FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

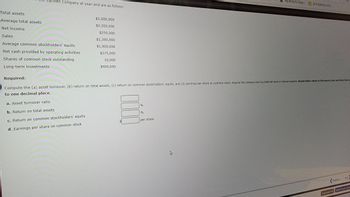

Transcribed Image Text:Total assets

men Company at year-end are as follows:

Average total assets

Net income

Sales

Average common stockholders' equity

Net cash provided by operating activities

Shares of common stock outstanding

Long-term investments

$2,000,000

$2,200,000

$250,000

$1,300,000

$1,000,000

$275,000

10,000

$400,000

000

Required:

Compute the (a) asset turnover, (b) return on total assets, (c) return on common stockholders' equity, and (d) earnings per share on common stock. Assume the company had no preferred stock or interest expense. Round dollar values to the nearest cent and other final am

to one decimal place.

a. Asset turnover ratio

b. Return on total assets

c. Return on common stockholders' equity

d. Earnings per share on common stock

%

%

My account | Roku...

per share

2019 RENTALS SCR

Previous

Next

Email Instructor Submit Test for Grad

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute and Analyze Measures for DuPont Disaggregation Analysis The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements. NETFLIX INC. Consolidated Statements of Earnings For Year Ended December 31, $ thousands 2018 Revenues $9,318,661 Cost of revenues 5,880,847 1,397,987 720,870 630,294 688,663 Marketing Technology and development General and administrative Operating income Other income (expense) Interest expense Interest and other income Income before income taxes Provision for income taxes Net income NETFLIX INC. Consolidated Balance Sheets in thousands, except par value 2018 Current assets Cash and cash equivalents Current content assets, net Other current assets Total current assets Noncurrent content assets, net Property and equipment, net Other noncurrent assets Total assets Current liabilities Current content liabilities Accounts payable Accrued expenses Deferred revenue (248,091) 41,725 482,297 8,977…arrow_forwardSome recent financial statements for Smolira Golf, Incorporated, follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INCORPORATED 2022 Income Statement Net income Dividends Retained earnings 2021 Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity $3,061 4,742 12,578 $ 20,381 SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other $ 52,746 $ 73,127 2021 $ 188,370 126, 703 5,283 $ 56,384…arrow_forwardWhat company is better in short term investment?arrow_forward

- Dec. 31, 2020 Dec. 31, 2019 Assets Current assets: Cash and cash equivalents $248,005 $419,465 Accounts receivable 38,283 34,839 Inventory 15.043 15,332 Prepaid expenses and other current assets 39,965 34,795 Income tax receivable 58,152 16,488 Investments 415,199 338,592 Total current assets 814.647 859,511 Property, plant, & equipment, net 1,217.220 1,106,984 Long-term investments 622,939 496.106 Other assets 70,260 64,716 Total assets $2,725,066 $2,527,317 Liabilities and Shareholders' Equity Current liabilities: Accounts payable $85,709 $69,613 Accrued payroll and benefits 64,958 73,894 Accrued liabilities 129,275 102,203 Total current liabilities 279,942 245,710 Deferred liabilities 284.267 240,975 Other liabilities 32.883 28,263 Total liabilities 597,092 514,948 Shareholders' equity: Common stock 358 354 Additional paid-in capital 954,988 861.843 Retained earnings 1,172.628 1,150,172 Total shareholders' equity 2,127,974 2,012.369 Total liabilities and shareholders' equity…arrow_forwardThe following data are taken from the records of Grouper Company. Cash Current assets other than cash Long-term debt investments Plant assets Accumulated depreciation Current liabilities Bonds payable Common stock Retained earnings Additional information: 1. 2. 3. 4. 5. December 31, December 31, 2025 2024 $15,100 84,300 10,000 334,300 $443,700 $20,100 39,900 74,800 255,400 53,500 $443,700 $8,000 60,600 52,500 214,900 $336,000 $40,400 21,800 -0- 255,400 18,400 $336,000 Held-to-maturity debt securities carried at a cost of $42,500 on December 31, 2024, were sold in 2025 for $34,300. The loss (not unusual) was incorrectly charged directly to Retained Earnings. Plant assets that cost $50,300 and were 80% depreciated were sold during 2025 for $8,000. The loss was incorrectly charged directly to Retained Earnings. Net income as reported on the income statement for the year was $57,100. Dividends paid amounted to $11,740. Depreciation charged for the year was $19,940.arrow_forwardYou find the following financial information about a company: net working capital = $7, 809; total assets $11,942; and long-term debt Multiple Choice $9, 115 $4, 507 $10, 339 $6, 129 $4, 133 = = = $1, 287; fixed assets $4,589. What is the company's total equity?arrow_forward

