Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

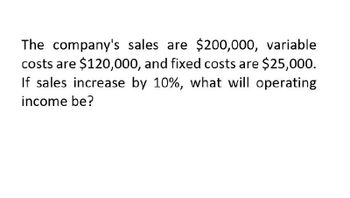

Transcribed Image Text:The company's sales are $200,000, variable

costs are $120,000, and fixed costs are $25,000.

If sales increase by 10%, what will operating

income be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Marigold Corp. has fixed costs of $2200000 and variable costs are 20% of sales. What are the required sales if Marigold desires net income of $200000? $12000000 $2750000 $11000000 $3000000arrow_forwardIf the contribution margin ratio solve this questionarrow_forwardWhat amount will net income increase?arrow_forward

- How many units must it sell?arrow_forwardSuppose executives estimate that the unit variable cost for their DVD recorder is $100, the fixed cost related to the product is $10 million annually, and the target volume for next year is 100,000 recorders. What sales price will be necessary to achieve a target profit of $l million?arrow_forwardA firm uses simple linear regression to forecast the costs for its main product line. If fixed costs are equal to $235,000 and variable costs are $10 per unit, how many units does it need to sell at $15 per unit to make a $300,000 profit?arrow_forward

- SmartTech Electronics sells wireless earbuds at $80 per unit. The variable cost per unit is $35, and fixed costs are $90,000 per year. What sales volume (in units) is needed to achieve a target profit of $60,000?arrow_forwardPlease answerarrow_forwardThe Price Company will produce 55,000 widgets next year. Variable costs will equal 40 percent of sales, while fixed costs will total R110,000. At what price must each widget be sold for the company to achieve an EBIT of R95,000?arrow_forward

- Log Co has an operating gearing ratio of 33.33%. Its sales are currently $100m and its operating profit is $20m. Operating gearing is calculated by dividing fixed costs by variable costs. What will its operating profit be if its sales increase by 15%? O $21m O $23m O $27m O $26marrow_forwardA company is analyzing its break-even point for a product with a selling price of $50 per unit. The variable cost per unit is $30, and the fixed costs are $200,000 per year. If the company wants to achieve a profit of $50,000, how many units must it sell to meet this profit goal?arrow_forwardIf the objective of the firm is to get 25% profit, how many units does the firm need to sell if the price per unit is $250? Given information: Annual fixed costs are 114,000, CTO is .65, breakeven point is 175,384.62.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning