follow: Current Year Previous Year Current assets $300,300 $186,760 Property, plant, and equipment 446,160 392,840 Intangible assets 111,540 64,400 Current liabilities 163,020 90,160 Long-term liabilities 368,940 270,480 Common stock 68,640 77,280 Retained earnings 257,400 206,080 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place.arrow_forwardBlue Elk Manufacturing Balance Sheet For the Year Ended on December 31 Assets Current Assets: Cash and equivalents Accounts receivable Liabilities Current Liabilities: $150,000 Accounts payable $250,000 400,000 Accrued liabilities 150,000 Inventories 350,000 Notes payable 100,000 Total Current Assets $900,000 Total Current Liabilities $500,000 Net Fixed Assets: Long-Term Bonds 1,000,000 Net plant and equipment(cost minus depreciation) $2,100,000 Total Debt $1,500,000 Common Equity Common stock 800,000 Retained earnings 700,000 Total Common Equity Total Assets $3,000,000 Total Liabilities and Equity $1,500,000 $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Blue Elk Manufacturing generated $500,000 net income on sales of $14,500,000. The firm expects sales to increase by 17% this coming year and also expects to maintain its long-run dividend payout ratio of 30%. Suppose Blue…arrow_forwardThe following data are for the Akron Division of Consolidated Rubber, Incorporated: Sales $ 750,000 Net operating income $ 45,000 Average operating assets $ 250,000 Stockholders' equity $ 75,000 Residual income $ 15,000 For the past year, the minimum required rate of return wasarrow_forward

- Uarrow_forwardCondensed financial data are presented below for the Phoenix Corporation: 20X2 20X1 Accounts receivable $ 267,500 $ 230,000 Inventory 312,500 257,500 Total current assets 670,000 565,000 Intangible assets 50,000 60,000 Total assets 825,000 695,000 Current liabilities 252,500 200,000 Long-term liabilities 77,500 75,000 Sales 1,640,000 Cost of goods sold 982,500 Interest expense 10,000 Income tax expense 77,500 Net income 127,500 Cash flow from operations 71,000 Cash flow from investing activities (6,000 ) Cash flow from financing activities (62,500 ) Tax rate 30 % If there is no preferred stock, the return on common equity for 20X2 is (rounded): Multiple Choice 25.8% 27.9% 41.4% 43.4%arrow_forwardSONAD COMPANY Income Statement For Year Ended December 31 Sales $ 2,123,000 Cost of goods sold 1,040,270 Gross profit 1,082,730 Operating expenses Salaries expense $ 290,851 Depreciation expense 50,952 Rent expense 57,321 Amortization expenses—Patents 6,369 Utilities expense 23,353 428,846 653,884 Gain on sale of equipment 8,492 Net income $ 662,376 Accounts receivable $ 27,750 increase Accounts payable $ 15,725 decrease Inventory 24,000 increase Salaries payable 5,050 decrease Prepare the operating activities section of the statement of cash flows using the direct method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forward

- The following condensed income statements of the Jackson Holding Company are presented for the two years ended December 31, 2021 and 2020: 2021 2020 Sales revenue $ 15,000,000 $ 9,600,000 Cost of goods sold 9,200,000 6,000,000 Gross profit 5,800,000 3,600,000 Operating expenses 3,200,000 2,600,000 Operating income 2,600,000 1,000,000 Gain on sale of division 600,000 — 3,200,000 1,000,000 Income tax expense 800,000 250,000 Net income $ 2,400,000 $ 750,000 On October 15, 2021, Jackson entered into a tentative agreement to sell the assets of one of its divisions. The division qualifies as a component of an entity as defined by GAAP. The division was sold on December 31, 2021, for $5,000,000. Book value of the division’s assets was $4,400,000. The division’s contribution to Jackson’s operating income before-tax for each year was as follows: 2021 $400,000 2020 $300,000 Assume…arrow_forwardThe year-end financial statements for North Railway report the following information: 0.46 0.41 1.74 (In millions) 0.25 Revenues Year ended December 31, Property and equipment, net Total assets Year 2 Year 1 The annual property, plant, and equipment turnover (PPET) is: $15,095 $21,967 61,250 59,510 84,122 81,703arrow_forwardSelected data from the Carmen Company at year-end are as follows: Total assets Average total assets Net income Sales Average common stockholders' equity Net cash provided by operating activities Shares of common stock outstanding Long-term investments $2,000,000 $2,200,000 $250,000 $1,300,000 $1,000,000 $275,000 10,000 $400,000 Required: Compute the (a) asset turnover, (b) return on total assets, (c) return on common stockholders' equity, and (d) earnings per share on common stock. Assume the company had no preferred stock or interest expense. Round dol values to the nearest cent and other final answers to one decimal place. a. Asset turnover ratio b. Return on total assets c. Return on common stockholders' equity d. Earnings per share on common stock 1000 % % per share Karrow_forward

- Assume a company had net income of $79,000 that included a gain on the sale of equipment of $4,000. It provided the following excerpts from its balance sheet: This Year Last Year Current assets: Accounts receivable $ 40,000 $ 46,000 Inventory $ 53,000 $ 50,000 Prepaid expenses $ 13,000 $ 11,000 Current liabilities: Accounts payable $ 38,000 $ 44,000 Accrued liabilities $ 18,000 $ 15,000 Income taxes payable $ 13,000 $ 10,000 If the credits to the company’s accumulated depreciation account were $21,000, then based solely on the information provided, the company’s net cash provided by (used in) operating activities would be: Multiple Choice $63,000. $55,000. $105,000. $97,000.arrow_forwardInc. reported the following data for last year: Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash $ 126,000 $ 131,000 Accounts receivable 332,000 488,000 Inventory 576,000 476,000 Plant and equipment, net 896,000 875,000 Investment in Tesla Inc. 396,000 427,000 Land (undeveloped) 253,000 246,000 Total assets $ 2,579,000 $ 2,643,000 Liabilities and Stockholders' Equity Accounts payable Long-term debt $ 380,000 1,013,000 1,186,000 $ 340,000 1,013,000 1,290,000 Stockholders' equity Total liabilities and stockholders' equity $ 2,579,000 $ 2,643,000 Inc. Income Statement Sales $ 5,265,000 4,317,300 947,700 Operating expenses Net operating income Interest and taxes: Interest expense Tax expense Net income $ 123,000 210,000 333,000 $ 614,700 Inc. paid dividends of $510,700 last year. The "Investment in Tesla Inc." item on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return is 15%. What was the company's…arrow_forwardFitz Company reports the following information. Selected Annual Income Statement Data Selected Year-End Balance Sheet Data Net income $ 391,000 Accounts receivable decrease $ 27,200 Depreciation expense 44,200 Inventory decrease 46,000 Amortization expense 8,000 Prepaid expenses increase 6,400 Gain on sale of plant assets 7,100 Accounts payable decrease 8,200 Salaries payable increase 1,900 Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. Note: Amounts to be deducted should be indicated with a minus sign.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education