- Arlington Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock (4,000 shares) Retained earnings Common equity Total llabilities and equity Sales Operating costs excluding depreciation and amortization EBITDA Depreciation & amortization EBIT Interest EBT Taxes (25%) Net Income Dividends pald Income Statement for Year Ending December 31, 2021 2021 Balances, 12/31/20 2021 Net Income Cash Dividends Addition to retained earnings Balances, 12/31/21 $ 15,000 35,000 34,190 $ 84,190 48,000 $132,190 $ 10,100 7,300 6,200 $ 23,600 15,000 $ 38,600 60,000 33,590 $ 93,590 $132,190 c. Construct Arlington's 2021 statement of stockholders' equity. Shares $ 2020 $ 13,000 30,000 28,000…arrow_forwardA company has the following balance sheet. What is its total net operating capital? (Round it to a whole dollar, if necessary) Cash $ 20 Accounts payable $ 60 Short-term investments 30 Accruals 50 Accounts receivable 50 Notes payable 10 Inventory 80 Current liabilities xxx Current assets xxx Long-term debt 70 Net fixed assets 100 Common equity 30 Retained earnings xx Total assets $xxx Total liab. & equity $xxarrow_forwardFind the below: Cash ratio Inventory turnover EPS Total asset turnover Debt ratio Debt-to-equity ratio Times interest earned ROI Net profit margin ROE Market price/Book value P/E BALANCE SHEET ASSETS LIABILITIES & STOCKHOLDERS EQUITY Cash $ 1,500 Accounts payable $12,500 Marketable securities 2,500 Notes payable 12,500 Accounts receivable 15,000 Total current liabilities $25,000 Inventory 33,000 Long-term debt 22,000 Total current assets…arrow_forward

- Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: $104,000 0 34,500 490,000 Notes payable Stockholders' equity: Common stock 590,000 590,000 Retained earnings 1,815,500 1,754,200 Total liabilities and stockholders' equity $3,034,000 $2,948,000 Earnings per share for the year ended December 31, 2024, are $1.25. The closing stock price on December 31, 2 Required: Calculate the following profitability ratios for 2024. (Use 365 days a year. Round your final answers to 1 decima Profitability Ratios 1. Gross profit ratio 2. Return on assets 3. Profit margin 4. Asset turnover 5. Return on equity 6. Price-earnings ratio 38.6% 42.3 % 14.4 % 2.9 times 53.2 % 17.1 1,095,000 (398,000) $3,034,000 1,095,000 (199,000) $2,948,000 $80,000 3,900 29,900 490,000arrow_forwardSales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes. Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Sin Comparative Income Statements For Years Ended December 31 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity Assets Current assets Long-term investments Plant assets, net. Total assets Liabilities and Equity Current liabaties Common stock Other paid-in capital Retained earnings Total liabilities and equity 2020 $ 321,775 202,718 KORBIN COMPANY Comparative Balance Sheets December 31 2021 119,057 44,405 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as answers to 2 decimal places.) 111.77 % 0.00 $ 37,003 700…arrow_forwardSelected data from the Carmen Company at year-end are as follows: Total assets Average total assets Net income Sales Average common stockholders' equity Net cash provided by operating activities Shares of common stock outstanding Long-term investments $2,000,000 $2,200,000 $250,000 $1,300,000 $1,000,000 $275,000 10,000 $400,000 Required: Compute the (a) asset turnover, (b) return on total assets, (c) return on common stockholders' equity, and (d) earnings per share on common stock. Assume the company had no preferred stock or interest expense. Round dol values to the nearest cent and other final answers to one decimal place. a. Asset turnover ratio b. Return on total assets c. Return on common stockholders' equity d. Earnings per share on common stock 1000 % % per share Karrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education